The weekend came and went – this time with crypto making some green instead of the all-too-common red. 🟩

In today’s Litepaper, we’re going to look at what’s making $GALA.X skyrocket, where analysts think Ethereum and XRP might face some selling pressure, and the shenanigans SBF is playing with his Robinhood shares.

Green across the board, but the ticker stats don’t tell us everything. Many of the day’s big gainers are well off their highs. $ADA.X, for example, was up +16.50% and is struggling now to hold a +5% gain.

$SOL.X was today’s big leader, followed by Cardano and $UNI.X.

Here’s how the market looked at the end of the trading day:

| Solana (SOL) |

$16.40

|

19.79% |

| Cardano (ADA) | $0.316 | 8.59% |

| Uniswap (UNI) | $5.86 | 7.17% |

| Dogecoin (DOGE) |

$0.077

|

6.59% |

| Cosmos (ATOM) |

$11.12

|

6.17% |

| Polygon (MATIC) | $0.85 | 4.9% |

| Shiba Inu | $0.00000888 | 4.60% |

| Stellar (XLM) | $0.079 | 4.42% |

| Chainlink (LINK) | $6.09 | 4.36% |

| Polkadot (DOT) |

$4.95

|

4.32% |

| Altcoin Market Cap |

$477 Billion

|

2.12% |

| Total Market Cap | $811 Billion | 1.64% |

GALA Games ($GALA.X) is making some dramatic moves today, with analysts attributing the spike to a combination of fundamental and technical conditions. 🎮

Fundamentally, GALA announced they are working on two film projects with The Rock (Dwayne Johnson) and Mark Wahlberg.

https://twitter.com/GoGalaGames/status/1612299581731086337

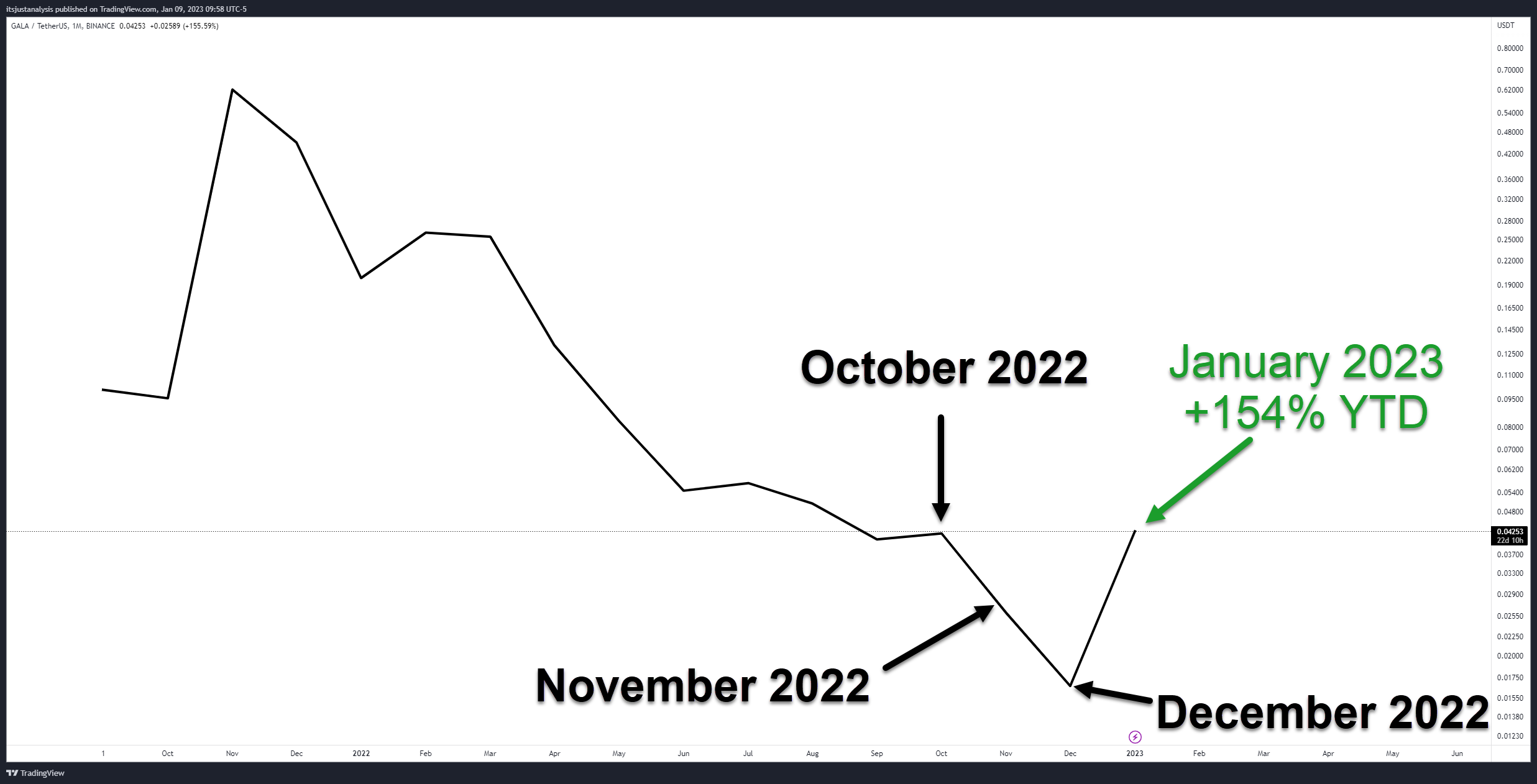

GALA’s performance since the beginning of 2023 has been impressive – especially considering it was down -98.17% from its November 21, 2021, all-time high ($0.84).

At the time of writing this article, GALA is up +23.74% today and up +154% so far for 2023. On its monthly chart, the current close is higher than the October 2022, November 2022, and December 2022 open and close.

Whether this is a mean reversion from insanely oversold conditions or a broader trend change, crypto assets like GALA have been long overdue for some pamp. 💪

Analysts see near-term resistance at $0.044 and again at the psychologically important $0.05 level, where the 2022 Volume Point Of Control sits.

Last Friday, various news agencies worldwide released a court filing from SBF’s legal team, requesting the court to let SBF keep his $HOOD shares.

According to the filing, the Robinhood shares are (worth roughly $460 million) needed to pay for SBF’s criminal defense.

And in a shocking display of empathy to FTX’s customers, the filing notes that the FTX customers “… face only the possibility of economic loss.”

The HOOD shares are owned by any entity known as Emergent Fidelity Technologies, 90% owned by SBF. And SBF believes the Robinhood shares are not tied to FTX.

However, now the U.S. Department of Justice has seized the shares, alleging they are “… seeking to forfeit property that constitutes or was derived from proceeds traceable to the conspiracy to commit wire fraud, wire fraud, and property involved in the conspiracy to commit money laundering.”

But analysts and pundits believe the reason the DOJ seized the funds is because of this pattern:

SBF sends Alameda Research customer funds – Alameda Loans SBF money – SBF makes a new Antiguan shell company – SBF buys Robinhood shares.

We’ll keep you updated as the story develops. 🕵️♂️

Lots of nice big breakouts and moves across the board since last week. Looking at the top 25 cryptocurrencies by market cap, all are in the green for the past seven trading days, with 20 out of 25 in double-digit percentage gains.

However, analysts warn that a pause in the near-term upward momentum may occur. Not necessarily a cessation of the current bullish momentum but a pause as the rest of the market digests what the moves mean. We’re going to look at key price levels that investors, traders, and analysts are looking at as resistance. ✋

If you want to skip the Magic 8 Ball, chicken bone, voodoo technical analysis mumbo jumbo, scroll to the Too Long; Didn’t Read (TL;DR) part of the summary.

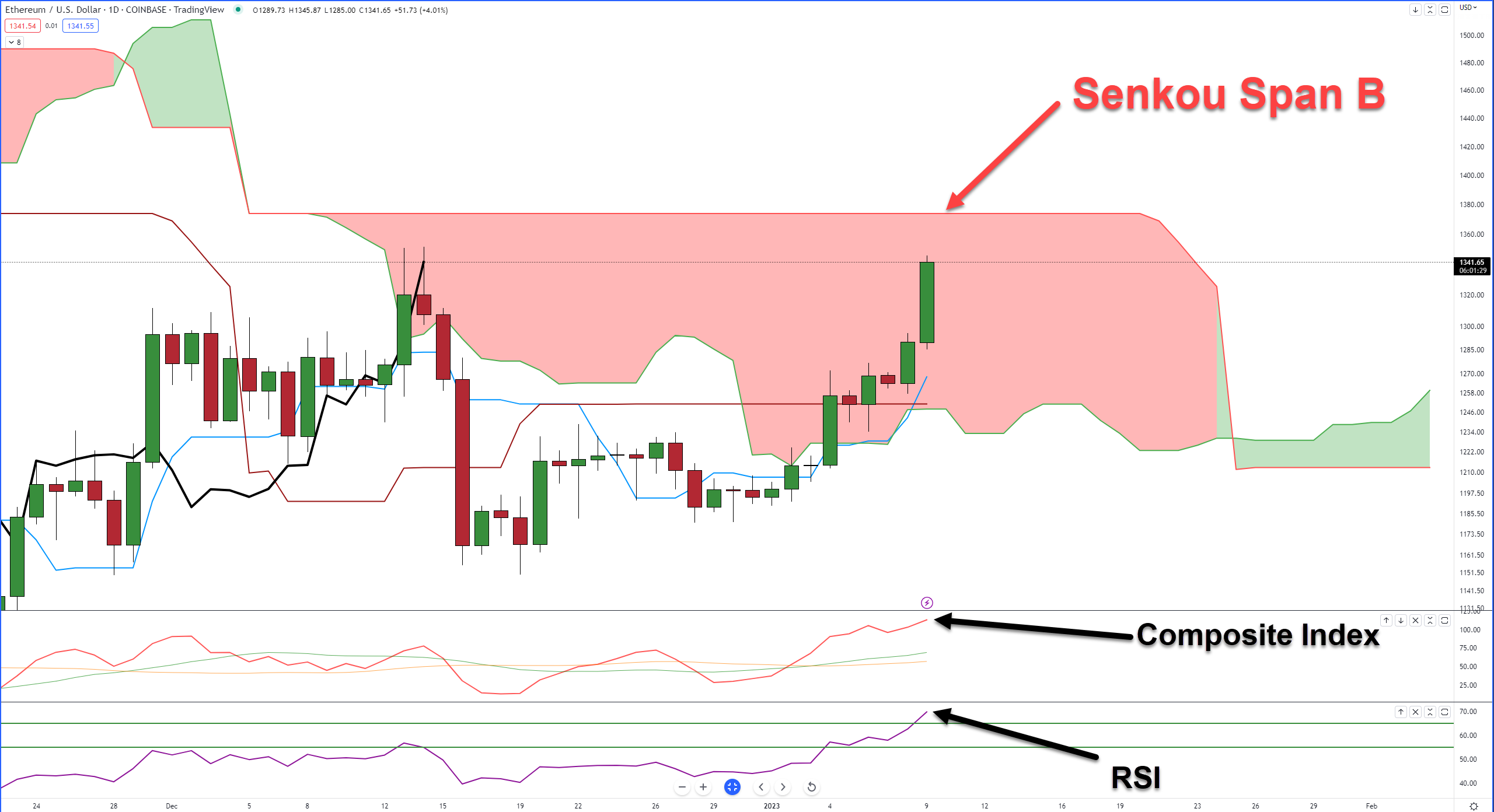

Ethereum

$ETH.X is inside the daily Ichimoku Cloud. The Cloud is the red and green blobs you see on the screen, and it represents indecision, volatility, whipsaws, misery, and all things bad in the world. It’s the place where trading accounts go to die. The top of the Cloud, Senkou Span B ($1,375), is the strongest support and resistance level in the Ichimoku Kinko Hyo system. When Senkou Span B is flat, its strength as support/resistance is exacerbated by how long it remains flat.

From an oscillator perspective, there are some warning signs. The Composite Index has been trading at its highest level on the daily chart since March 29, 2022. The RSI has moved above the last oversold level in a bear market, 65, and hit level 70.

TL;DR

Analysts and traders anticipate selling pressure and/or a pause at $1,375.

Long-term swing traders want to see the RSI move below level 70 and then return to test it again. A successful breakout above the retest of 70 could confirm that a new bullish breakout is likely to continue. 👉

XRP

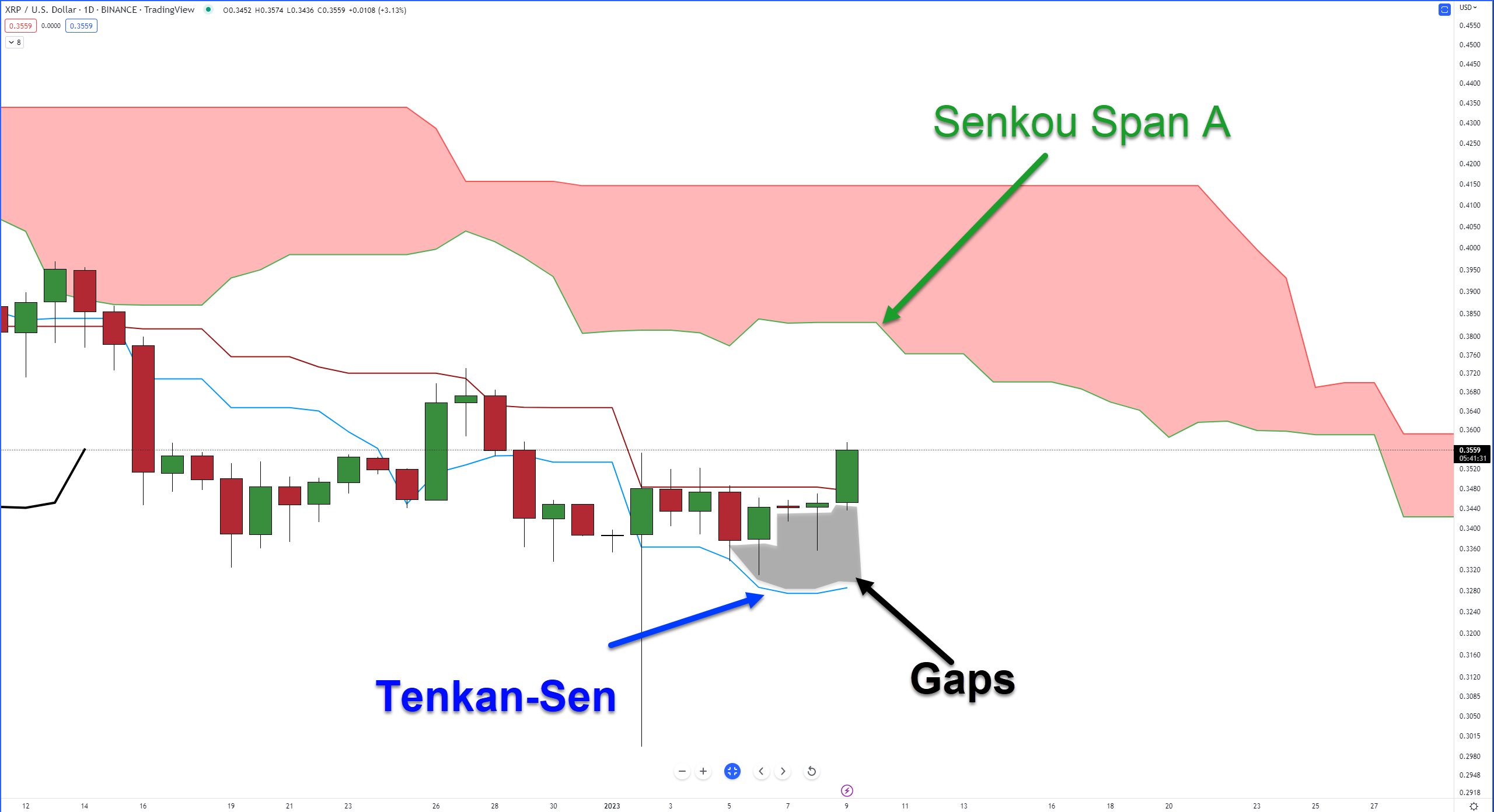

$XRP.X is attempting to close above the daily Kijun-Sen for the first time since December 14, 2022. 👀

Some traders see enough juice/momentum to keep XRP moving beyond the Kijun-Sen, but analysts warn that the bottom of the Cloud, Senkou Span A ($0.38), could prove difficult to close above.

There are already significant gaps between the bodies of the daily candlesticks and the Tenkan-Sen.

Additionally, the RSI (not shown) is close to the first overbought level in a bear market, 55. XRP has not tested the 65 level since November 5, 2022.

TL;DR

Analysts see XRP as having enough short-term momentum to move to the $0.38 level but warn that any further movement away from the Tenkan-Sen could trigger a violent pullback. 🔙

Bullets

Bullets From The Day:

💵 Cash outflows from Binance are much worse than what CZ said in December 2022. According to a detailed article from Forbes, Binance customers withdrew $360 million last Friday. Since CZ’s December 13, 2022 tweet, 15% of Binance’s assets have gone poof. A concerning report of Binance’s reserves was also raised. 31% of Binance’s reserves were made up of its $BNB.X token, their USD-stablecoin $BUSD.X at 20%, and $USDT.X at 17%. Forbes has more.

🏦 Metropolitan Commercial Bank ($MCB) is moving away from the crypto space and winding down its crypto-related services. The bank reported that it would have a minimal financial impact, citing their institutional crypto clients represent only 1.5% of total revenue and 6% of deposits. While this may not seem like a big deal, it is for the crypto space. MCB provides debit/pre-paid card services for Ubanked’s Block and Crypto.com cards, COIN uses MCB for wire transfers and deposits. This story has a high probability of ballooning into a much broader issue for cryptocurrency firms that lose one of the major banking players in the space. More from CoinDesk.

🪙 A major rating agency gave $COIN a ‘Hodl’ rating. A research report by Jefferies gave an updated rating to Coinbase with a $35 target. They warned that COIN would be under significant pressure in the short term, but its healthy cash balance of $5 billion puts it in a good place. Additionally, they cited Coinbase’s proactive regulatory compliance, risk management, and being a publically traded company as more reasons to hold. MarketScreener has more.

💰 Bankrupt doesn’t mean done for Core Scientific. Despite slowing down and, in some cases, shutting down its mining operations due to major winter storms in December, the mining firm yielded +5.8% (1,356 to 1,435) more Bitcoin in December 2022 compared to November 2022. The company filed for Chapter 11 bankruptcy in December 2022. More from TheBlock

Links

Links That Don’t Suck:

🏧 Crypto payments firm Wyre limits withdrawals as it mulls ‘strategic options’ amid market downturn

🐻 Crypto layoffs mount as exchanges continue to be ravaged by the prevailing bear market

🐧 Digital asset manager Osprey Funds lays off staff as crypto winter fallout continues

🚰 Liquid staking tokens $LDO and $RPL Rally as Ethereum (ETH) withdrawals near

🕹️ The Best Gaming Gear at CES: From powerhouse laptops to the widest monitor

📇 French regulator pushes for faster issuance of crypto licenses

🐐 Police chase loose goat through Utah city for over an hour

😵 Coincidence? Four crypto billionaires die in one month

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: