Well, well, well, another day of green across the board! Bulls don’t want the other bulls to get exhausted, and any bears with short positions are sweating. 🟢

It’s the weekend coming up, though, and they’re historically times when big moves can occur and spoil a bunch of people’s plans.

Today’s Litepaper focuses on Cardano’s 2023 outlook. Out of the top ten cryptocurrencies by market cap, none have as big of a year for updates and changes as Cardano. We’ll also look a little at Bitcoin 🔮

$ETC.X keeps pamping higher, taking the first place slot for the second Litepaper issue in a row.

Here’s how the market looked at the end of the trading day:

| Ethereum Classic (ETC) |

$19.49

|

5.39% |

| Cardano (ADA) | $0.275 | 2.37% |

| Uniswap (UNI) | $5.48 | 1.77% |

| Ethereum (ETH) |

$1,266

|

1.42% |

| Litecoin (LTC) |

$75.62

|

1.22% |

| Monero (XMR) | $156.19 | 1.11% |

| Polkadot (DOT) | $4.66 | 0.95% |

| BNB (BNB) | $259.09 | 0.85% |

| Cosmos (ATOM) | $10.08 | 0.63% |

| Bitcoin (BTC) |

$16,919

|

0.53% |

| Altcoin Market Cap |

$457 Billion

|

0.85% |

| Total Market Cap | $783 Billion | 0.74% |

Crypto

Is 2023 Cardano’s Year?

2023 will be a big year for one of the top 10 cryptos by market cap, Cardano ($ADA.X).

Crypto Capital Venture Founder Dan Gambardello thinks that Cardano’s time to shine is 2023:

#Cardano will be a top altcoin to hold in 2023 and most people won’t realize it until it’s 1,000%+ again.$ADA

— Dan Gambardello (@cryptorecruitr) January 1, 2023

$ADA is undervalued and oversold. Fear will blind most people, making them unable to see it.

Zoomed out in 5 years it will make so much sense.

Save this tweet.

— Dan Gambardello (@cryptorecruitr) January 6, 2023

In September 2022, The Litepaper talked with Input Output Group’s (IOG) Chief Marketing Officer, Jerry Fragiskatos (you can read that interview here).

Mr. Fragiskatos mentioned in the interview that “All I can say is that 2023 will be a big year for Voltaire.”

Voltaire is the final step in Cardano’s roadmap. From Cardano.org:

“The Voltaire era of Cardano will provide the final pieces required for the Cardano network to become a self-sustaining system. With the introduction of a voting and treasury system, network participants will be able to use their stake and voting rights to influence the future development of the network.”

“… Voltaire will also see the addition of a treasury system, whereby a fraction of all transaction fees will be pooled to provide funds for development activities…”

“When both a voting and treasury system are in place, Cardano will be truly decentralized and no longer under IOHK’s management. Instead, Cardano’s future will be in the hands of the community…”

In other words, Cardano will be on its own after Voltaire is done.

Djed

Coming sometime this month (January 2023) is Cardano’s first algorithmic stablecoin, Djed (DJED).

Just as Cardano is named after Gerolamo Cardano, and Cardano’s wallet Daedalus is named after the mythological Greek architect who created the Labyrinth maze to imprison the Minotaur (which happens to be the logo of the Daedalus wallet), Djed is an ancient Egyptian symbol that means stability.

Pegged to the U.S. Dollar, Djed is considered an over-collateralized (between 400 and 800%) stablecoin that uses not just the ADA token but a new(er) concept called a Reserve Coin.

The reserve coin, SHEN (Shen is another Egyptian symbol for protection, connection, royalty, and symmetry), maintains the algorithmic peg and provides incentives to hodl.

However, there is extreme skepticism after Terra’s collapse in 2022 and the destruction of its stablecoin, TerraUSD.

And the skepticism isn’t just because of Terra’s collapse; it’s because of this: all algorithmic stablecoins have failed.

We’ll have to see if Cardano can pull it off.

Speaking of $ADA.X.

From a technical analysis perspective, Cardano looks messier than a floor after a Roomba that’s just finished a six-hour cleaning cycle and didn’t realize it started that cycle by mowing over, repeatedly, a pile of freshly laid Tibetan Mastiff poo, spreading a trail a horribleness over those six hours that a 3-year old who just discovered poopie can be used as finger paint would struggle to compete with. 💩

If you don’t want to read all the fancy schmancy technical analysis bits, look for the TL;DR (Too Long; Didn’t Read) below.

Cardano

Cardano hit a new 21-day high today, and yesterday’s close is already the highest of the last 21 days.

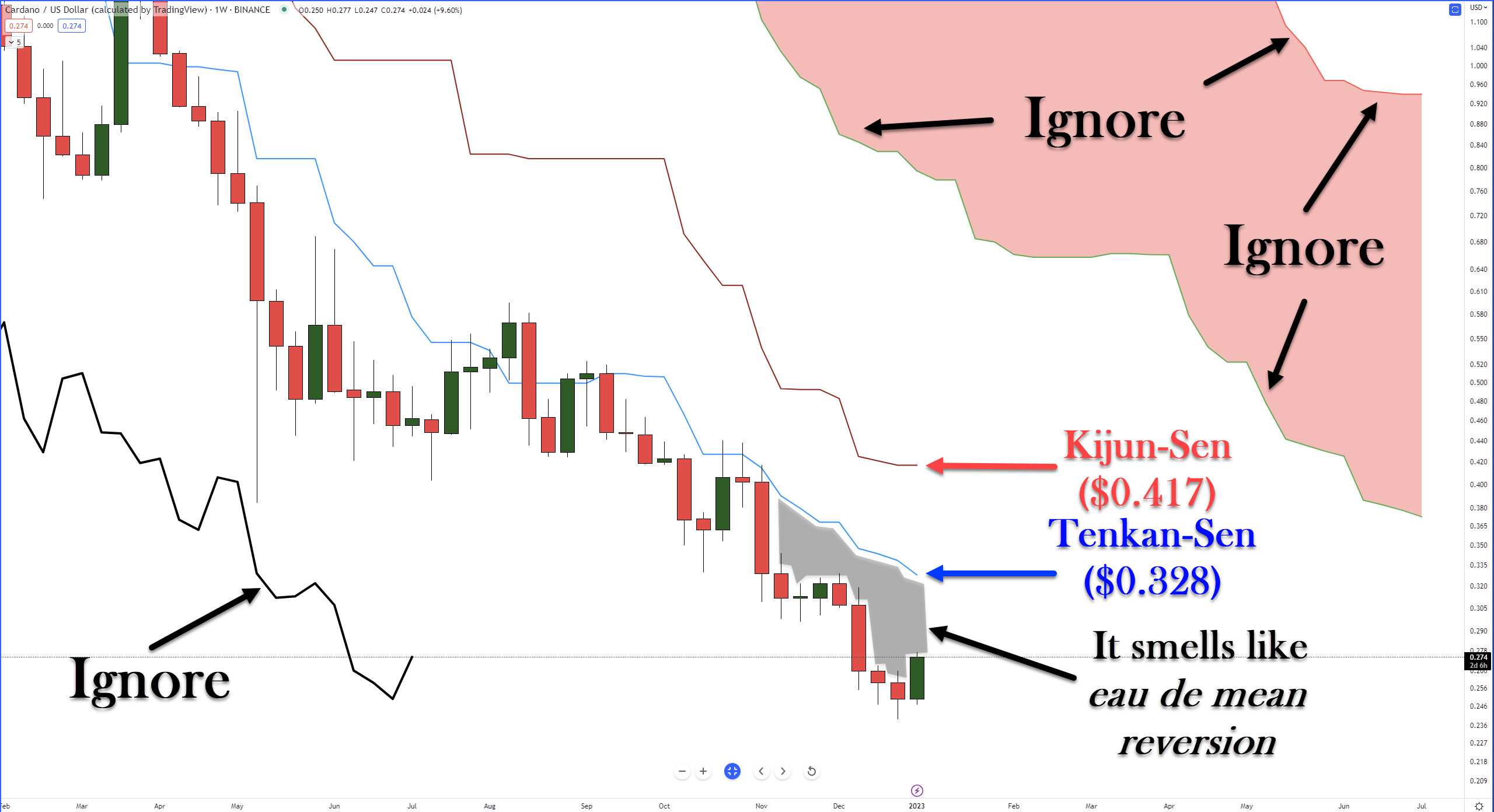

On Cardano’s weekly chart below, I placed arrows pointing to things you can ignore as they’re not immediately relevant to this analysis.

From an Ichimoku perspective, the most immediate and important factor that analysts see is the shaded black/grey zone between the candlesticks and the Tenkan-Sen. ⚠️

Why?

Because large gaps between the Tenkan-Sen and the bodies of candlesticks often ‘fill’ within four to five periods, the end of this week brings it to seven without a return to the Tenkan-Sen.

How probable is it that Cardano will return to the Tenkan-Sen? Let’s take a peek at the weekly oscillators, too.

The Composite Index and the RSI have sharp moves higher, with the RSI showing a return above the first oversold level (#2) in a bear market, 30.

However, the weekly RSI has been stuck between the 35 and 30 levels since October 2022, and there’s no reason it couldn’t remain that way.

For the Composite Index, the CI line’s (red) angle suggests (#1) that if momentum remains strong going into next week, it will likely cross above its fast average (green) and, possibly, its slow average (yellow). 👀

Analysts see the primary and strongest resistance for Cardano at the weekly Kijun-Sen, which is also the 50% Fibonacci retracement (not shown) of last week’s swing-low at $0.239 and the high of the weekly May 9, 2022, strong bar.

The daily chart for Cardano (not shown) faces resistance against the daily Kijun-Sen at $0.279, while the daily RSI is up against the first overbought level in a bear market, 55.

TL;DR

Near-term resistance: $0.279

Intermediate resistance: $0.328

Primary resistance: $0.417

Analysts anticipate some resistance in the $0.279 value area, but any sustained breakout above that level is likely to continue toward the Intermediate and/or Primary resistance level(s). 🔭

The trend remains extremely bearish, and the path of least resistance remains lower despite recent bullish signs.

Bitcoin

We won’t tackle a ton on Bitcoin’s chart – we hit it pretty hard in Wednesday’s Litepaper. 🪙

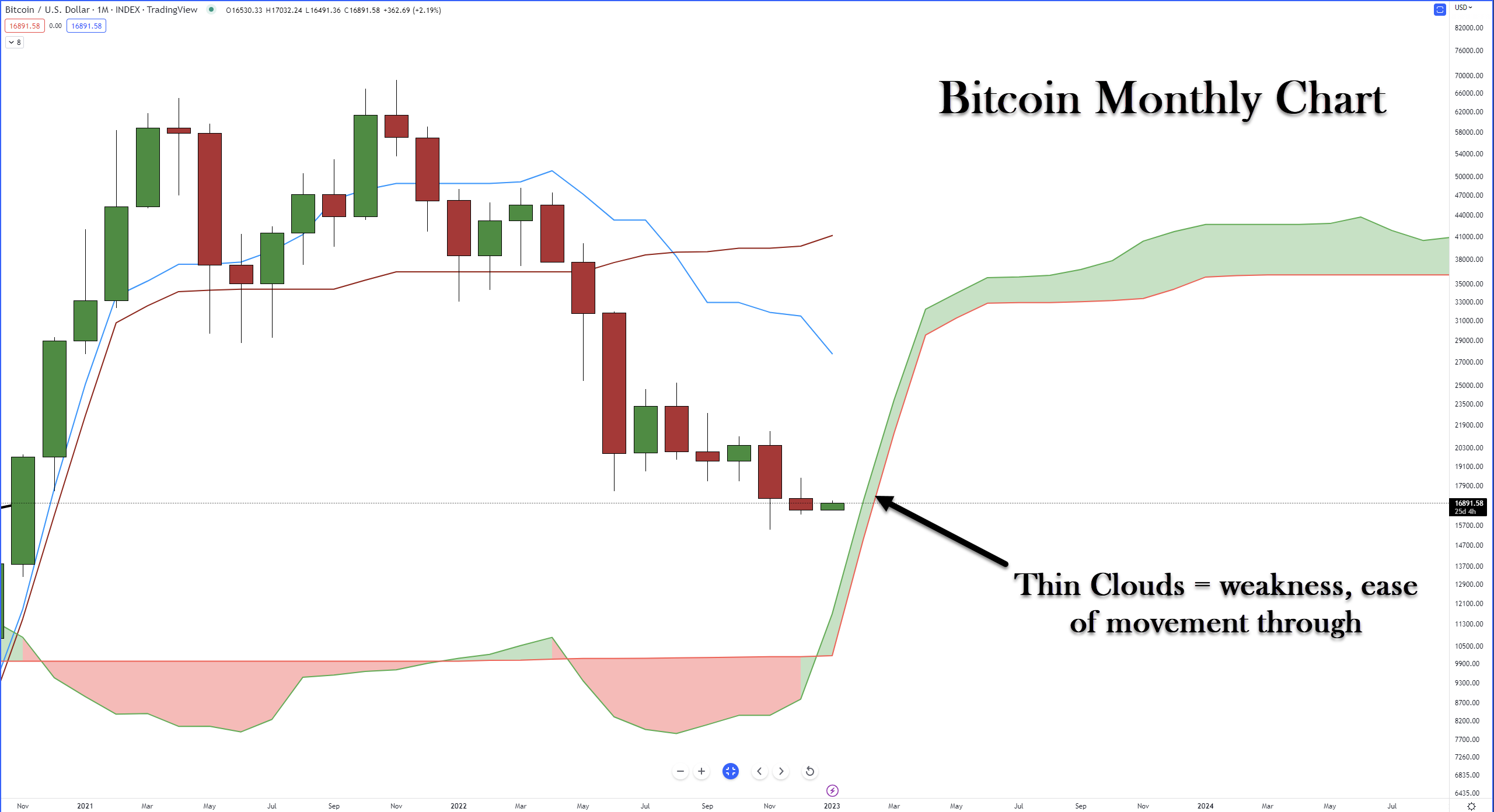

Not trying to throw any shade here on the bulls, but while the mood of crypto enthusiasts is somewhat upbeat, analysts warn that caution should still be the name of the game. And this is especially true if we take another look at Bitcoin’s monthly chart.

Wednesday’s Technically Speaking article highlighted several bullish considerations for Bitcoin, but there are some major red flags, too.

The Ichimoku Cloud (Kumo) is an important barometer of how analysts, traders, and investors interpret an instrument’s sentiment. Above the Cloud is interpreted as bullish, and below is bearish.

Thick Clouds represent strength, indecision, and volatility. Thin Clouds, however, represent weakness. It’s as if the closer Senkou Span A and Senkou Span B are to each other, the weaker they become. So, theoretically, the behavior that analysts expect to see when price approaches a thin Cloud is an easy time moving past/through it.

This is where things get very, very iffy. 🤔

Except for the quick crash and rally from the Covid crash in 2020, Bitcoin has never fallen below the Ichimoku Cloud. In fact, Bitcoin is still so young that the first time its monthly chart had a complete Ichimoku chart was in December 2016!

What analysts, investors, and traders do know is this: risk-on appetite is low across the board in all asset classes, and crypto represents the riskiest of the risky assets out there. And the Cloud for Bitcoin is very, very thin.

If you’re interested in learning more about the Ichimoku Kinko Hyo system, read our introduction to Ichimoku here. 🤔

Bullets

Bullets From The Day:

🧅 Show Solana’s 2022 chart to an onion; it would make the onion cry. The crypto world has another chapter of sadness to add to Solana, and it’s the latest pamp-and-damp in crypto. A Doge-themed memecoin spawned from Solana’s network called BONK! ($BONK.X). BONK! had upwards of +3,000% gains this week before losing over 64% in the last 36-ish hours. How do you solve a collapse in value like that? The monetary policy titans behind BONK!, using Venezuelan Maduro Economic Theory, believe the best way to make the supply of something nobody wants worth more is to burn it. So they burned (removed from ‘circulation’) 5 Trillion BONK!, thinking that reducing the supply of something when there’s no longer any demand would still drive up the price. This means there’s only 94.16 Trillion BONK! left. Decrypt has more.

🌋 Mt. Gox’s creditor registration deadline was extended from January 10, 2023, to March 10, 2023. This means the timing of creditors getting their distributions is also moved back from July 1, 2023, to September 30, 2023. The loss of 850k Bitcoin in 2014 triggered the biggest bear market in cryptocurrency history when Bitcoin lost nearly -87% of its value. To put that into context, if the current bear market for Bitcoin were to hit -87%, that would put BTC near the $9,000 value area – which would require a -48.50% drop from its present value. More from Finbold.

✏️ Chalk up another big bounty payout for Pwning.eth. After getting a $6 million bounty in 2022 for finding an exploit in Aurora, Moonbeam and Astar (parachains on $DOT.X) just awarded Pwning.eth $1 million for finding a vulnerability that could have led to a hack/theft of up to $200 million. Ethereum World News has more.

🪙 Cathie Wood is making another round of dip buying in the crypto space. The CEO of ARK Invest picked up another $5.7 million worth of $COIN (144,463 chares) for its ARK Fintech Innovation ETF and ARK Next Generation Internet ETF. Many of ARK’s funds have lost 50% since 2022, but Woods continues to buy on major dips, not worried about the industry’s long-term future. More from Cointelegraph.

Links

Links That Don’t Suck:

🛑 SEC Moves to Block Binance.US Attempt to Buy Distressed Assets of Voyager Digital

🚂 Why this FTX former Chief Engineer is now under The lens of U.S. authorities

🏠 Stealing home? Man accused of burglarizing Brewers clubhouse

🧑💻 SEC Investigating FTX Investors’ Due Diligence: Reuters

👎 Genesis Global dismisses an additional 30% of staff

🦕 XRP whales move assets as price dips; what’s next?

🌎 Lasers reveal sites used as the Americas’ oldest known star calendars

🍁 Canadian province’s most inappropriate 911 calls include clogged drain

🎮 Final Fantasy creator says 2023 will be a breakthrough year for blockchain gaming

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: