Sometimes when the market feels like its ready to ride off on its own, it does. Right into a tree. Face first. 🌳

Bulls and bears are still digesting the news from Gary ‘Guns Out’ Gensler’s decision with staking-as-a-service.

We’re going to take a look at the SEC’s crackdown on Kraken, Crypto Mom’s dissent, a Technically Speaking article focusing on Bitcoin’s support zone, and an update on the staking rewards.

A relatively flat end of the day for crypto – but there were some major intraday swings.

Here’s how the market looked at the end of the trading day:

| Shiba Inu (SHIB) |

$0.0000128

|

3.07% |

| Litecoin (LTC) | $94.11 | 2.62% |

| OKB (OKB) | $41.06 | 0.38% |

| TRON (TRX) | $0.064 | 0.35% |

| Cosmos (ATOM) | $13.90 | 0.34% |

| Ethereum Classic (ETC) | $21.35 | -0.13% |

| Bitcoin Cash (BCH) | $128.58 | -0.33% |

| Uniswap (UNI) | $6.43 | -0.35% |

| Polygon (MATIC) | $1.27 | -0.41% |

| Dogecoin (DOGE) | $0.083 | -0.78% |

| Altcoin Market Cap |

$550 Billion

|

0.29% |

| Total Market Cap | $970 Billion | 0.13% |

If you’re not caught up on the latest FUD, here’s a quick rundown. 🟢

Shortly before Wednesday’s Litepaper was e-mailed out and well after editing, $COIN CEO Brian Armstrong sent out this Tweet:

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

— Brian Armstrong (@brian_armstrong) February 8, 2023

Initial market responses were ‘meh’, no major selling or FUD in price action.

That was until yesterday’s cheeky announcement from SEC Chairman Gary ‘Guns Out’ Gensler:

Today @SECGov charged Kraken for the unregistered offer & sale of securities thru its staking-as-a-service program.

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

— Gary Gensler (@GaryGensler) February 9, 2023

Long story short, staking through Kraken is no longer allowed for U.S. citizens, and Kraken paid a $30 million fine. 💸

And then crypto markets took a big ol’ FUD dump.

SEC Commissioner Hester Peirce, affectionately known as ‘Crpyto Mom’, was not a fan and issued a dissent.

My thoughts on today's Kraken settlement: https://t.co/mijt3MNN4U

— Hester Peirce (@HesterPeirce) February 9, 2023

Coincidentally, BlockFi’s $100 million settlement was just a year ago, in February 2022 – huh.

From a subjective point of view, many in the crypto community are calling for blood.

From an objective point of view – it’s not really that bad. It’s not great, but it’s not the end of the crypto world, either.

The execution, delivery, messaging, and aesthetics could have been waaaaaaay better.

And Gensler does make a good point about the staking rewards and disclosures needing to be made.

For example: If you stake $ADA.X on Kraken, you get the rewards once a week. However, staking ADA in the native Cardano wallet, Daedalus, you are awarded at the end of every epoch – which is 5 days.

At once a week, Kraken gives you your ADA reward – 52 times a year. Cardano’s native staking reward interval is every 5 days – 73 awards a year.

That’s nearly a -28% loss in the frequency of your rewards – where does that go, and who gets it? 🤔

We’ll update you as this topic continues to unfold.

Open a brokerage account with at least $250 by Feb 10, 2023, to be automatically entered to win a 5-day / 4-night stay for yourself and a guest at the all-inclusive Hyatt Ziva Rose Hall resort in Montego Bay, Jamaica.

You’ll also receive roundtrip airfare to Montego Bay and roundtrip transportation between the resort and Montego Bay airport.

The contest is open to US residents only and ends on Feb 10, 2023, so don’t delay! Here are the official rules.

P.S. Want to increase your odds? Receive an additional entry for every $250 deposited into your account during the contest period (maximum 20 additional entries).

Crypto

Crypto Mom Dissents

SEC Commissioner Hester “Crypto Mom” Peirce disagreed and dissented from the SEC’s decision to shut down Kraken’s staking program.

Maybe ‘disagree’ and ‘dissent’ are not good enough words to describe what she wrote in her rebuttal.

Commissioners use a certain decorum and style in their statements, very governmenty sounding with fancy-schmancy speaking and writing styles.

Read between the lines, though, and Crypto Mom’s response was the equivalent of a fist to the face.

Commissioner Peirce suggested that agreeing with the SEC’s decision (or not) probably wouldn’t have mattered: “Whether one agrees with that analysis or not, the more fundamental question is whether SEC registration would have been possible.”

She argued that there are myriad issues with staking, such as whether the whole program should be registered or if only some tokens should be registered. And what disclosures there would be.

Crypto Mom then winds up a sock full of nickels. She writes, “Instead of taking the path of thinking through staking programs and issuing guidance, we again chose to speak through an enforcement action, purporting to “make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

And then another sock full of Washington’s comes down, “Most concerning, though, is that our solution to a registration violation is to shut down entirely a program that has served people well.”🥊

And then, the coup de grace, the body slam, the suplex, the curb stomp to end all curb stomps:

A paternalistic and lazy regulator settles on a solution like the one in this settlement: do not initiate a public process to develop a workable registration process that provides valuable information to investors, just shut it down.

You can read the full statement from Commissioner Hester M. Peirce here.

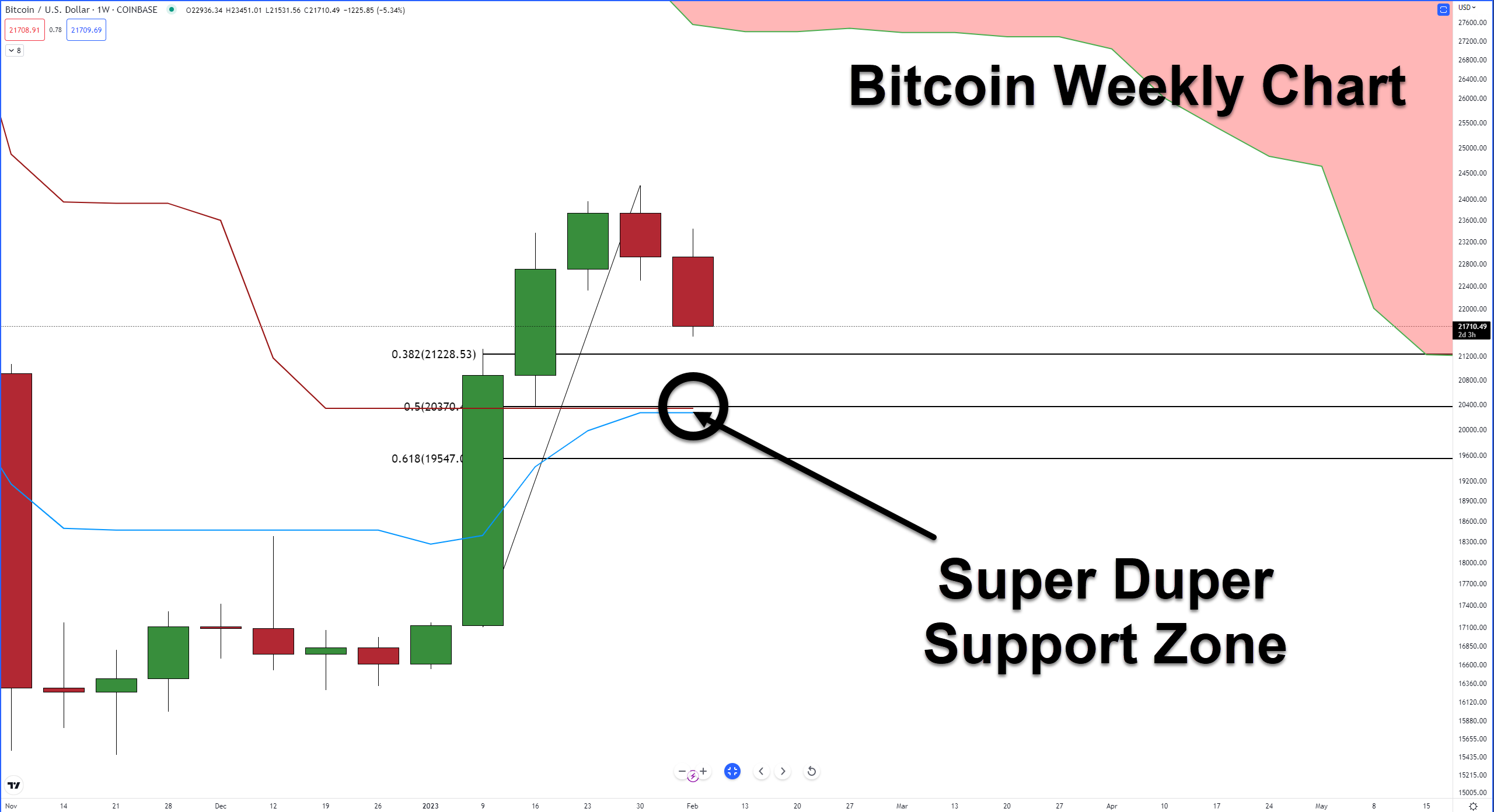

If $BTC.X continues to fall, how low could it go?

That’s the main question analysts, traders, and investors want to know – especially going into the weekend. 🤔

Let’s take a quick peek at what the analysts are looking at. And it’ll be quick.

$20,370 – that’s the major support zone traders, investors, and analysts are paying attention to. Why? Four reasons:

- $20,370 is close to the psychological number of $20,000.

- $20,370 is the 50% Fibonacci retracement from the swing high of $24,262 to the low of the strong bar at $17,102.

- $20,370 is near the Weekly Kijun-Sen ($20,337).

- $20,370 is near the Weekly Tenkan-Sen ($20,267).

That’s a big chunk of technical support levels sitting right on top of one another. If it holds as support, analysts believe another leg up is likely.

However, if $20,370 fails to hold as support… well, that could be a warning that the bear market could continue. 🐻

And if you didn’t read or forgot about the Rising Wedge pattern, give it another look from Wednesday’s Litepaper.

The drop was the most probable direction from a technical analysis perspective, even before the SEC’s Kraken decision.

The table below is the current (February 10, 2023) staking yield rates of the top ten Proof-Of-Stake cryptocurrencies by market cap.

Staked % is what percent of the total supply of that cryptocurrency is currently used to earn staking rewards – sometimes called ‘Lock-Up.’

The Lock-Up Period is how long crypto must stay staked before you can withdraw it and/or any rewards earned.

Nominal Yields are the rewards listed, whereas Real Yield is the expected return when factoring in other costs, factors, or changes like inflation rates (not listed).

It should also be noted that calculations and factors for Real Yields can vary substantially from one week to the next. Additionally, the Nominal Yield may have an expected range but is not guaranteed. For example, Polkadot’s ($DOT.X) Nominal Yield is advertised/listed between 8% to 14%.

Another factor to consider is that the rewards are not in US Dollars but in token/crypto your stake. Staking Cardano ($ADA.X) rewards you in ADA and so forth.

This table is updated weekly.

| Crypto | Nominal Yield % | Real Yield % | Staked % | Lock-Up Period |

|---|---|---|---|---|

| Ethereum (ETH) | 3.86% (-0.04) | 4.09% (+0.02) | 14.32% (+0.13) | 12+ Months |

| BNB (BNB) | 2.52% (+0.12) | 8.04% (-0.35) | 97.517% (+0.64) | 7 Days |

|

Cardano (ADA)

|

3.34% (+0.02)

|

0.04% (+0.13) |

71.86% (-0.08)

|

None

|

|

Polygon (MATIC)

|

6.06% (+1.79)

|

3.02% (+0.75)

|

39.63% (+1.90)

|

21 Days

|

| Polkadot (DOT) | 14.42% (-0.02) | 6.79% (+0.07) | 46.39% (+0.33) | 28 Days |

|

Chainlink (LINK)

|

7%

|

0%

|

NA

|

5 Days

|

|

TRON (TRX)

|

3.57% |

1.52% (-0.01)

|

45.25% (+0.10)

|

3 Days

|

|

Avalanche (AVAX)

|

9.13% (+1.03)

|

2.95% (+0.37) |

62.51% (+1.30)

|

14 Days

|

|

Algorand (ALGO)

|

6.78% (+0.02)

|

2.82% | 54.51% (-1.62) | 90 Days |

|

Near Protocol (NEAR)

|

9.43% (+0.08)

|

4.41% (+0.09)

|

43.81% (-0.73) |

1 Day

|

Source: www.stakingrewards.com

Staking on Chainlink’s blockchain was activated on December 6, 2022 and data is still pending.

$DOT.X and $BNB.X continue to offer the highest Real Yields.

Polygon’s nominal and adjusted yields experienced a big spike along with a jump in the Staked % – it’s also appreciated more than its peers over the past week.

$ADA.X’s adjusted reward finally flipped into positive territory – barely.

Bullets

Bullets From The Day:

♾️ Does it seem like crypto lawsuits have jumped over the past couple of years? Well, they have. According to HedgewithCrypto, crypto lawsuits spiked nearly 50% in 2022. The study used class action and SEC investigations as criteria. There were 30 in 2018, 21 in 2019, 34 in 2020, 28 in 2021, and 41 in 2022. Analysts expect more lawsuits by the industry to be filed against the SEC in the coming months and years. Finbold has more.

😤 A big name in the crypto institutional side of crypto, Paxos, is facing regulatory ire. The New York Department of Financial Services (NYDFS) has begun an investigation into Paxos – but for what reason(s) is still unknown. Paxos has been around since 2012 (formerly itBit) but has since worked closely with providing crypto services to institutional trading/investing and payment processors like $MA. Paxos has its own stablecoin, Paxos Dollar (USDP), a gold-backed $ETH.X token Pax Gold ($PAXG.X). Some believe the NYDFS investigation may have something to do with Paxos’s recent partnership with Binance to issue Binance’s stablecoin, $BUSD.X. More from Bitcoinist.

⤵️ Ethereum’s share of the NFT market cap has taken a nose dive. According to DappRadar, the ETH NFT market cap fell almost 60% in 2022 from $9.3 billion in Q1 2022 to $3.7 billion in Q4. Not surprisingly, the collapse coincided with the broader crypto bear market. It is anticipated that $BAYC.NFT and CryptoPunks will continue to lead in this space well into 2023. NewsBTC has more.

Links

Links That Don’t Suck:

📱 Tech layoffs: Yahoo to slash 20% of its workforce

🎮 Switch owners are getting Game Boy Advance games

😖 DYdX DeFi grants renewal proposal spurs polarized community discussion

⏰ US lawmakers question SEC chair on timing of Sam Bankman-Fried’s arrest

🔨 SEC chair speaks on using ‘all means available’ to bar crypto from mainstream

😝 We asked ChatGPT to explain Bitcoin like a 1920s mobster; The result is hilarious

🤯 Bitcoin options market turns most bearish since 2022 with investors facing new wall of worries

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: