There’s a strong mix of selling, consolidation, and pamping across all crypto today. 😑

Investors and crypto traders appear unfrazzled or ‘meh’ despite regulatory and government FOMO news with crypto.

We added a new custom Stocktwits Crypto Index, the A.I. Index. We’ll also look at a ton of NFT news, a tokenized BlackRock ETF, and an update to Monday’s Technically Speaking article.

Another day, another mix of green and red. Notice anything interesting about the assets in the table below? They all have a passive income utility via staking except for Stellar ($XLM.X).

No major cryptocurrencies flew higher than anyone else, a relatively ‘even’ drive up across the board.

Here’s how the market looked at the end of the trading day:

| NEAR Protocol (NEAR) |

$2.69

|

12.44% |

| Polygon (MATIC) | $1.32 | 5.66% |

| Cosmos (ATOM) | $14.90 | 1.71% |

| Cronos (CRO) |

$0.083

|

1.71% |

| TRON (TRX) |

$0.066

|

1.22% |

| Algorand (ALGO) | $0.286 | 0.56% |

| Cardano (ADA) | $0.393 | 0.01% |

| OKB (OKB) | $44.24 | -0.05% |

| Stellar (XLM) | $0.091 | -0.24% |

| Chainlink (LINK) |

$7.08

|

-0.95% |

| Altcoin Market Cap |

$580 Billion

|

-1.43% |

| Total Market Cap | $1.021 Trillion | -1.54% |

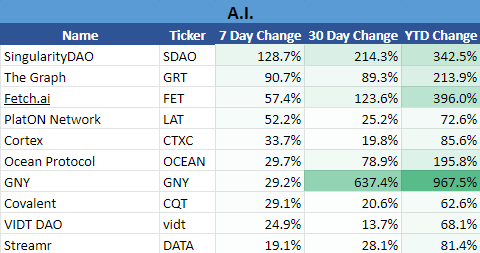

A new Stocktwits Crypto Index will be tracked from now on, the A.I. Index. 🦿

The A.I. Index comprises cryptocurrencies dedicated to making the Battlestar Galactica, 2001 Space Odyssey, I Robot, and the Terminator universes very real.

We construct this index by limiting the assets in this space to a minimum market cap of $20 million.

Overall, the index is up +140.98% over the past 30 days and up 208.92% YTD.

If the A.I. Index were included in last week’s indices, it would be the best performer YTD and the only one over 200%.

The other indices include the DeFi Index, DEX Index, Lending Index, Metaverse Index, NFT Index, Proof-Of-Stake Index, Proof-Of-Work Index, Privacy Index, Smart Contracts Index, and the Web 3 Index.

See how they performed for 2022 here.

Read the latest Saturday Litepaper issue here.

Open a brokerage account with at least $250 by Feb 10, 2023, to be automatically entered to win a 5-day / 4-night stay for yourself and a guest at the all-inclusive Hyatt Ziva Rose Hall resort in Montego Bay, Jamaica.

You’ll also receive roundtrip airfare to Montego Bay and roundtrip transportation between the resort and Montego Bay airport.

The contest is open to US residents only and ends on Feb 10, 2023, so don’t delay! Here are the official rules.

P.S. Want to increase your odds? Receive an additional entry for every $250 deposited into your account during the contest period (maximum 20 additional entries).

NFTs

NFT Ya You Know Me

You’re not alone if you’ve noticed an uptick in NFT news. That sector of the crypto world is rebounding heavily off of its lows.

Out of the 10 custom Stocktwits cryptocurrency indices, the NFT index is the best-performing index YTD and the only one over 100% YTD – it’s up +135% YTD. 🤯

And it’s not just the best-performing Stocktwits Crypto Index YTD; it’s the only index that’s been in the Top 3 every week so far for 2023 (the whole five weeks we’ve had).

It’s been a helluva performer, too: 2nd best for Week 1, the best performer for Week 2 and Week 3, 2nd best again for Week 4, and the best performer for last week.

You can read the Saturday Litepaper here.

Just take a look at the GIF of the RRG. It’s 12 weeks’ worth of movement.

It starts during the week of December 25, 2022, when the NFT Index looks like a squirrel that fell off the Punch-Me-In-The-Face-Tree and hit every branch before going splat face first, making a sound like a golf-ball hitting concrete.

The total opposite happens as the market transitioned into 2023, where said squirrel finds a cocaine-infused acorn and scurries back up the Punch-Me-In-The-Face-Tree, giving every branch and twig 4 middle fingers on its way back to the top. 🥜

Here’s a quick breakdown of some news happening in the crazy NFT space:

- The Dookey Dash game leaderboard has had some scores removed by $BAYC. Why? Stoopid cheaters. From The Block.

- An OpenSea user had two of his NFTs stolen through a phishing scam and complained to OpenSea; then, they locked him out of his account. He’s suing for $500k. From CryptoNews.

- NFT artist Mason Rothschild was awarded a $133k judgment by a jury in France after winning the case against some French company named Hermes. From Coindesk.

- The Beijing Guoan Football Club launched its GLEO NFT collection on Sunday. From Forkast.

- Open Edition NFTS might be one of the reasons the NFT market has a lot of pamp going on. From Decrypt.

- From last week, but still worth mentioning because it’s an epic way to quit your job – man makes an NFT out of his resignation letter. From Yahoo!

- WeTransfer, the file-sharing company, is stepping into the NFT space. From TheBlock.

- CryptoPunk#5066 sold on Monday for 857 $ETH, and Bored Ape Yacht Club#7090 sold for 800 ETH yesterday. From Decrypt.

One of the biggest adoptions that blockchain enthusiasts want to see is the stonk market converting its current system to a tokenized system over a blockchain. 😲

A step in that direction happened earlier this month.

The Zug, Switzerland-based DeFi company Backed Finance launched bCSPX on one of the world’s most active and liquid DEXs (decentralized exchange), Uniswap ($UNI.X).

The bCSPX token represents one share of BlackRock’s ($BLK) iShares Core S&P 500 ETF (CSPX). Every bCSPX token created results in one share of CSPX purchased and then deposited with Backed Finance’s regulated custodian, Maerki Baumann & Co.

According to Backed Finance, the token is legally classified as a certificate.

While the token can be traded on Uniswap’s DeFi platform, Backed says that redeeming the token for the stock will require individuals to complete KYC (know your customer) information.

Whether BlackRock was involved or is aware of this development is unknown. 🙄

I’ll keep this one short and sweet.

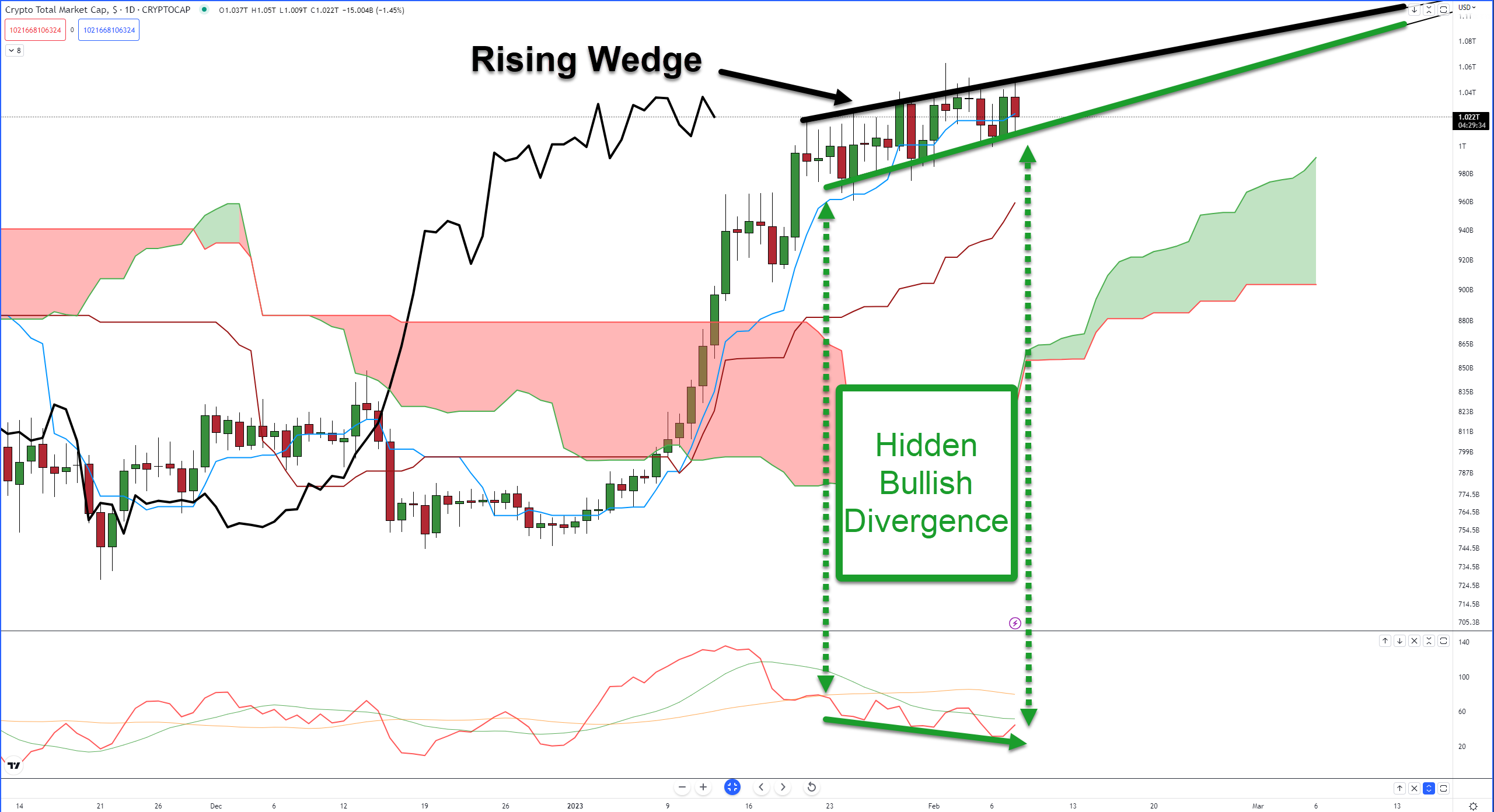

In Monday’s Litepaper, we looked at what analysts see as major bullish and bearish warning signs on the Total Crypto Market Cap chart.

This is an update to Monday’s Technically Speaking article.

Analysts continue to see rejection against the upper trendline of the Rising Wedge and a struggle to stay above the Tenkan-Sen (blue moving average). That’s something the bears are ready to pounce on if bulls fail at moving higher.

That is especially true given the high percentage of time that price drops below a rising wedge pattern, but as we looked at on Monday with Bulkowski’s research, the moves are often underwhelming.

From a bullish perspective, there’s hidden bullish divergence between the Composite Index and the candlestick chart.

Monday’s analysis looked at the hidden bullish divergence with the RSI, but the Composite Index shows something slightly more interesting for bulls.

A quick recap of the Composite Index: Created by Connie Brown, it’s essentially the RSI with a momentum calculation and two moving averages. It’s able to catch divergences that the RSI is unable to. The red line is the Composite Index line; the slow average is yellow, and the green average is the fast average.

Hidden bullish divergence is only valid if the last move was up – which it was. But the condition analysts are watching for is something Connie Brown points out in her books regarding the Composite Index:

Divergences that occur not at extremes and/or when the Composite Index crosses one of its averages are often the most powerful signals that a major move could be coming.

Suppose the Total Crypto Market Cap chart pushes above the upper trendline around $1.05 Trillion (black), and the Composite Index crosses above the green average. In that case, analysts expect some fireworks to begin.

Bullets

Bullets From The Day:

😱 FTX’s Lawyers billed $7.5 million for 19 days worth of work. The law firm Sullivan & Cromwell reported 150+ staff working on the case – 32 partners, 85 associates, and 34 other non-legal staff worked more than 6,500 hours. According to a court filing, some of the hourly rates were over $2,000/hour, which was at a discount. And the firm isn’t requesting the full amount; $7.5 million represents only 80% of the full bill ($9.5 million). Sullivan and Cromwell’s relationship with FTX is contentious – the firm billed $8.5 million to FTX for work they did over a year and a half before FTX’s collapse. Additionally, a former partner of Sullivan and Cromwell is FTX’s General Counsel. Coindesk has more.

❓ Where In The World Is Carmen Sandiego Do Kwon? South Korea confirmed it sent a team to Serbia, where Do Kwon is believed to be hiding, and requested their help to expatriate Do Kwon to South Korea. However, the team they sent wasn’t just a few low-level lackeys in the prosecutor’s office. The group included the director for Financial and Securities Crimes from the Seoul Southern District’s Prosecutors Office and the International Criminal Affairs Division director. South Korean officials reported that Serbian authorities would actively cooperate in apprehending Do Kwon. More from Forkast.

🏰 Metaverse crypto giant The Sandbox ($SAND.X) spiked up over 25% yesterday. The LEAP 2023 conference in Saudi Arabia showed a partnership ceremony involving The Sandbox and the Saudi government. Sandbox and the Saudi Arabia Digital Government Authority signed a memorandum of understanding (MOU). Details are scarce, but it’s expected that Sandbox will help with Saudi plans for expanding into the metaverse. Cointelegraph has more.

🤬 Dubai has effectively banned privacy coins. The Virtual Assets and Regulatory Authority (VARA) bars any privacy-focused crypto assets that “… prevent the tracing of transactions or record of ownership through distributed public ledgers and for which the virtual asset service provider [VASP] has no mitigating technologies or mechanisms to allow traceability or identification of ownership.” Crypto assets that would be affected likely include Monero ($XMR.X), Zcash ($ZEC.X), Decred ($DCR.X), and PIVX ($PIVX.X).

Links

Links That Don’t Suck:

🤖 Bard: Google launches ChatGPT rival

📛 ChatGPT ENS domain name sells for over $10,000

🛥️ Arrest made in stolen yacht rescue, ‘Goonies’ fish incident

🏦 IRS broadens tax requirements for crypto to encompass everyone

🪙 India in ‘no hurry’ for CBDC as digital rupee pilot onboards 50k users

👍 ConsenSys founder ‘bullish’ on Ethereum following crypto winter performance

😤 $4 million in Ethereum being actively laundered by North Korean hackers now: FBI report

🤔 Microsoft’s $69 billion Activision takeover in doubt as UK regulator raises competition concerns

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: