If $BTC.X continues to fall, how low could it go?

That’s the main question analysts, traders, and investors want to know – especially going into the weekend. 🤔

Let’s take a quick peek at what the analysts are looking at. And it’ll be quick.

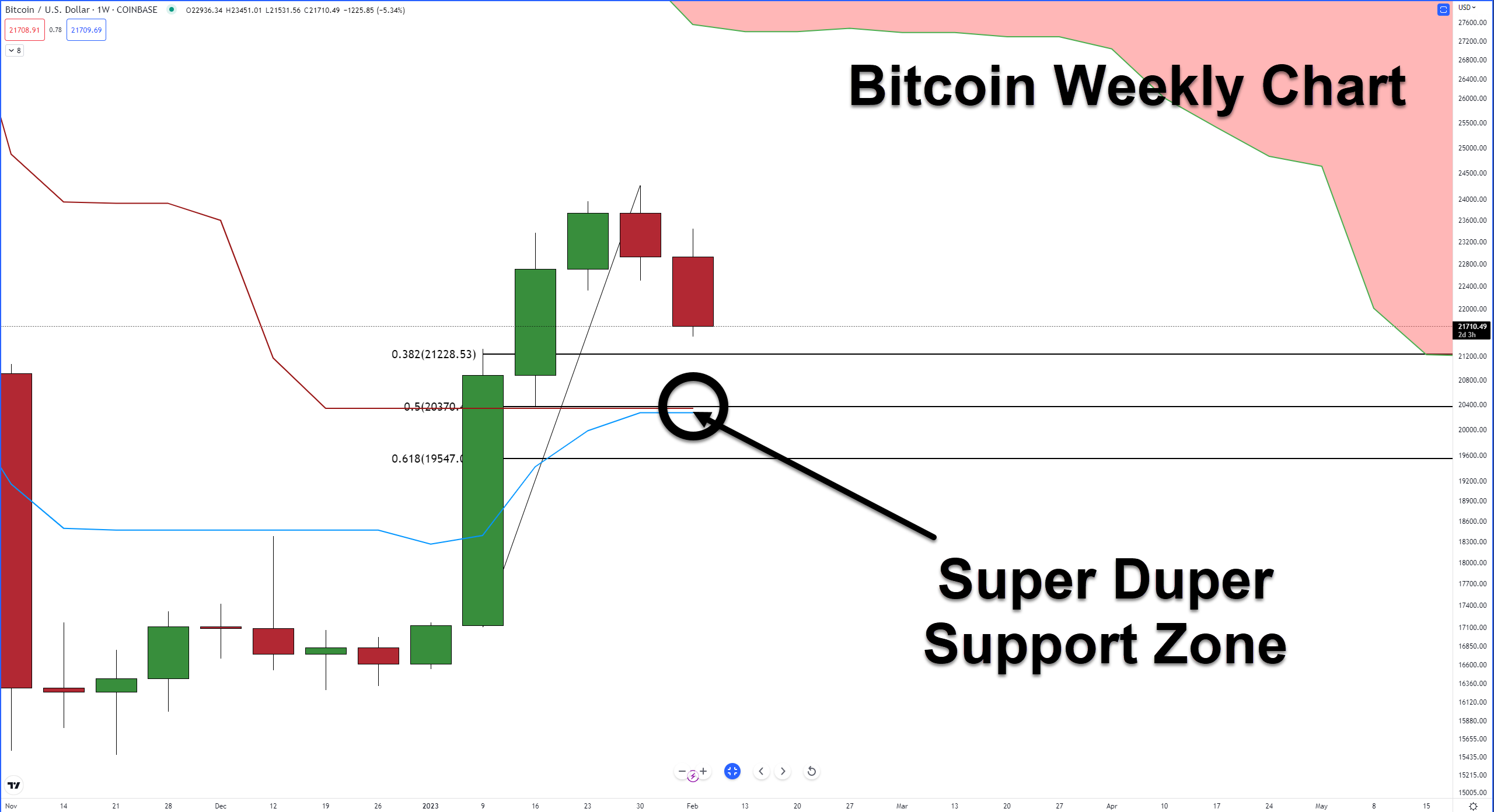

$20,370 – that’s the major support zone traders, investors, and analysts are paying attention to. Why? Four reasons:

- $20,370 is close to the psychological number of $20,000.

- $20,370 is the 50% Fibonacci retracement from the swing high of $24,262 to the low of the strong bar at $17,102.

- $20,370 is near the Weekly Kijun-Sen ($20,337).

- $20,370 is near the Weekly Tenkan-Sen ($20,267).

That’s a big chunk of technical support levels sitting right on top of one another. If it holds as support, analysts believe another leg up is likely.

However, if $20,370 fails to hold as support… well, that could be a warning that the bear market could continue. 🐻

And if you didn’t read or forgot about the Rising Wedge pattern, give it another look from Wednesday’s Litepaper.

The drop was the most probable direction from a technical analysis perspective, even before the SEC’s Kraken decision.