A good chunk of the market continues to move sideways and consolidate before its next major move. 🟡

In today’s Litepaper we’re starting with a Technically Speaking on Ethereum.

Also on deck: a dude who is surrounded by some bad stuff, KyberSwap’s hack, and a look at what Jump Crypto did/didn’t do when UST collapsed last year.

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) | $37,735 | -0.28% |

| Ethereum (ETH) | $2,026 | -1.15% |

| Total Market Cap | $1.387 Trillion | -0.53% |

| Altcoin Market Cap | $648 Billion | -0.91% |

| RUNE (RUNE) – Biggest Winner |

$6.30

|

5.26% |

| ImmutableX (IMX)- Biggest Loser | $1.27 | –5.36% |

Congestion and consolidation all around – that’s the name of the game. 🎰

Unfortunately, things can’t always go Moon and Lambo; sometimes they pull back, and sometimes they park and bark.

Ethereum

$ETH, like the majority of the market, is experiencing a little breather.

On Ethereum’s daily chart, the Ichimoku system is warning of either a prolonged congestion phase or a return to upside price action. The key thing to watch is the Chikou Span.

When the Chikou Span is no longer in open space (a condition where the Chikou Span won’t hit the body of a candlestick horizontally over the next five to ten periods), it is the first warning that consolidation has a high probability of happening soon.

The Chikou Span, at its current level, will hit a candlestick body in six days. If Ethereum is going to return to an expansion phase and move higher, the Chikou Span will need to stay above the candlestick bodies.

When dealing with consolidation, the question is: when will it end? That’s where one of the coolest parts of the Ichimoku Kinko Hyo system comes in. 😎

In Manesh Patel’s Trading With Ichimoku Clouds, he identified a behavior I call the two-Cloud theory. Patel wrote that when the upper and lower Clouds are both pointing in the same direction as the future Cloud, that is often the point when explosive moves occur.

Two are coming up (the blue rectangles on the chart); the first is between November 30 and December 1. The second is between December 3 and December 4.

So, if Ethereum continues to trade sideways as it approaches those dates, keep your eyes open! 😀

A U.S. court has given the green light for Jump Crypto to whisper sweet nothings (read: confidential info) to the court, away from our prying eyes. 👀

Let’s rewind a bit. Terraform Labs and its ex-CEO, Do Kwon, are in hot water with the SEC. The charge sheet? Allegedly peddling unregistered securities and dabbling in fraud, raking in billions in the process. Their lol-stablecoin, TerraUSD ($UST) crashed and burned in May 2022, now worth a measly $0.01.

Now, enter Judge Jed S. Rakoff, who’s playing it cool by saying he might spill the beans on those confidential filings later. If that happens, Jump Crypto’s legal eagles get a chance to squawk their objections. 🐔

So, what’s Jump Crypto’s role in this crypto soap opera? They’re not defendants, but the SEC is pointing fingers at them for the UST stablecoin’s nosedive. As alleged by the SEC, the plot goes something like this:

Back in May 2021, when UST started to wobble off its dollar peg, Terraform Labs supposedly cooked up a scheme. What was the scheme? Getting Jump Crypto to buy heaps of UST to prop up its price. Fast forward to May 2022, and no Jump Crypto cavalry can save the day, leading to UST’s downfall. ⤵️

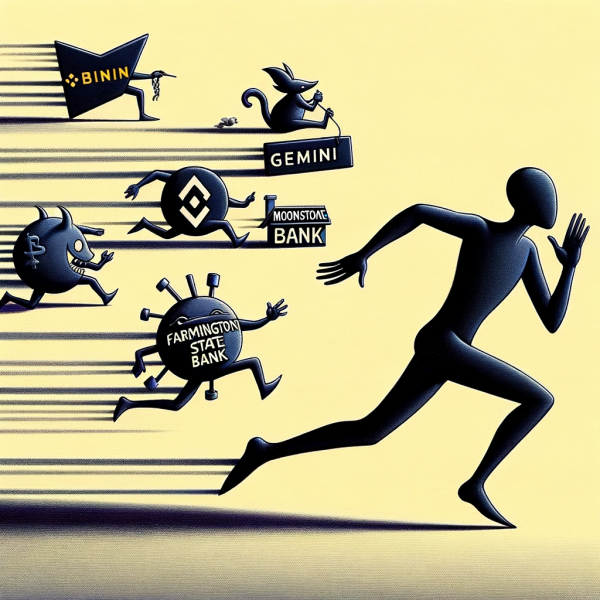

Noah Perlman, the chief compliance officer at Binance, has a past involving not only major crypto scandals but also some of the world’s most sensational controversies. 🌎

And the list is kind of nuts.

- Ties to Jeffrey Epstein: Noah Perlman’s connection to Jeffrey Epstein is highlighted by his father, Itzhak Perlman, who reportedly took flights on Epstein’s plane and visited a location where Epstein built a lodge, later referred to as a “lair to target girls.”

- Role in Gemini’s Earn Program: Perlman was deeply involved in Gemini’s Earn program, which became the center of a $1.1 billion fraud lawsuit by the New York Attorney General, especially after the collapse of FTX and the subsequent issues with Gemini Earn.

- Involvement with Moonstone Bank: As a director at FBH Corp., which took over Farmington State Bank (later Moonstone Bank), Perlman was implicated in dealings that attracted investments from Alameda Research and FTX’s Sam Bankman-Fried. Moonstone Bank faced regulatory challenges, leading to an enforcement action by the Federal Reserve.

- Legal Challenges at Binance: Perlman’s role at Binance has been marked by navigating numerous government investigations and legal challenges, including settlements with the Department of Justice and Commodity Futures Trading Commission, and ongoing issues with the Securities and Exchange Commission.

- Connection to Binance’s Executive Scandals: Perlman’s tenure at Binance coincides with the legal troubles of former CEO Changpeng Zhao and Samuel Lim, adding to the complexity of his role in the company’s compliance and legal affairs.

Bad luck? Bad guy? Who knows. 🤷♂️

The hacker behind the $47 million heist from KyberSwap ($KNC) has hinted at a possible deal with the victims. 🕵️

The anonymous cyber bandit, who made headlines last week for the massive exploit, embedded a message in an $ETH transaction on November 28. They promised to unveil details about a “treaty” by November 30.

The hacker’s message conveyed a willingness to negotiate but lamented the hostile reception from KyberSwap’s executive team. Despite the tension, they left the door open for rescheduling the announcement if treated with more civility. Otherwise, they plan to proceed as initially scheduled. 🗓️

This development follows the alarming incident where KyberSwap’s Elastic Pools liquidity solution was drained of $47 million. In response, KyberSwap urged users to withdraw their funds and later announced a 10% bounty for the perpetrator. Interestingly, the hacker had already signaled a readiness to negotiate after a period of rest, leaving a breadcrumb in blockchain data.

As of the latest updates, KyberSwap has managed to claw back $4.7 million of the stolen funds. 🫳

Bullets

Bullets From The Day:

🚀 Hoskinson Calls Out SEC on Crypto Regulation: Cardano’s Charles Hoskinson criticizes U.S. regulators for their approach to cryptocurrencies, particularly ADA. He argues that Bitcoin, often given a pass, could also be considered a security under the broad criteria of U.S. securities laws. Hoskinson challenges the SEC’s application of the Howey Test to cryptocurrencies, suggesting that Bitcoin’s centralized aspects and investor expectations could qualify it as a security. He advocates for clear crypto regulations from the U.S. Congress, noting that major exchanges like Binance, Coinbase, and Kraken face lawsuits for securities violations.

💔 Charlie Munger Passes Away, Leaves Legacy of Crypto Skepticism: Berkshire Hathaway’s vice chairman and Warren Buffett’s longtime business partner, Charlie Munger, dies at 99. Known for his colorful critiques, Munger famously dismissed Bitcoin as “rat poison” and criticized it for undermining the Federal Reserve system. His comments at Berkshire Hathaway meetings, often targeting cryptocurrencies, reflected his belief in the inherent risks and foolishness of investing in digital assets.

🔍 Coinbase Alerts Users About CFTC Subpoena Involving Bybit: Coinbase informs some users about a subpoena received from the U.S. Commodity Futures Trading Commission (CFTC) concerning crypto exchange Bybit. The exchange reassures users that no action is required from them but may share information with the CFTC. Bybit, led by CEO Ben Zhou and based in Dubai, remains silent on the matter. This development is part of a broader trend of federal agencies seeking information on crypto-related activities, with Coinbase itself facing regulatory challenges from the SEC.

📉 DYDX Braces for Token Unlock Impact: Decentralized exchange dYdX anticipates a significant token unlock on December 1, 2023, potentially releasing tokens worth over $500 million into the market. This event could affect the token’s price due to increased supply. Past data shows mixed reactions to such unlocks, with dYdX’s price previously unaffected and even rising post-unlock. However, market sentiment appears bearish this time, with a high probability of a price drop despite continued interest and discussion in the crypto community.

The Correlation IS Causation Chart Of The Day

Liquid gold makes for more productions of Don Giovanni.

Links

Links That Don’t Suck

🌡️ Celsius starts to open crypto withdrawals for holders of some claims

🎮 Netflix to offer ‘Grand Theft Auto’ trilogy as streamer doubles down on gaming

💧 Ripple CTO David Schwartz calls for legislative action to clarify crypto regulations

⚽ Cristiano Ronaldo’s partnership with Binance results in a lawsuit