I’m thrilled about $40k, not just because it’s more than $39k but because the number of Warhammer 40k shenanigans the Litepaper will have will be epic. ⚔️

Everywhere on the screen is green today, and everyone’s waiting for a sign that a breakout higher is about to happen.

We’re going to look at that in today’s Technically Speaking.

Also on deck: how November 2023’s close compares to past Novembers, Bitcoin’s historical performance in December, and a story about some famous soccer player.

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) | $38,789 | 2.83% |

| Ethereum (ETH) | $2,091 | 1.96% |

| Total Market Cap | $1.422 Trillion | 2.18% |

| Altcoin Market Cap | $663 Billion | 1.49% |

| ImmutableX (IMX) – Biggest Winner |

$1.44

|

12.59% |

| Injective Protocol (INJ) – Biggest Loser | $18.76 | -1.55% |

We’re looking at the beginning of another breakout higher or a very ugly, nasty fakeout. 🤷♂️

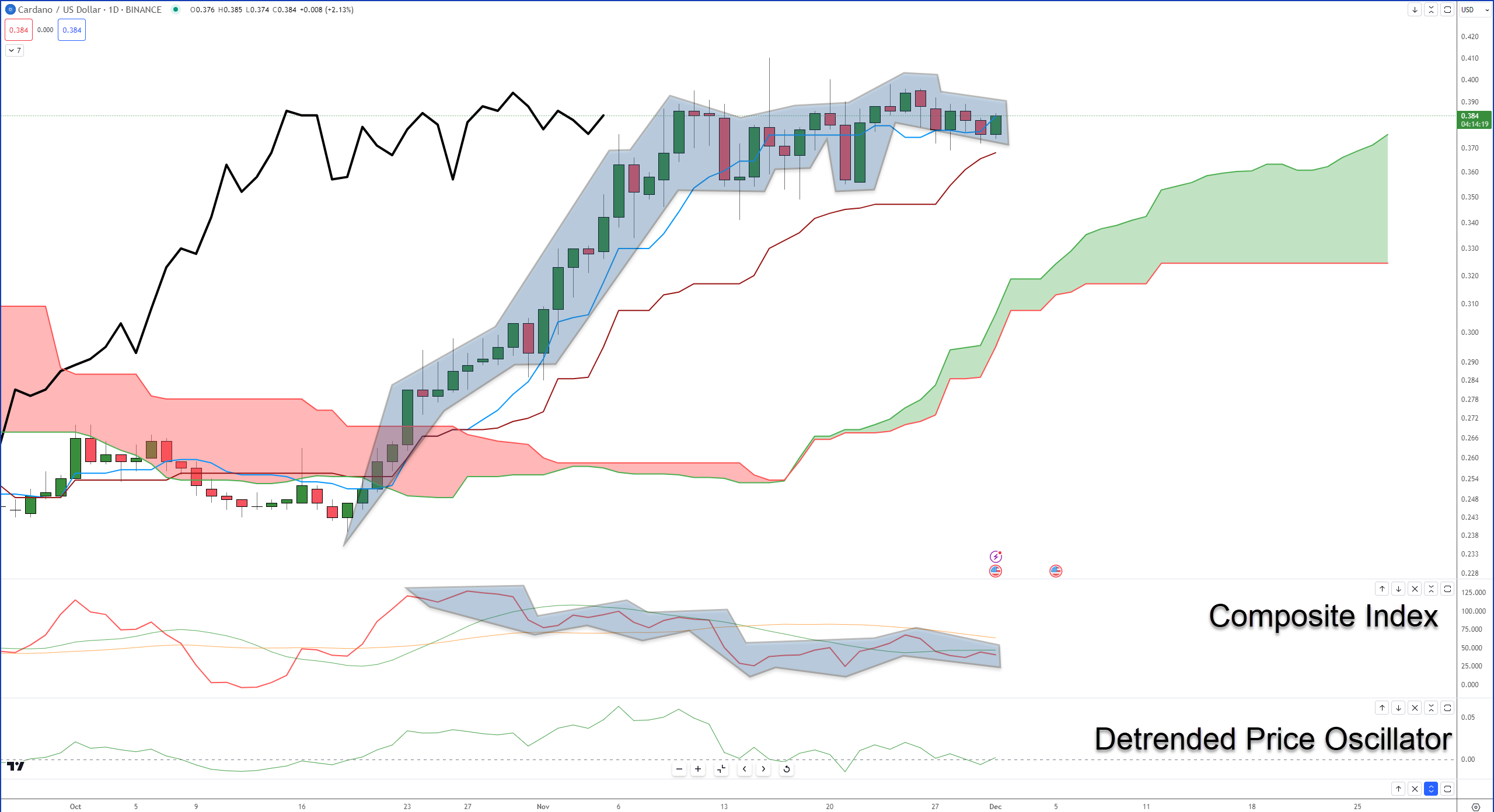

Today we’re looking at Cardano and Chainlink – two cryptos whose charts look much like the rest of the altcoin market.

Cardano

It’s hard to believe that $ADA‘s consolidation is almost a month long. And there’s some early warning signs that a breakout higher might be right around the corner. ⤴️

I’ve highlighted Cardano’s price action, and the Composite Index’s movement to show the overall direction of price action is higher with higher lows, and the Composite Index’s overall direction is lower with lower lows – also known as hidden bullish divergence.

Hidden bullish divergence is a warning sign that the prior move is likely to continue, and there have been many hidden bullish divergences since late October.

Because the Composite Index has slid down into its historical neutral territory and the Detrended Price Oscillator is about to cross above the zero line, a new upswing for Cardano looks imminent.

But, and there’s always a but, be aware that Cardano’s stuck in the Cloud on the weekly chart (not shown), and the Composite Index is pointing lower after returning to its historical resistance level. 🛑

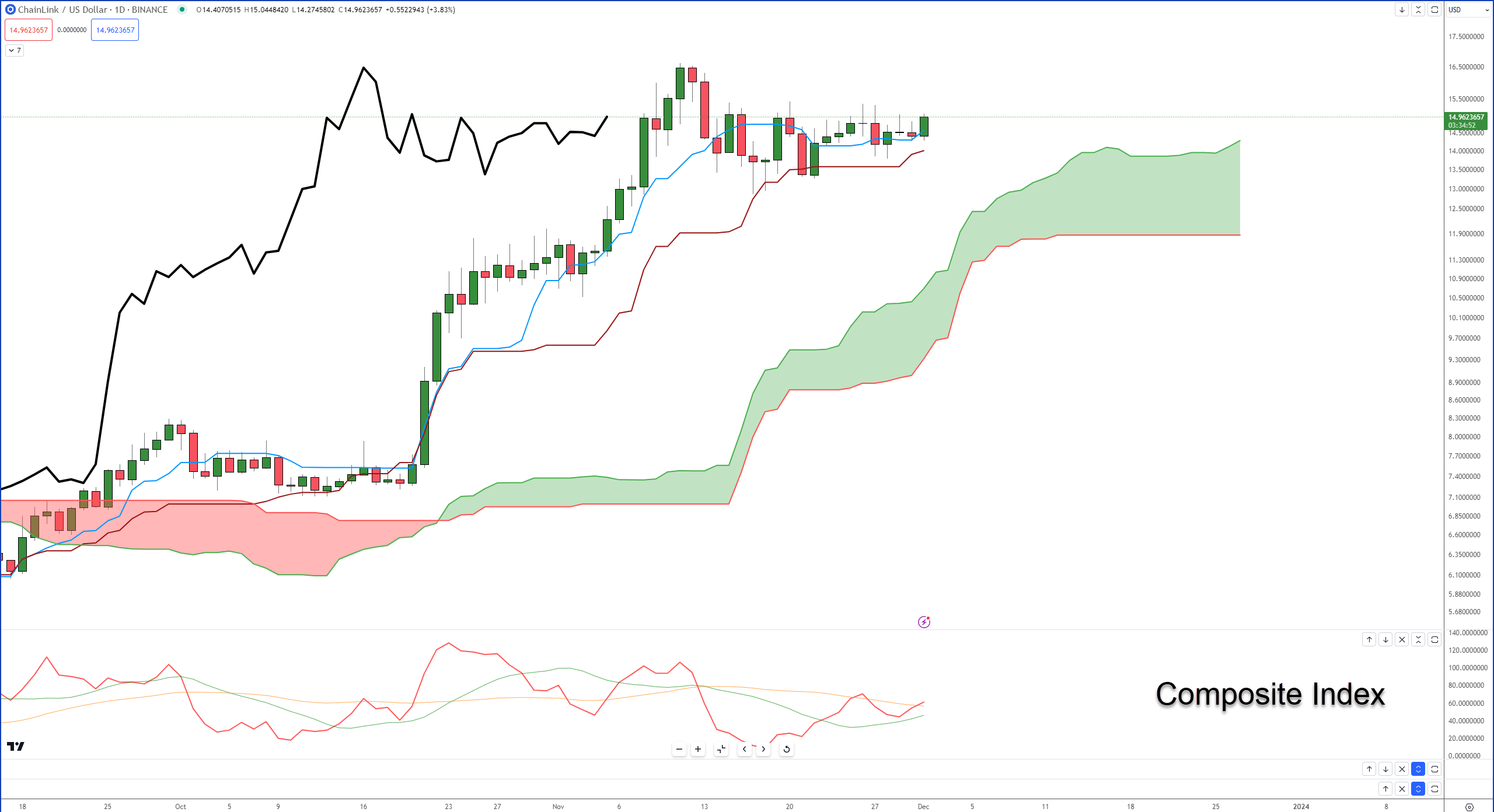

Chainlink

$LINK is one of the best-performing major market-cap cryptocurrencies of 2023. From the June lows, Chainlink has moved up almost +250%! 😱

Bulls are working on the highest close in over two weeks, and because the Composite Index just crossed above its slow-moving average, momentum hasn’t really begun to come in yet.

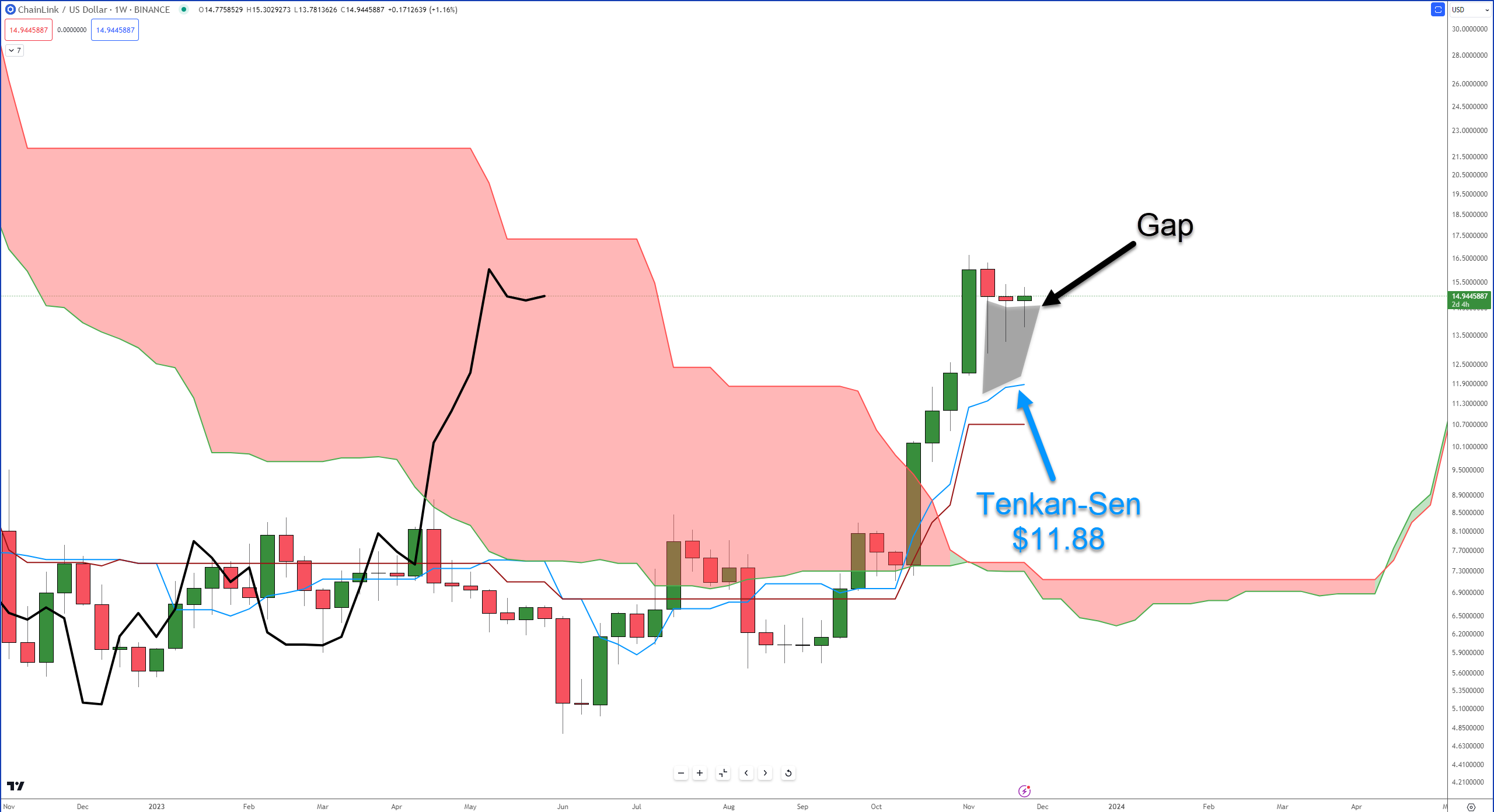

But, like Cardano, the weekly chart warns of caution.

Depending on how long you’ve been reading the Litepaper, you’ll know I keep a strong focus on gaps between candlestick bodies and the Tenkan-Sen because those gaps often correct quickly.

So if you’re looking at the daily and things seem bullish as hell, but nothing is happening, take a peak at the weekly chart. 🔭

November 2023 ranks third in terms of performance, behind the bullish Novembers of 2018 and 2019. It’s a respectable showing, especially given the past volatility. 🐓

- November 2018: +57.61%

- November 2019: +21.29%

- November 2022: +19.44%

- November 2011: +10%

- November 2023: +8.84% (the newcomer)

- November 2021: +7.77%

- November 2012: -11.11%

- November 2014: -9.87%

- November 2016: -5.91%

- November 2020: -6.62%

- November 2015: -17.67%

- November 2017: -35.16%

- November 2013: -82.49%

$BTC‘s November close put it at a 20-month high – regaining all of the post-Terra and FTX losses and then some.

Looks like 2023’s November decided to be more of a dark horse than a turkey. 🦃

We’re peeling back the calendar pages to see how Bitcoin has closed out each year in December. ❄️

December 2010: The Infant Takes Its First Steps 👶

Crypto

Ronaldo’s Binance Foul

A guy no one in the US knows, playing a sport none of us in the US plays, is under fire. ⚽

Soccer superstar Cristiano Ronaldo is now dribbling through a legal minefield, facing a staggering $1 billion lawsuit over his promotion of Binance’s NFTs. The suit, filed in Florida, accuses Ronaldo of leading his massive fanbase into the world of unregistered crypto securities.

The plaintiffs’ attorney is playing hardball, arguing that new legal standards could make Ronaldo liable for promoting what might be unregistered securities.

Ronaldo’s foray into NFTs with Binance, launched last November, featured animated digital statues capturing iconic moments from his career. With prices ranging from $77 to $10,000, the collection was aimed at both crypto enthusiasts and soccer fans.

As the legal drama unfolds, Ronaldo’s move from the soccer pitch to the crypto market is proving to be a challenging game, with potential implications for other celebrities dabbling in crypto endorsements. 🥅

ChatGPT Crypto Art Of The Day

If your spouse doesn’t want you to talk about crypto ever again, use this picture to change their mind.

It’s so damn cute. It’s like an overdose of cute.

Bullets

Bullets From The Day:

🎮 Riot Games Clarifies Voice-Over Confusion: Riot Games, the creator of League of Legends, has cleared the air regarding the voice-over issues in a recent video announcement. The problem wasn’t AI but a lack of direction given to the human voice actor. This clarification comes amid growing concerns about AI’s role in gaming.

🔍 Crypto Regulation Under Treasury’s Lens: U.S. Treasury Department’s new recommendations are stirring the pot in the crypto world. Republican lawmakers, like Rep. Tom Emmer, are skeptical, warning against the Treasury’s expanding reach over the industry, especially concerning dollar-based stablecoins. The debate heats up as the Treasury pushes for more tools to combat the potential misuse of crypto platforms by terrorists and other illicit actors.

🌐 Ethereum’s Growing HODLer Base: Ethereum is now the darling of long-term crypto investors, surpassing Bitcoin in the “Hodler Ratio.” Ethereum’s appeal is skyrocketing thanks to staking rewards, with nearly 72% of ETH holders keeping their assets for over a year. This shift towards Ethereum highlights the evolving landscape of cryptocurrency investments and the growing importance of staking in the crypto ecosystem.

💰 ProShares ETF Gains Momentum: The ProShares Bitcoin Strategy ETF (BITO) is riding high, with a record $1.5 billion in Bitcoin futures contracts under management. This surge reflects the growing institutional interest in Bitcoin, especially in anticipation of the potential approval of a Bitcoin spot ETF. The market is abuzz, with experts predicting a new wave of institutional capital flowing into Bitcoin once a spot ETF is approved.

Links

Links That Don’t Suck

😱 Traders lose $36.8 million as Bitcoin starts December strong

💲 KyberSwap plans to offer victims treasury grants after $48.8 million exploit

🦑 Kraken Co-Founder backs Elon Musk, says: We need him

🤖 Surprise: ‘Cyberpunk 2077’ is getting a big update with romance and transit options

🤏 MicroStrategy’s Bitcoin bet at risk? CFA investigates the ‘Debt Problem’

💦 Bitcoin breaks 2023 peak to liquidate bears across the board

Say Hello

💻 Questions? Comments? Email Jon at jmorgan@stocktwits.com 💻