Last year, the Biden administration rescinded a former rule that made it easier for gig companies to classify workers as independent contractors instead of employees. Today, they paved the way for more pro-worker reforms by releasing a new proposal that could cause regulators and courts to reclassify gig workers as employees. 📝

The proposed rule would make classifying workers more holistic, including questions like whether their work is an “integral” part of the employer’s business.

Many gig economy companies classify their workers as independent contractors for their business models to work. However, with the Biden Labor Department’s new proposal, more regulation at the federal level will likely complicate things for their business.

If you need any evidence of that, look to California. The state passed a similar law in 2020, but voters approved a proposition to exempt app-based ride-hailing and delivery companies after a ton of lobbying and campaigning.

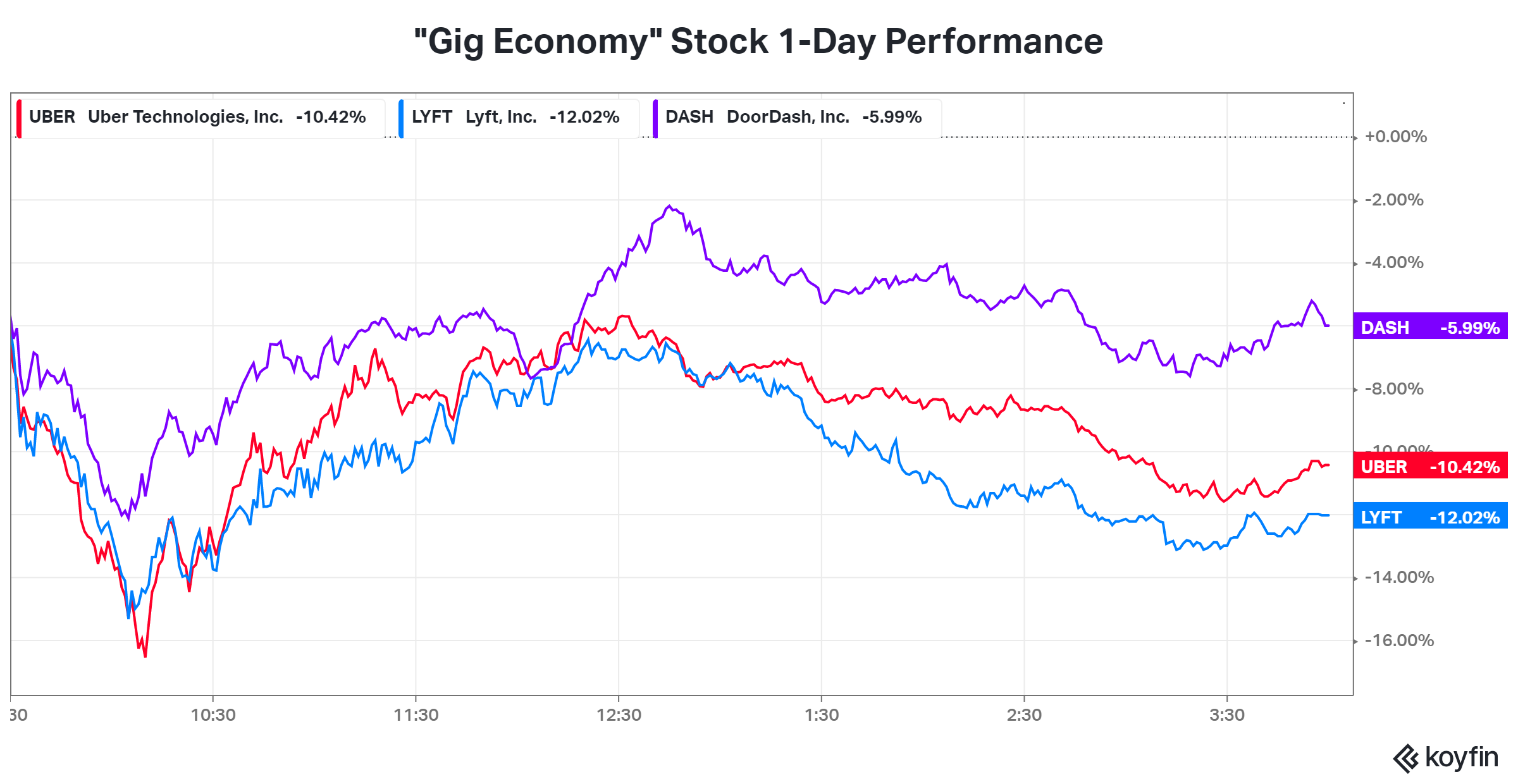

While this new proposal is still in its early stages of the lawmaking process, the news sent shares of $UBER, $LYFT, and $DASH all down sharply today. Bearish investors argue that if these companies aren’t profitable while hiring contractors, they’re unlikely to reach that milestone if they need to absorb more employee-related costs. 🐻

As a result, any news around the employee vs. contractor debate tends to spook investors in these stocks. We’ll have to wait and see how this develops in the months ahead. 📆