Virgin Orbit Holdings, Richard Branson’s other space company, vaulted 24.29% higher after the company rang the Nasdaq opening bell today. 🔔 🚀 The satellite-launching company even brought a full-sized rocket to Times Square for the celebration!

Originally a spinoff from Virgin Galactic, the company went public last Thursday via SPAC with NextGen Acquisition Corp. II under the symbol $VORB.

$VORB raised $228 million from the merger, but fell deathly short of the $480 million that was initially estimated. 💀 The company’s PIPE investors include Boeing, Virgin Group, Mubadala Investment Company, and AE Industrial Partners.

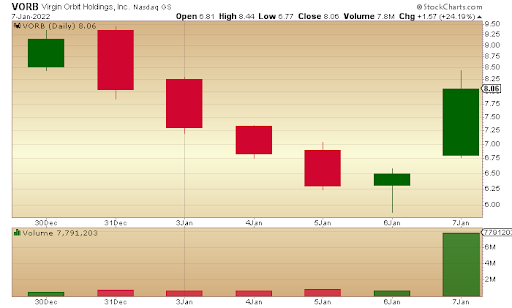

To date, Virgin Orbit has launched 19 successful satellites and expects at least six more throughout 2022. 🛰️ $VORB entered positive YTD territory thanks to today’s impressive performance. Here’s the daily chart since merging on Dec 30: