What a year it’s been for markets in 2023, with crypto soaring, tech stocks battling back, the economy staying upright, regional banks collapsing, and the Fed setting the stage to cut rates.

The Stocktwits community was on top of it all, so what better way to recap the year than with some of our platform’s unique data? Let’s dive into it. 👇

First up is our “most active” tickers, which had a variety of symbols ranging from mega-cap technology stocks like Nvidia all the way down to “meme stocks” like AMC and Bed Bath & Beyond. We see you too, $GNS & $TTOO bulls. 😉

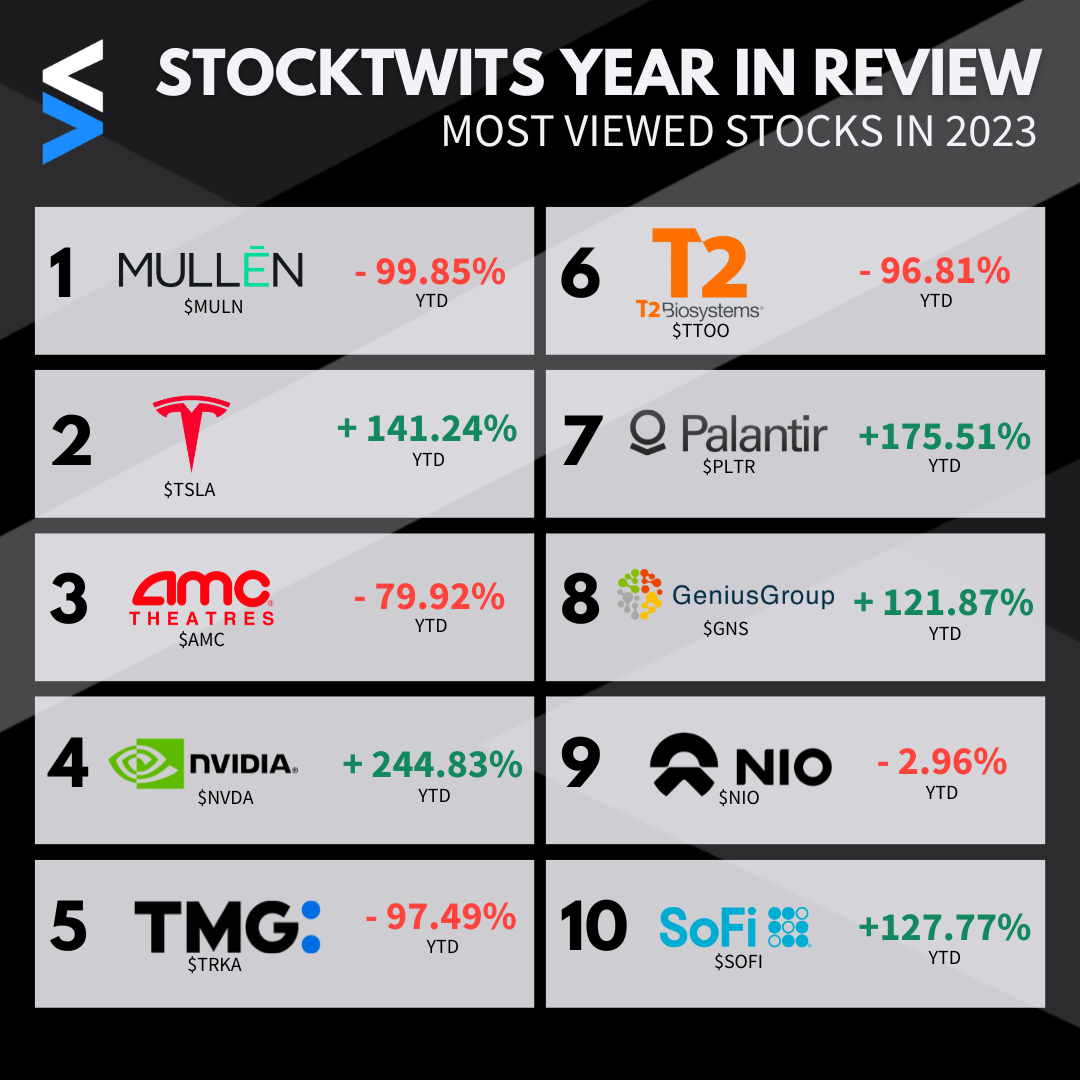

Next, we’ve got the “most viewed” tickers, which has some similar names. Electric vehicle startup Mullen again took the top spot, with Tesla closely behind. There is quite a variety on the list, but they all have one thing in common — lots of volatility. 📊

Then we’re into the “most watched” tickers category, which has many of the mega-cap technology stocks that led this year’s market rebound. The two exceptions are Bitcoin and AMC, which both have a “cult-like” following of their own. 🍿

And to build on that category, we’ve got the symbols with the most “new watchers” in 2023. While some familiar names are atop the list, several smaller names, like American Battery Technology Company and C3.ai, caught investors’ attention as the artificial intelligence and electric vehicle boom picked up further steam. ⚡

It was an exciting year in the markets and our community. We look forward to sharing more insights (and tools to unlock those insights) from our unique data in the year ahead. Stay tuned!