JPMorgan rallied 6.19% today after the firm’s Investor Day presentations reversed its January guidance, which suggested that the bank would miss a key performance target for the next year or two.

The firm now says that a 17% return on tangible common equity “remains our target and may be achieved in 2022.“ 🎯

Additionally, it gave updates on its digital consumer bank in the U.K., which has attracted more than half a million customers and $10 billion of deposits since launching eight months ago. 💷

This U.K. initiative will lose the firm $450 million this year and not break even for 5-6 years. However, investors are looking at this test in Britain to determine whether the bank can successfully expand its services to other overseas markets. 🌐

Lastly, the banking giant had positive things to say about the U.S. consumer’s health. Chief Financial Officer Jeremy Barnum said, “Big picture, the near-term credit outlook, especially for the U.S. consumer, remains strong.” 💳

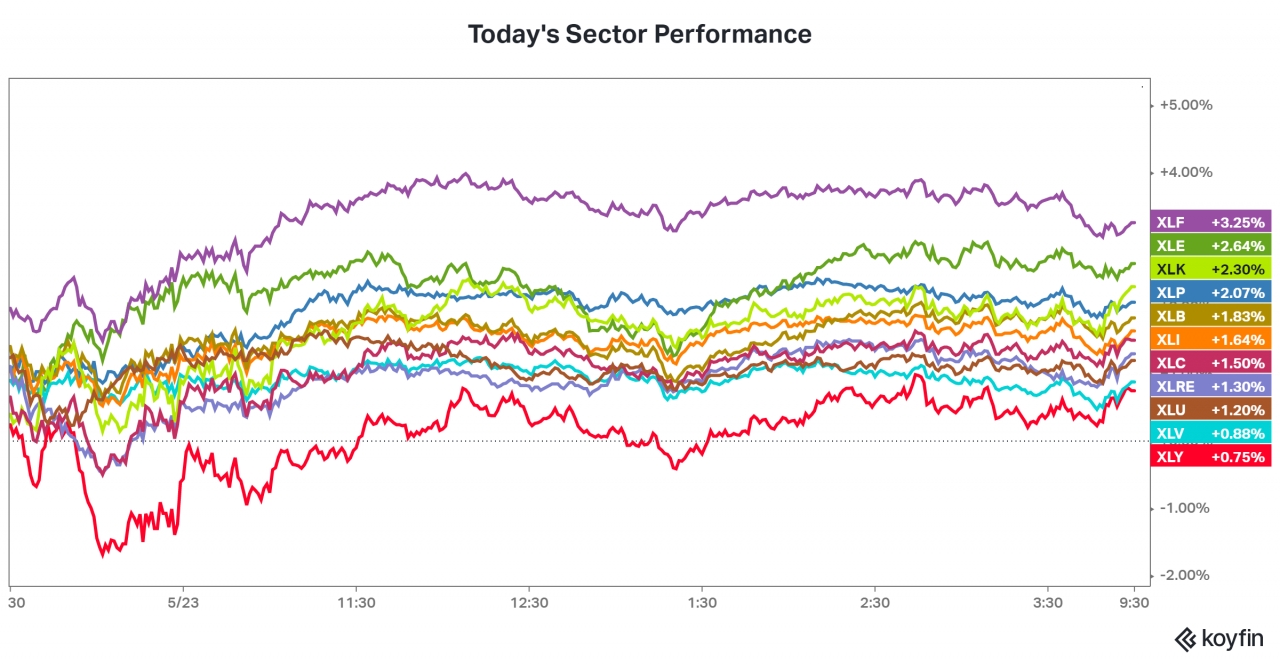

The upbeat outlook from America’s largest bank sent the entire financial sector higher today, with $XLF rising 3.25%.