You didn’t drink too much this weekend and wake up in 2020 or 2021. It’s August 2022, and the classical meme stocks are still doing their thing. 🗓️

Despite lackluster (or straight-up bad) earnings reports from Bed Bath & Beyond, AMC, Carvana, and Beyond Meat, the stocks are squeezing to the upside. 📈

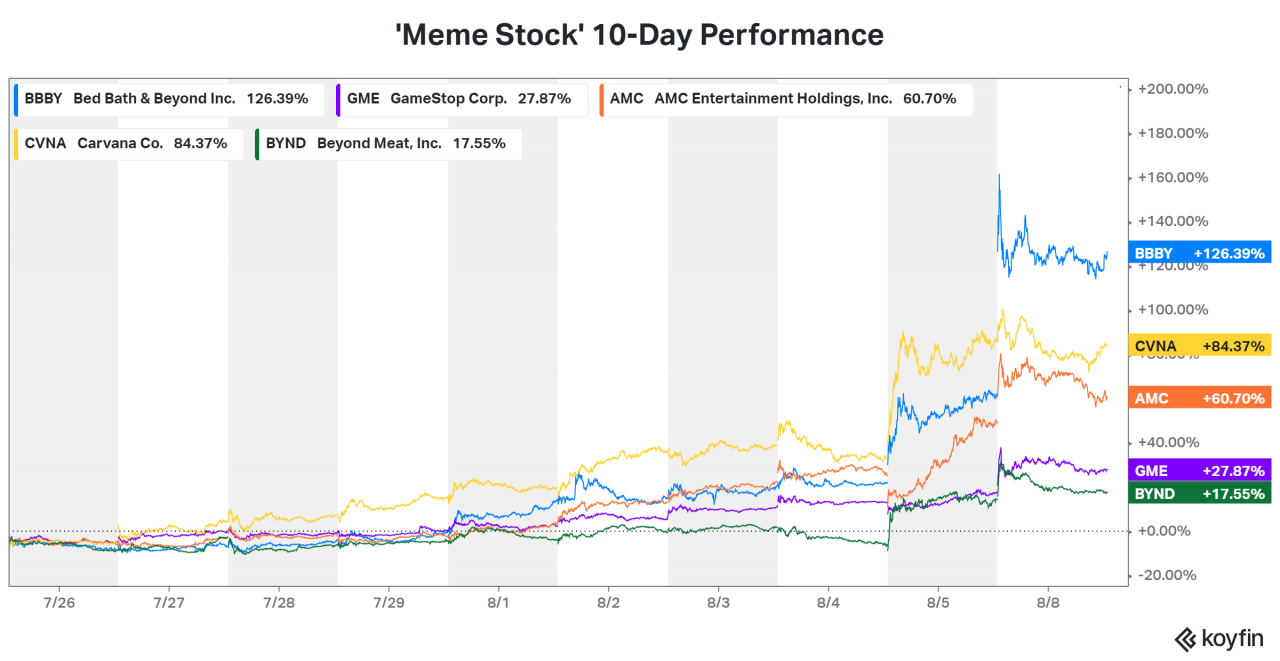

Below is a chart of their performance over the last ten days since their upward moves began.

While a lot of the mania we saw in past years has died down along with the overall market’s performance, there’s still plenty of craziness happening (as there always is). 🤪

How long these moves will last is anyone’s guess, but the message is clear. Anyone that thought retail trading activity and collaboration on social media and other platforms was entirely going away may have to eat their words at this point… 🤷♂️

Are you trading any of these stocks or avoiding the madness? Let us know. 💭