International stocks continue to outperform, with Chinese stocks getting significant attention. And the attention is widespread, with micro-cap, small-cap, mid-cap, and large-cap names popping up on investors’ radars…and our trending tabs.

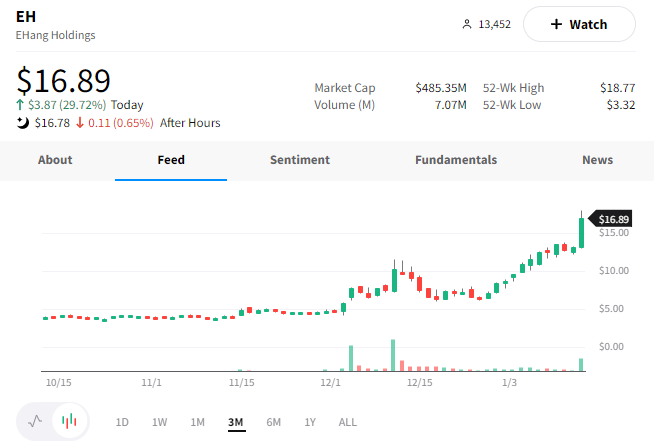

We first spoke about EHang a few weeks ago when it began rallying. But today, it’s worth another mention as $EH shares are up another 35%…closing out their third straight week of gains. 😮

There wasn’t any specific news driving the stock this week. But certain areas of the market have been keeping investors’ attention, which we think is a theme worth highlighting.

How long the obsession with Chinese stocks is anyone’s guess. But for now, we’ll keep tracking all the moves. 📝