With the public markets rebounding in 2023, more and more tech IPOs are testing the waters again. Last week, Arm Holdings kicked things off with the most prominent initial public offering (IPO) since 2021, pricing at the top of its range and popping 25% on its first day of trading. 🤩

That caused Instacart’s parent company, Maplebear Inc., to price at the top end of its $28 to $30 price range and achieve the $10 billion valuation it was seeking.

During Arm’s IPO, the market was green, but Instacart had a rougher session to deal with today. While it was still able to jump 40% initially to an opening price of $42, its price faded throughout the day to close at $33.80. Although that’s 13% above where its offering priced, it seems some traders and investors decided to remove shares from their $CART and look elsewhere. 🙃

Additionally, for private market investors, today’s valuation represented a significant haircut.

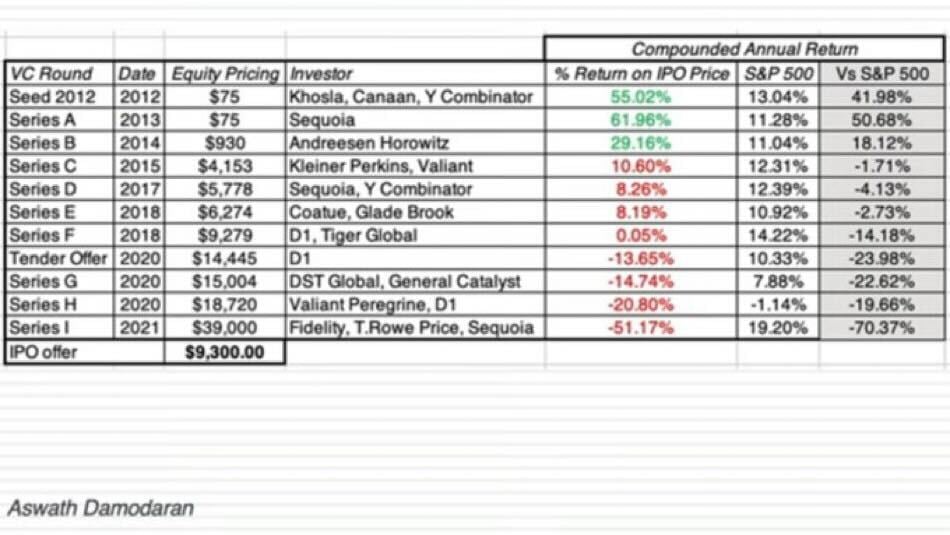

The chart below from NYU’s “Dean of Valuation” Aswath Damodaran outlines how much money the company raised and at what valuation. Some early investors made money, but most did not and will have to wait to see if public market prices rise enough to get them back to even. 😬

Valuations clearly extended far beyond historical norms during the pandemic, especially for companies like Instacart, whose major tailwinds are now in the rear-view mirror. Whether or not those levels will ever be experienced again remains to be seen. But in an environment with a risk-free rate above 5%, it’s unlikely to happen anytime soon. 🤷

Marketing automation company Klaviyo Inc. will be the next unicorn to test its luck in the public markets. The company revised its indicated IPO price range of $25-$27 to $27-$29 on Monday after seeing strong appetite for Arm Holdings. And today, it confirmed that it priced at $30 per share, allowing it to raise $576 million at a $9.2 billion valuation when it begins trading on Wednesday. 👀