The U.S. initial public offering (IPO) market welcomed its third unicorn in the past week, with marketing automation company Klaviyo debuting on the NYSE today.

It offered 19.2 million shares, with 11.5 million sold by the company to raise $345 million in cash. The pricing gave it a $9 billion valuation, down slightly from its $9.5 billion private round in 2021. 💸

As for its trading…after pricing at the top end of its upwardly revised $28 to $30 range, the price jumped 32% to open at $39.47. However, like its recent peers and likely due to the market’s lackluster day overall, it faded throughout the day like Instacart.

Funnily enough, its opening price was the high of the day. Traders are already making bets as to whether that will be its high for a while. 🙃

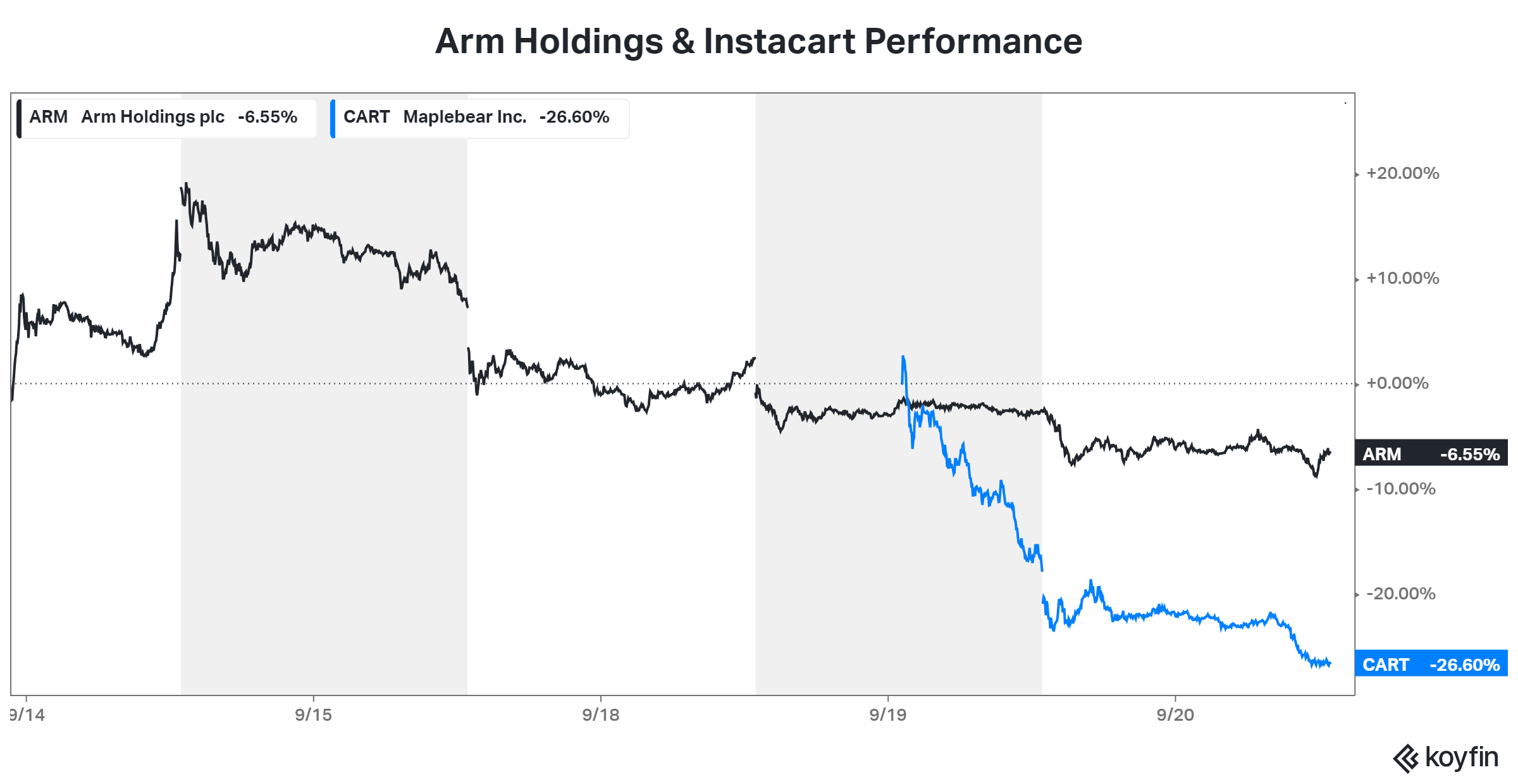

Alongside it, Arm Holdings and Instacart have also been falling from their peaks as the initial hype of their offering wears off. Now that momentum is fading, investors are trying to assess what these businesses are actually worth vs. where they currently trade. Easier said than done, which is why the volatility is likely to continue as this “price discovery” process develops.