Advertisement|Remove ads.

Tesla Rejoins Trillion-Dollar Club After 2 Years On Musk-Trump Synergy, But Stocktwits Sentiment Is Bearish

Tesla, Inc. ($TSLA) shares surged more than 5% on Friday, on track for a fourth straight day of gains, as the electric vehicle giant rejoined the trillion-dollar market cap club after more than two years.

TSLA hit $300 for the first time since September 2022, driven by a nearly 30% rally since Donald Trump’s victory in the U.S. Presidential election earlier this week.

Tesla CEO Elon Musk has been a vocal supporter of Trump’s bid for a second term, and analysts believe his close ties with the President-elect could lead to favorable government policies benefiting his companies.

Trump has even suggested a government efficiency commission headed by Musk.

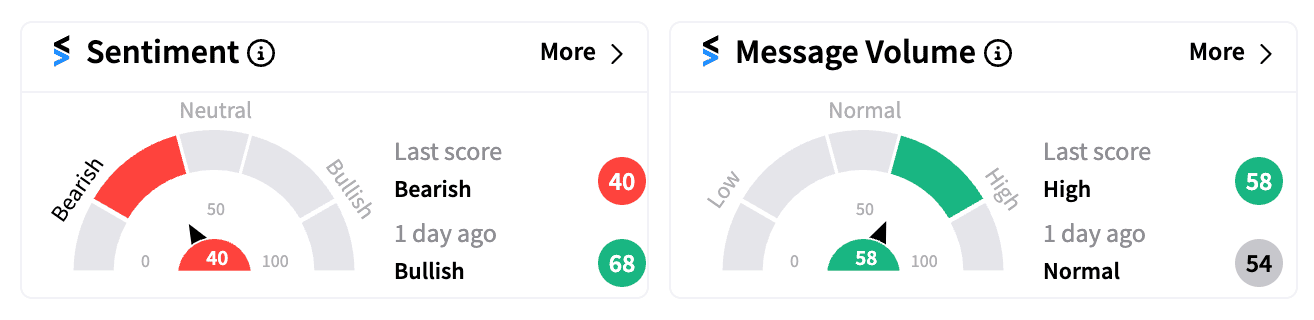

Despite the strong stock performance, retail sentiment on Stocktwits flipped into the ‘bearish’ territory, moving from ‘bullish’ the day prior.

With nearly 980,000 followers, TSLA is the most-watched ticker on the Stocktwits platform.

Several users expressed concerns about potential profit-taking, a possible boycott of Musk and Tesla by liberals, and doubts about the stock’s valuation.

On the other hand, some bullish posts highlighted the broader scope of Tesla’s business beyond just cars.

Another post praised Musk’s $50 million donation to Trump’s campaign, stating it led to a remarkable $26.5 billion gain for Musk via TSLA’s surge on the day Trump won.

Before the election, Wedbush had predicted that a Trump win could add $40-$50 per share to Tesla’s valuation if autonomous driving were accelerated in 2025 and if the Cybercab project gained momentum.

However, lingering concerns about slowing EV demand, Tesla’s shrinking margins, and Musk’s distractions with his other ventures continue to cast a shadow on the stock’s prospects.

Tesla’s stock has rallied 27% year-to-date, recovering from its earlier struggles.

According to a Stocktwits poll, over 60% of retail investors expect Tesla’s stock to exceed $313 by the end of the year.

For updates and corrections, email newsroom@stocktwits.com

Read next: Paramount’s Q3 Streaming Surge Delights Retail Investors, But Broader Market Fears Over Major Misses

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2196132812_jpg_086f367c0b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263007357_jpg_aff2a32e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_XRP_original_jpg_005097c9e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261448901_jpg_dec7c2c9b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_32b8924ac2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)