Advertisement|Remove ads.

a16z Executive Urges CLARITY Act To Move Forward, Despite The Flaws

- An a16z crypto managing partner, Chris Dixon, said the CLARITY Act should provide clear regulatory rules for crypto developers.

- The debate on the CLARITY Act was postponed after the Coinbase CEO, Brian Armstrong, said the bill had too many issues.

- Armstrong said that the White House officials were being constructive, and amendment discussions were ongoing, refuting previous claims of the White House dropping the bill altogether.

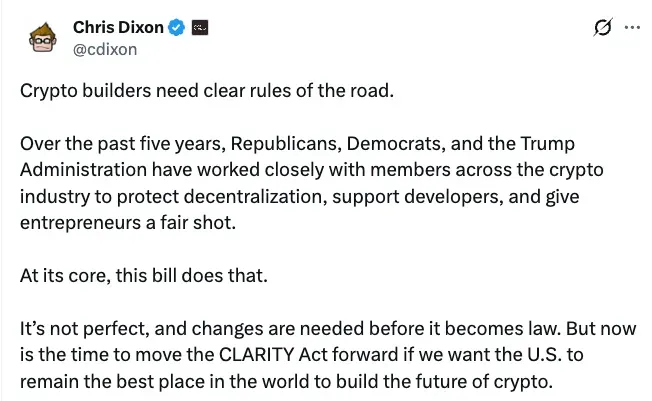

Andreessen Horowitz's (a16z) crypto managing partner Chris Dixon wants Congress to move the CLARITY Act forward, despite its several issues ranging from DeFi to stablecoin yields.

In an X post, Chris Dixon stated that crypto builders require “clear rules of the road,” noting that Republicans, Democrats, and the Trump administration have collaborated with the crypto industry over the past five years on decentralization, developer support, and entrepreneurship.

Last week, Dixon said that the CLARITY Act was intended to address those goals, while noting the bill would still require changes before becoming a law.

The Senate Banking Committee was scheduled to debate amendments on the bill last Thursday, but it was postponed after Coinbase (COIN) CEO Brian Armstrong said that the bill had “too many issues.” Armstrong claimed that the CLARITY Act undermines decentralization for tokenised assets and DeFi protocols. Armstrong previously said that the clarity act undermines decentralisation for tokenised assets and decentralised finance and more importantly he said that the language used in the bill aims to ban passive stablecoin yield, prioritising banks over crypto companies.

Coinbase Global, Inc (COIN) closed at $241.15 on Friday. On Stocktwits, retail sentiment around Coinbase remained in ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

White House, Coinbase Signal Ongoing Talks

As negotiations continue between the White House, crypto companies, and the banking sector, the market structure bill sees a renewed discussion.

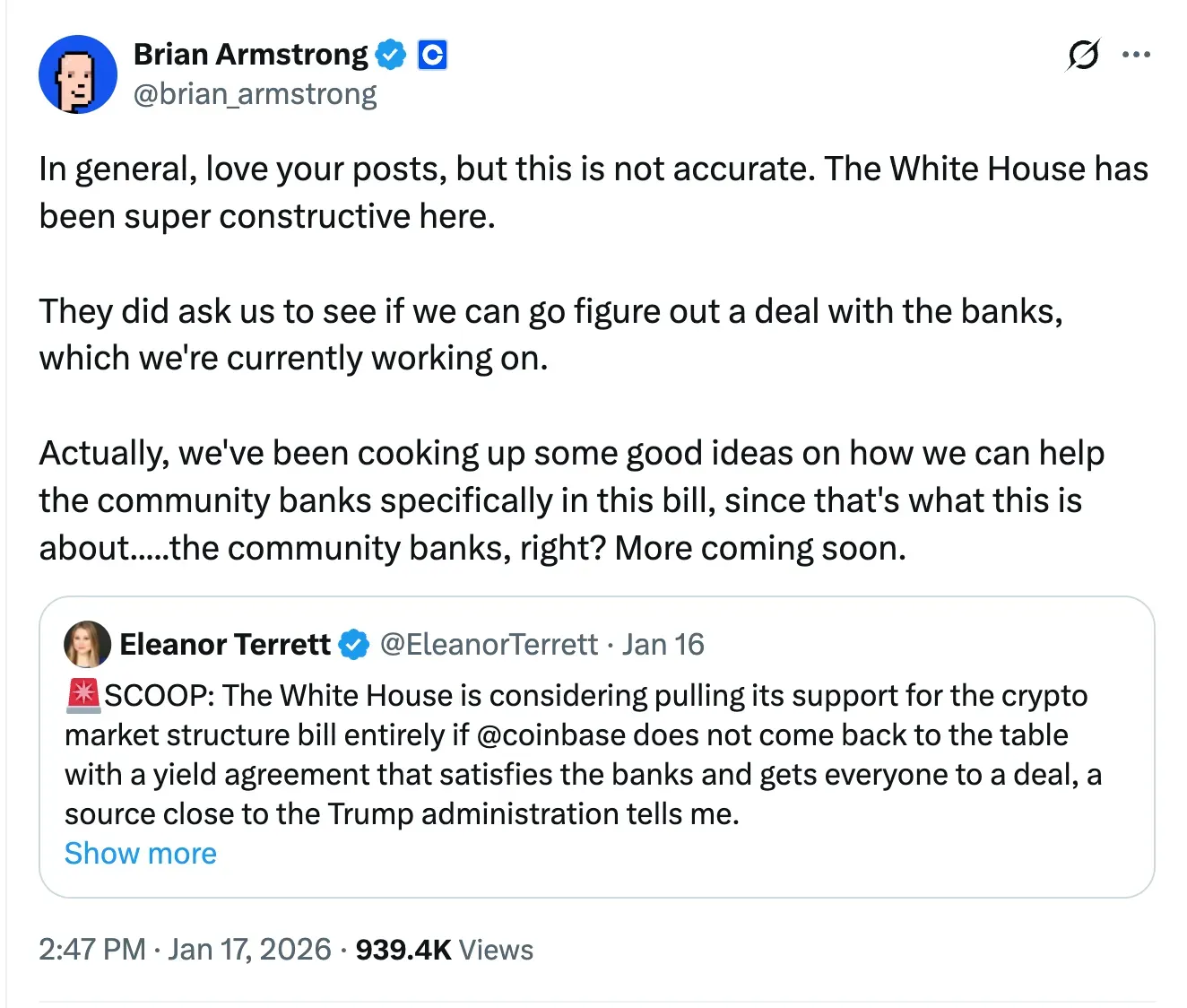

Brian Armstrong said on X that the White House has been “constructive” in discussions, and asked Coinbase to explore potential agreements with banks related to the bill, refuting previous claims that the White House was looking to drop the bill completely.

Armstrong’s comments came as a response to a post by Eleanot Terret, which he addressed as “not accurate.” Journalist Eleanor Terret posted on X on Friday, saying that the White House was considering withdrawing support for the market structure bill if outstanding issues related to yield were not resolved. Armstrong revealed that the company was working on proposals focused on community banks, and further updates would follow.

Read also: Trump Threatens New Tariffs On NATO Allies Over Greenland, Markets Start to Price in Risk

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)