Advertisement|Remove ads.

Arthur Hayes Says Bitcoin Nearing Bottom, But AI Stocks Need To ‘Crater’ First

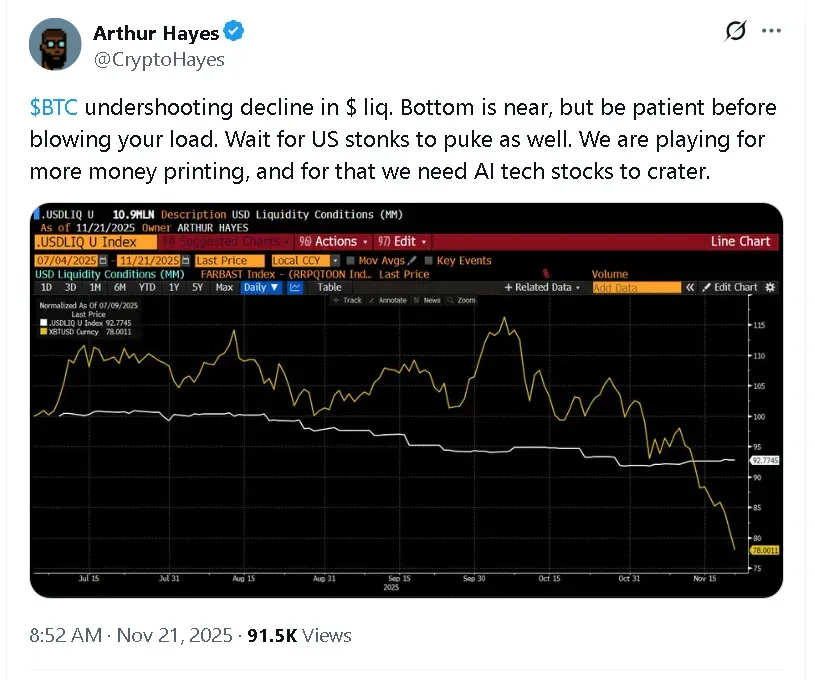

- In a post on X, Arthur Hayes suggests the crypto rally will be driven by Federal Reserve quantitative easing.

- The BitMEX cofounder and Maelstrom CIO wrote that for the central bank to print more money, AI tech stock would have to ‘crater.’

- In a broadcast on X earlier his week, Hayes predicted Bitcoin would test support levels between $80,000 and $85,000 before recovery.

BitMEX co-founder and Maelstrom CIO Arthur Hayes suggested Friday that Bitcoin (BTC) may be nearing a market bottom after its dip to around $82,200 in early-morning trade.

In a post on X, Hayes stated that Bitcoin could be close to its lowest point, but investors might want to wait for U.S. AI stocks to decline further before buying. He reiterated that the main driver for a crypto rally would be renewed central bank money printing. “For that, we need AI tech stocks to crater,” he said.

AI bellwether Nvidia (NVDA) was down nearly 3% in morning trade. On Stocktwits, retail sentiment around the chipmaker remained in ‘extremely bullish’ territory, accompanied by ‘extremely high’ levels of chatter. Advanced Micro Devices (AMD) slipped 4.6% with retail sentiment in the ‘bearish’ zone, while Palantir Technology (PLTR) dropped more than 5%.

Arthur Hayes Predicts Bitcoin Price Could Hit $500,000

In a broadcast on X earlier this week, Hayes predicted that Bitcoin’s price could hit $500,000 in 2026 and that the primary catalyst would be quantitative easing by the Federal Reserve. However, Hayes also forecast that Bitcoin would first dip as low as $80,000 to $85,000 before staging any kind of recovery.

“Bitcoin is realigning with where the liquidity situation is,” he explained. He added that Bitcoin’s sell-off serves as a warning of what may be in store for U.S. equities.

“I think the Nasdaq and S&P 500 are going to fall quite markedly,” Hayes said. “The 10-year yield is going to rise, and this is going to present a situation where it will hopefully accelerate the resumption of money printing by the Fed and the Treasury.”

He explained that if the stock market dipped further, the Fed would have to step in to help it rise back up with quantitative easing because a stock market in the red impacts tax revenue for the government, which in turn, affects the larger U.S. economy.

Don’t Worry About ETF Outflows

Hayes shrugged off concerns that ETF outflows were a worrying indicator for Bitcoin’s future performance. “These are not people who care about Bitcoin per se, these are people putting on a trade,” he said.

U.S. Spot Bitcoin ETFs saw net monthly outflows reach a record $3.79 billion in November, following nearly $1 billion in net withdrawals on Wednesday alone. BlackRock’s iShares Bitcoin Fund (IBIT) led November withdrawals with $2.47 billion pulled from the fund.

IBIT’s price was down nearly 4% in morning trade on Friday. On Stocktwits, retail sentiment around the fund continued to trend in ‘extremely bullish’ territory over the past day as chatter rose to ‘extremely high’ from ‘high’ levels.

Bitcoin was trading at around $82,800, down 7.7% in the last 24 hours. BTC was among the top trending tickers on Stocktwits with retail sentiment in ‘bearish’ territory while chatter rose to ‘extremely high’ from ‘high’ levels.

Read also: Bitcoin ETFs Hit Record Monthly Outflows In November – Average Investor Now in the Red, Says Analyst

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)