Advertisement|Remove ads.

Arthur Hayes Sells Nearly 1,500 Ethereum, Cuts DeFi Holdings Over The Weekend

- Arthur Hayes also reduced positions in major DeFi tokens, including ENA, LDO, AAVE, UNI, and ETHFi, according to Akram Intelligence data.

- Hayes’ current ETH holdings are valued at $16.11 million with an unrealized gain of 0.94%.

- Meanwhile, Fundstrat analyst and executive chairman of BitMine, Tom Lee, projects Ethereum could follow Bitcoin’s 100x Supercycle trajectory.

Arthur Hayes, co-founder and former CEO of BitMEX, offloaded nearly 1,500 Ethereum (ETH) over the weekend, according to on-chain analysis.

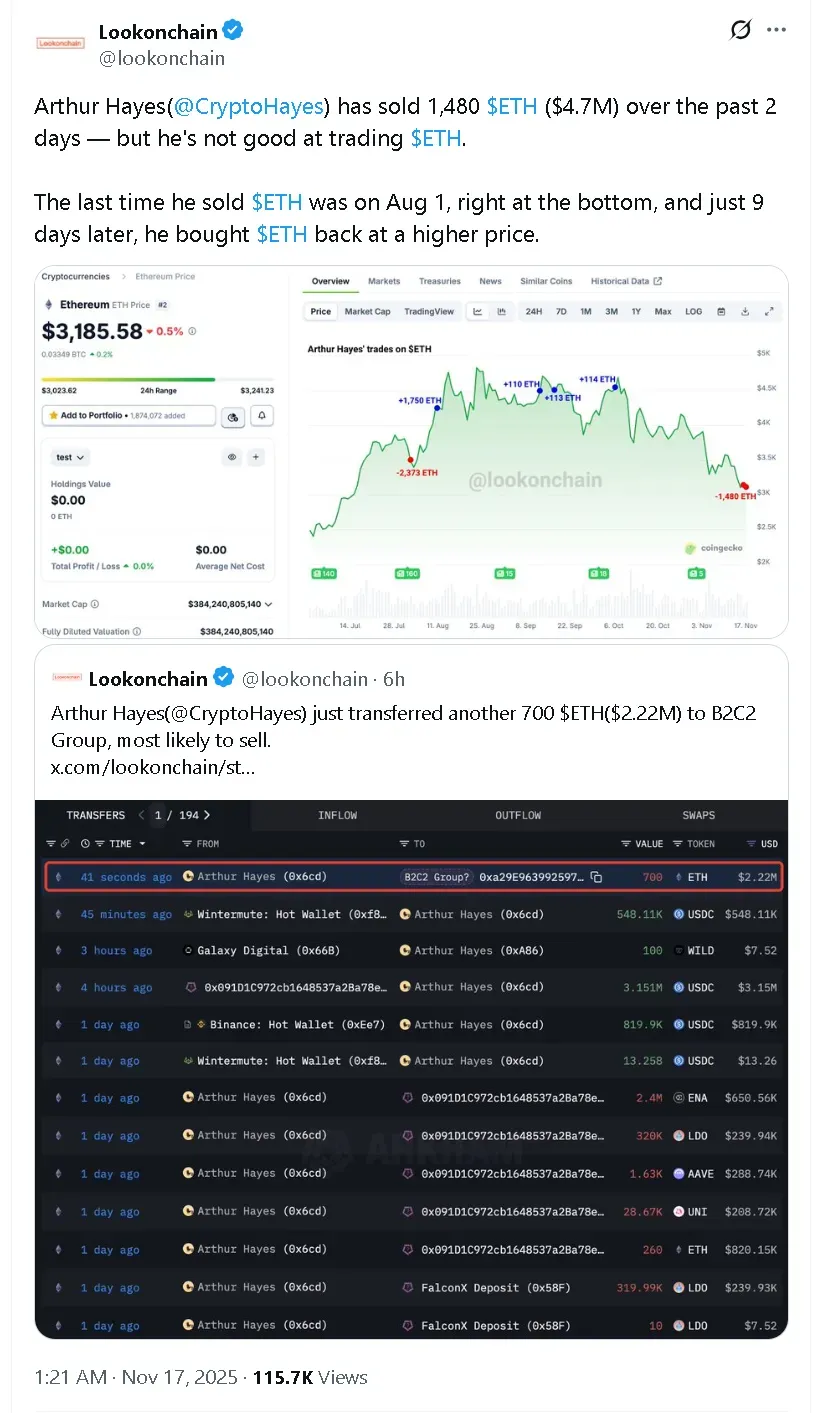

According to data from Akham Intelligence, Hayes’ ETH stash dipped to around 5,000 ETH from 6,500 ETH between November 15 to November 17. His current Ethereum holdings are valued at $16.11 million and unrealised profit of 0.94%.

Data showed that, in addition to Ethereum, Hayes also reduced his positions in several other tokens, including Enzyme (ENA), Lido (LDO), Aave (AAVE), Uniswap (UNI), and ETHFi (ETHFI).

According to Lookonchain, Hayes has been selling his stake, not just relocating it. In a post on X, the firm noted that the last time Hayes sold Ethereum was on August 1, when the token’s price was near market lows. It added that he bought it back just nine days later at a higher price.

Ethereum’s price rebounded in early morning trade on Monday, up more than 1% in the last 24 hours. On Stocktwits, however, retail sentiment continued to trend in ‘bearish’ territory with chatter at ‘normal’ levels over the past day. The leading altcoin’s price is now more than 35% below its all-time high of over $4,900, seen in August, at $3,182.

Tom Lee Points To Potential Ethereum “Supercycle”

Fundstrat’s Tom Lee said on Sunday that Ethereum may be on a similar supercycle as Bitcoin. Lee stated that he first recommended Bitcoin (BTC) to clients in 2017 when it traded around $1,000 and that the cryptocurrency experienced multiple declines of up to 75% in subsequent years before hitting 100x gains.

“We believe ETH is embarking on that same Supercycle,” he wrote on X. Ethereum had lagged behind Bitcoin for much of early 2025, with ETH peaking at $4,946 in August while Bitcoin’s price reached over $126,000 in October. Lee added, “To have gained from that 100x Supercycle, one had to stomach existential moments to HODL.”

Shares of Tom Lee-backed BitMine Immersion Technologies (BMNR) edged 0.3% higher in pre-market trade, with retail sentiment also in the ‘bearish’ zone amid ‘normal’ levels of chatter over the past day. The company is the leading digital asset treasury (DAT) with Ethereum as its primary token. It currently has more than 3.5 million tokens in its coffers.

Read also: Bitcoin Price Struggles While Crypto Liquidations Top $500 Million – Analyst Flags Retail Pressure

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)