Advertisement|Remove ads.

Bitcoin Breaks $71K Barrier, Hits 5-Month High as Retail Bulls Charge Ahead

Bitcoin ($BTC.X) has been on a broader uptrend since hitting a low just shy of $54,000 in early September. The rally gained further momentum on Tuesday as the apex crypto shot past the $71,000 mark for the first time since early June.

As of 9:05 am ET, Bitcoin climbed 3.16% to $71,057.34, off the day’s high of $71,494.73. The upside has been accompanied by a 107.19% increase in volume, which lends credence to the upward move.

Crypto analysts think bitcoin might have found its mojo back. Prominent crypto analyst Ali Martinez fell back on the technical chart to suggest a further run-up to $84,200 is likely.

“With #Bitcoin $BTC pushing past $70,500, the next local top might be around $84,200, according to MVRV Pricing Bands!,” he said in a post on social-media platform X. And he sees downside support around $72,000 in the eventuality of the king crypto taking off.

Many crypto traders have begun calling for the crypto hitting a new high in Tuesday’s session. Its previous high on an intraday basis was $73,750.07 (March 14) and on a closing basis $73,083.50 (March 13).

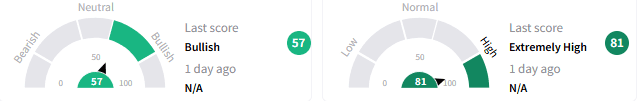

On Stocktwits, the retail sentiment score remained at 58/100, suggesting ‘bullish’ mood, with message volume spiking to ‘extremely high.’

Some retailers pointed to a golden cross formation, which signals an imminent breakout.

They also see short-squeeze rally loading, positioning the crypto for further upside.

Tuesday’s rally may have come on the back of hale activity on cryptocurrency exchange Binance and substantial inflows into Bitcoin ETFs, which saw a net increase of 47,000 bitcoins in the last two weeks, according to a report on Coindesk.

Crypto traders are also factoring in further upside for Bitcoin following the U.S. elections scheduled for November 5, irrespective of the outcome.

Read Next: FFIV Stock Spikes On Q4 Earnings Beat, Extra $1B Buyback Plan: Retail’s Mood Stuck In Neutral

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)