Advertisement|Remove ads.

FFIV Stock Spikes On Q4 Earnings Beat, Extra $1B Buyback Plan: Retail’s Mood Stuck In Neutral

F5, Inc. ($FFIV) shares rallied nearly 11% in premarket trading on Tuesday after the cloud application security and delivery company reported

The Seattle, Washington-based company reported fourth-quarter non-GAAP earnings per share (EPS) of $3.67, higher than the year-ago’s $3.50 and the consensus estimate of $3.45.

Revenue totaled $747 million compared to $707 million reported for the fourth quarter of 2023. Analysts, on average, modeled revenue of $730.43 million for the quarter.

Global services revenue rose 2% to $388 million and software revenue climbed 19% to $228 million, while systems revenue fell 3% to $130 million.

For the full year, the company reported non-GAAP EPS of $13.36 and revenue of $2.82 billion, up from $11.70 and $2.81 billion reported for fiscal year 2023.

For the fiscal year 2025, F5 guided to revenue growth of 4%-5% and non-GAAP earnings per share growth of 5%-7%. On a tax-neutral basis, the midpoint of 2025 non-GAAP EPS guidance represented 10% growth, the company said.

The consensus estimates call for roughly 6.3% non-GAAP EPS growth and 3.2% revenue growth.

The company guided first-quarter EPS to $3.29-$3.41 and revenue to $705 million to $725 million. Wall Street, on average, estimates $3.37 and $708.75 million, respectively.

F5 said its board has approved an additional $1 billion stock-buyback authorization, which is incremental to the $422 million pending from a previous program.

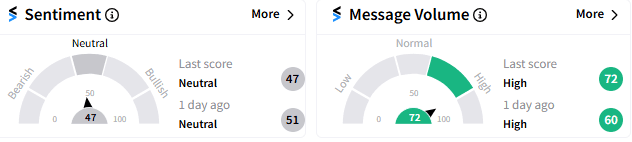

Notwithstanding the positive stock reaction, retailers’ sentiment was stuck at ‘neutral’ (47/100), although message volume remained ‘high.’

Analysts cheered the quarterly results, as the stock snagged price target revisions from Morgan Stanley, Piper Sandler and Barclays, according to the Fly. These firms upped the stock price targets up by $15, $60 and $32, respectively.

In premarket trading, as of 8:05 a.m. ET, F5 shares jumped 10.60% to $241.50. If the premarket gains hold in the regular session, the stock is poised to open at its highest levels since early-January 2023.

Read Next: VF Corp's Q2 Results Send Stock Soaring But Retail Sentiment Takes Beating

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)