Advertisement|Remove ads.

Bitcoin Drops Below $95K On Disappointing US CPI Data: Retail Sentiment Hits Year-Low

Bitcoin’s (BTC) price fell below the key $95,000 support level on Wednesday as higher-than-expected U.S. inflation data rattled both crypto and traditional markets.

Ethereum (ETH) was down 2.4% trading at $2,500 levels, while Ripple (XRP) tumbled 3.4% to $2.38.

The Consumer Price Index (CPI) rose 0.5% in January, exceeding forecasts of 0.3% and accelerating from December's 0.4% gain.

Core CPI, which strips out food and energy costs, increased 0.4% for the month, higher than the anticipated 0.3% and December's 0.2%.

Year-over-year, core CPI stood at 3.3%, surpassing forecasts of 3.1% and December's 3.2% reading.

The hotter inflation print dampened investor expectations for Federal Reserve rate cuts, weighing on risk assets like Bitcoin.

After already trending downward this week, Bitcoin’s price took a sharp dive following the disappointing report as the total cryptocurrency market value dipped by 3.7% in the last 24 hours.

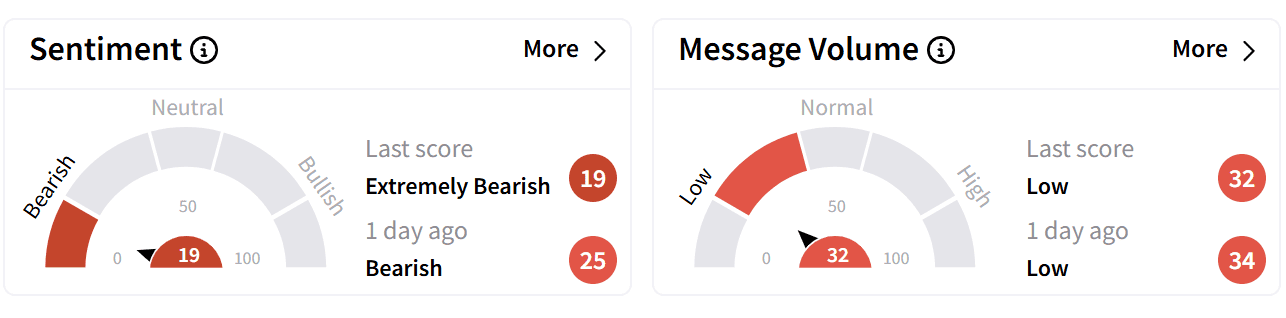

On Stocktwits, retail sentiment around Bitcoin deteriorated to ‘extremely bearish’ from ‘bearish’ a day ago – marking a year-low for the apex cryptocurrency’s ticker on the platform – as chatter remained at ‘low’ levels.

Some users highlighted the irony of Bitcoin, once viewed as an inflation hedge, now weakening on hotter-than-expected price data.

Others speculated that more downside could follow when the Producer Price Index (PPI) data is released on Thursday.

Bitcoin has remained rangebound between $90,000 and $109,000 for over two months.

Concerns over artificial intelligence (AI)-driven risks from China, potential trade wars, and persistent inflation—leading to expectations of higher-for-longer interest rates—have kept prices in check.

While Bitcoin’s price more than doubled in value over the past year, its gains for 2025 remain limited to just 1% so far.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: BNB Defies Crypto Market Decline Amid Binance-SEC Legal Time-Out But Retail Still Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)