Advertisement|Remove ads.

Bitcoin, Ethereum Slip As Powell’s Testimony Offers Little Relief For Crypto Market: Retail Turns Pessimistic

Bitcoin (BTC) fell more than 2.3% over the past 24 hours, mirroring a broader decline in cryptocurrencies following Federal Reserve Chair Jerome Powell’s testimony before Congress.

The total crypto market dipped 3.2%, with Ethereum (ETH) down nearly 3%, Solana (SOL) losing 3.3% and Ripple (XRP) tumbling by 1.7%.

Cardano (ADA), which surged as much as 15%, pared gains to 8% by the time of writing.

Powell largely reiterated his stance from two weeks ago, stating that monetary policy is now “significantly less restrictive” and that policymakers “do not need to be in a hurry to adjust” rates further.

While Powell’s routine testimony primarily focused on monetary policy, cryptocurrency regulation surfaced as a topic.

The Fed chair acknowledged concerns over the “debanking” of crypto firms and indicated that the Federal Reserve is adjusting internal supervision policies in response.

Powell also suggested that stablecoins “may have a big future” and voiced support for regulatory efforts around them.

However, he reaffirmed that the U.S. financial system would not adopt a central bank digital currency (CBDC) under his leadership, a long-standing concern within the crypto industry.

Traditional markets had little immediate reaction to Powell’s statements, but crypto prices weakened as investors parsed his remarks.

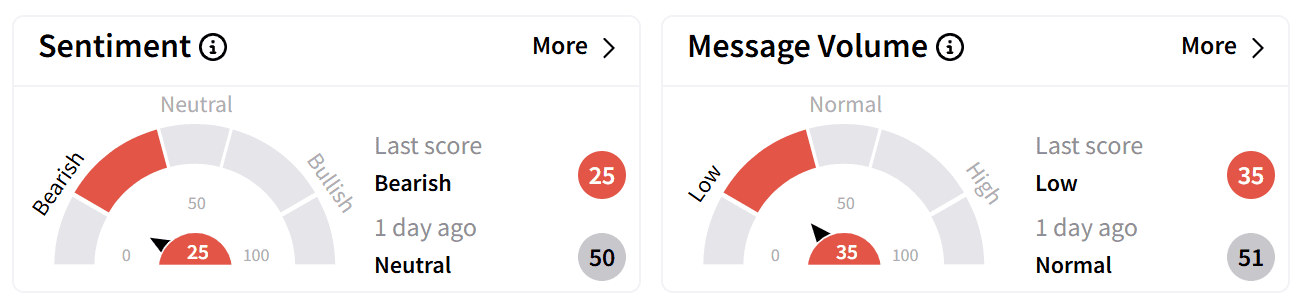

On Stocktwits, retail sentiment around Bitcoin dipped to ‘bearish’ from ‘neutral’ a day ago as chatter declined to ‘low’ levels.

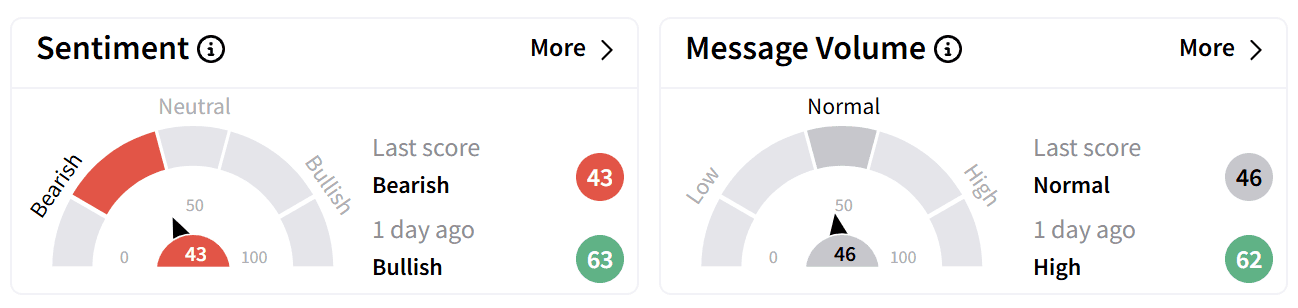

Meanwhile, retail sentiment around Ethereum flipped to ‘bearish’ from ‘bullish’ a day ago with chatter petering down to ‘normal’ from ‘high’ levels.

One user on Stocktwits noted that Powell’s comments, combined with new trade tariffs from the Trump administration, could keep pressure on the crypto market.

Others remarked that Powell’s statements have historically been negative for cryptocurrency prices.

Powell also addressed fiscal policy concerns, telling lawmakers that there is “no time like the present” to put the U.S. budget on a more sustainable path.

On U.S. President Donald Trump’s tariffs, Powell said it was too early to assess their economic impact, noting that the Fed would monitor data rather than speculate on outcomes.

Despite persistent questioning, Powell avoided commenting on the Trump administration’s economic policies, reiterating that the Fed remains independent of political considerations.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)