Advertisement|Remove ads.

Consumer Prices Up 0.5% In January, Higher-Than-Estimated Figures Spook Stocks, Bonds: Retail Even Considers ‘Rate Hike’ As Solution

Consumer price index (CPI) rose 0.5% on a seasonally adjusted basis in January while the annual inflation rate rose 3%, according to the Bureau of Labor Statistics. This compares with a Dow Jones estimate of 0.3% and 2.9%, respectively, according to a CNBC report.

Core CPI, which excludes food and energy prices, rose 0.4% in January and increased 3.3% annually, versus estimates for 0.3% and 3.1%.

With inflation coming in higher than expected, the Federal Reserve now has solid reasons not to worry about rate cuts in the near term, dampening market optimism. Traders had earlier anticipated a 25 basis point cut in July 2025, but those expectations have now shifted to October 2025.

The SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) fell nearly 1% in Wednesday’s pre-market as figures came in higher than Wall Street estimates.

Treasury yields rose, with the 10-year yield rising 10 basis points to 4.643%, while the two-year yield rose nine basis points to 4.386%, according to CNBC. The iShares 7-10 Year Treasury Bond ETF (IEF) traded nearly 0.7% lower in Wednesday’s pre-market session.

The index for shelter rose 0.4% in January, accounting for nearly 30% of the monthly all items increase. The energy index rose 1.1% over the month.

On Wednesday, Federal Reserve Chair Jerome Powell stated before the Senate Banking Committee that the central bank does not need to be in a hurry to cut interest rates and noted that while inflation has come down significantly, it is still above the 2% target.

“With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance. We know that reducing policy restraint too fast or too much could hinder progress on inflation,” Powell said in his prepared remarks. “At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment.”

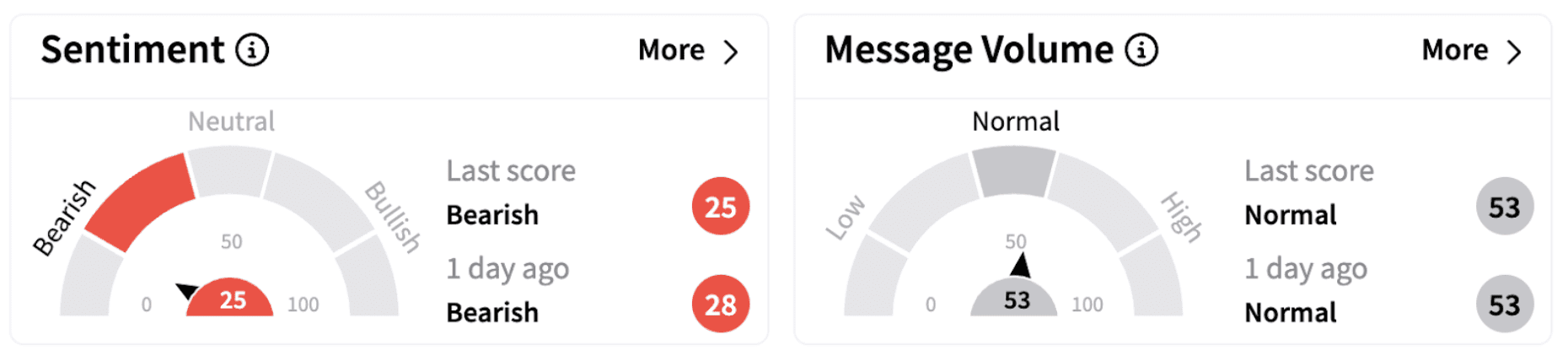

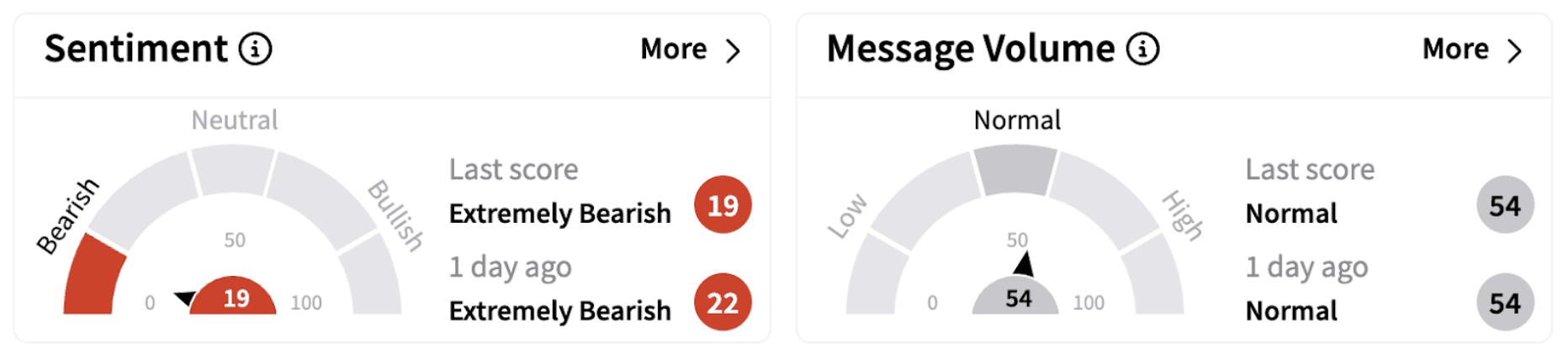

On Stocktwits, retail sentiment around SPY and QQQ trended in the ‘bearish’ to ‘extremely bearish’ territories.

One Stocktwits user said President Donald Trump will have to rethink his tariff policy if inflation has to come down.

A few users even believe a rate hike would be the potential solution to the sticky inflation.

Investors will keenly await further commentary from the Trump administration on tariff hikes and any potential remarks on the government’s stance on price rises.

Also See: FIS Stock Gets Barrage Of Price Target Cuts After Q4 Earnings Report: But Retail Looks The Other Way

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Emirates_jpg_2620b94b3d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)