Advertisement|Remove ads.

Bitcoin, Ethereum Climb Ahead Of Inflation Data: Fundstrat’s Tom Lee Sees BTC Surging Toward $2M On Gold Boost

- According to CoinMarketCap data, the apex cryptocurrency rose 1.1% to $111,210.60 at the time of writing, and Ethereum gained 2.3% $3,977.26.

- The majority of traders believe that despite sticky inflation, the U.S. Federal Reserve will still deliver a rate cut next week amid the recent tepid employment figures.

- If gold hits $5,000 per ounce, Bitcoin prices could jump up to $1.6 million to $2 million, within the next five years, Tom Lee said.

Bitcoin and other major cryptocurrencies advanced early on Friday, ahead of the release of September U.S. inflation data.

According to CoinMarketCap data, the apex cryptocurrency rose 1.1% to $111,210.60 at the time of writing, Ethereum gained 2.3% $3,977.26, and XRP rose 1.3% to $2.44. Among other tokens, Dogecoin and Cardano rose by 1.9% and 2.1%, respectively.

BNB was up 2.8% after Trump’s pardon of the Binance founder, Changpeng Zhao. Solana was up 3.2% after Fidelity Digital Assets launched Solana trading and custody across its retail, institutional, and wealth-management platforms.

U.S. CPI Report Unlikely To Deter Fed From A Rate Cut

The gains of the digital assets come ahead of the long-delayed release of the September U.S. inflation report on Friday. According to a FactSet poll, inflation rose 3.1% in September from a year earlier, up from 2.9% in August and the highest in 18 months. However, the majority of traders believe that despite sticky inflation, the U.S. Federal Reserve will still deliver a rate cut next week amid the recent tepid employment figures.

“Despite tariff-led price pressure in some sectors, there are indications that airfares, hospitality, and housing should be a drag on the CPI basket,” ING commodities analysts wrote, before adding that they do not see the inflation report moving up the dollar.

A weaker dollar makes Bitcoin and other cryptocurrencies more attractive to overseas investors. At the same time, digital assets tend to thrive in a low-interest-rate environment as investor appetite for riskier assets grows.

What Is Retail Thinking?

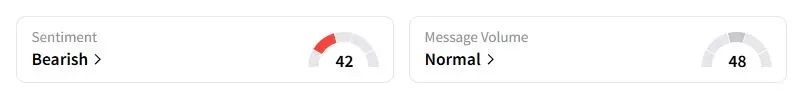

Retail sentiment on Stocktwits about Bitcoin was in the ‘bearish’ territory at the time of writing.

“Despite the CPI data and the situation with Canada, if tomorrow’s verdict is positive, Bitcoin could surge to the $114,000 to $116,000 range,” one user wrote, referring to the fresh trade dispute between the U.S. and Canada over an advertisement by Ontario criticizing Donald Trump’s tariff policies.

Tom Lee Says BTC Could Play Catch-Up With Gold

Amid geopolitical uncertainties and strong ETF flows, bullion has jumped nearly 57% this year. Tom Lee, the Chief Investment Officer of Fundstrat Global Advisors, said that if gold hits $5,000 per ounce, Bitcoin prices could jump up to $1.6 million to $2 million, within the next five years.

“Bitcoin does not get capped by gold; it gets pulled up by gold,” Lee said in an interview with investor Anthony Pompliano.

He also said Bitcoin could still outperform gold by the end of the year, backed by positive developments, while suggesting that Bitcoin is likely in a “longer cycle” that breaks the “four-year” cycle pattern. However, he warned that it’s not entirely impossible for Bitcoin to crash by 50%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rolls_royce_jpg_07109534ba.webp)