Advertisement|Remove ads.

Bitcoin, Ethereum, Solana Dip Amid Washington Policy Hang

- Bitcoin, Ethereum, and Solana fell over the past 24 hours as long-side liquidations dominated.

- In Bitcoin and Ethereum, liquidations favored longs, suggesting dip buyers were flushed as macro uncertainty repriced risk.

- The CLARITY Act markup was delayed to late January, with traders focused on U.S. CPI data and a Supreme Court tariff ruling in the coming week.

Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) were under pressure over the past 24 hours as traders re-priced risk for a headline-packed week in Washington.

Bitcoin (BTC) was trading at $91,232, down 0.9% in the last 24 hours. According to Coinglass data, liquidations were long skewed as $38.31 million in longs got liquidated versus $19.49 million in shorts over the last 24 hours. Total liquidations stood at $57.80 million, suggesting that it was more a cleaning up of dip-buyer positioning rather than an aggressive short squeeze. On Stocktwits, retail sentiment around Bitcoin dropped from ‘bullish’ territory to ‘neutral’ territory, while chatter levels remained at ‘normal’ levels.

Ethereum (ETH) was trading at $3109, down 1.3% in the last 24 hours, as liquidations were mostly on the long side at $30.20 million versus $9.21 million in shorts. The total liquidation across Ethereum stood at $39.41 million over the past day. On Stocktwits, retail sentiment around Ethereum dropped from ‘bearish’ to ‘extremely bearish’ territory while chatter levels remained at ‘low’ levels.

Macro, Policy Delays Weigh In On Market Sentiment

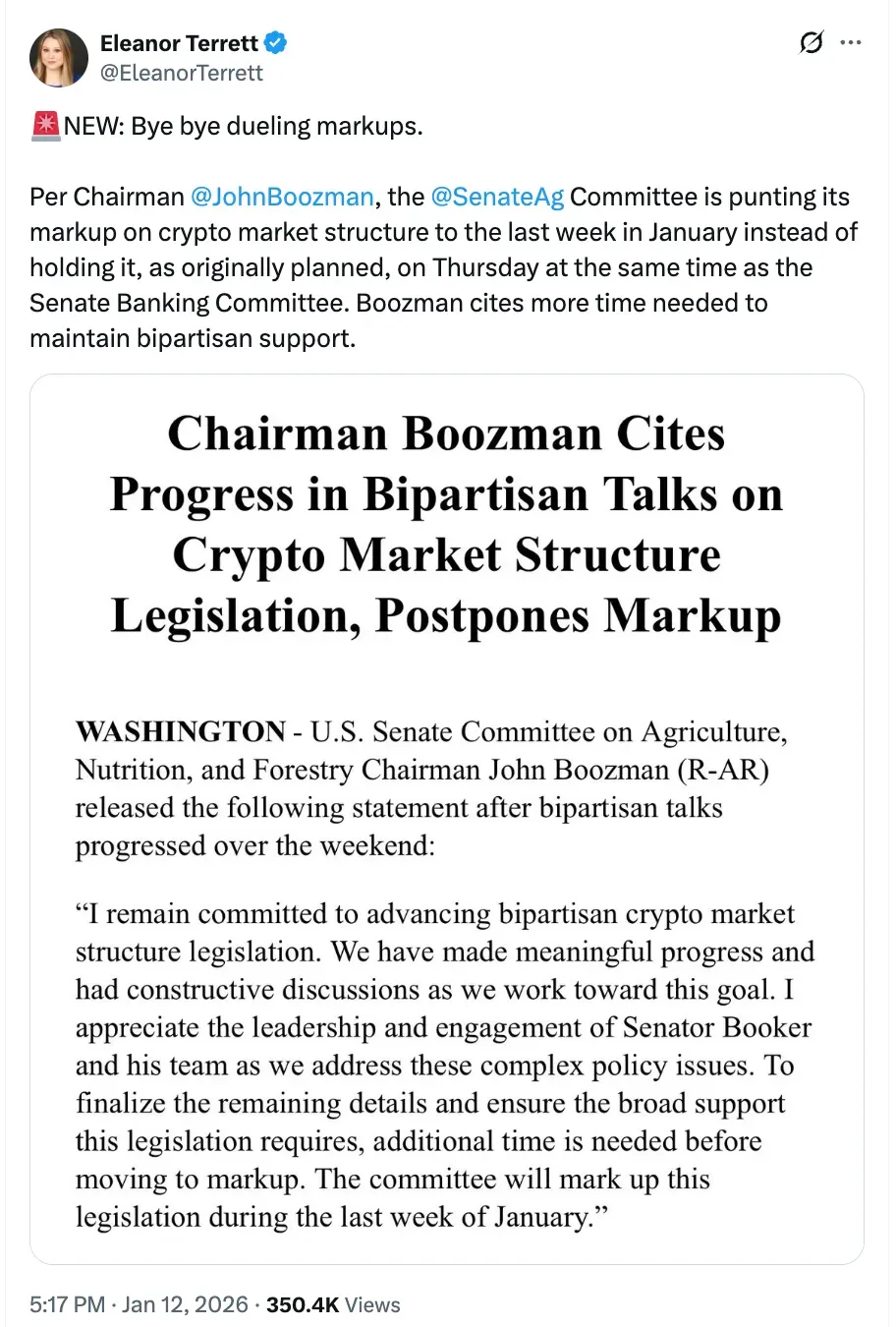

The current market sentiment is heavily driven by macro and policy. Market chatter honed in on the real-time timeline for the U.S. crypto market structure bill’s (CLARITY Act) markup, which journalist Eleanor Terrett flagged to have moved to late January now. Previously, the markup was due for Thursday, and Terrett said that Senator John Boozman cited that “more time [is] needed to maintain bipartisan support.”

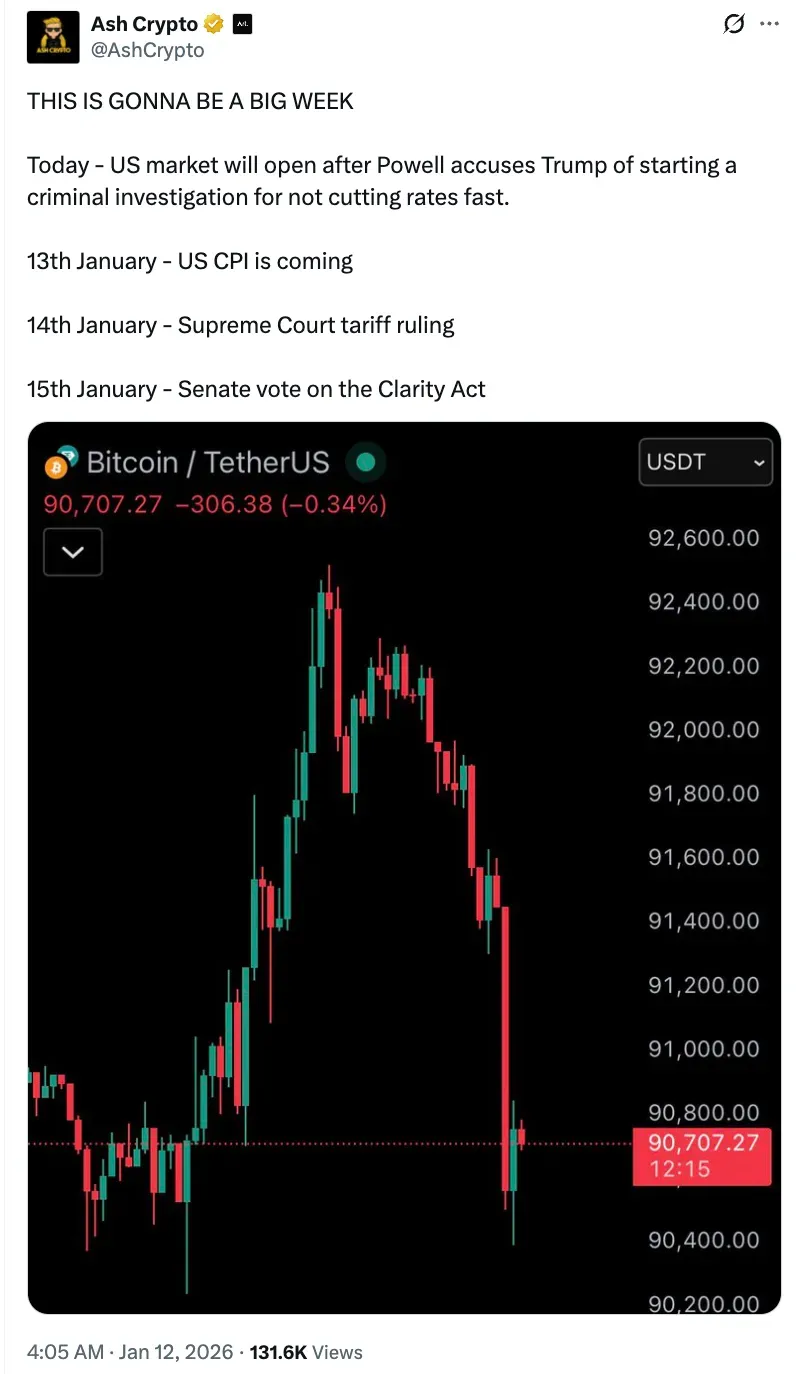

Crypto key opinion leader Ash Crypto said that January 13’s U.S. CPI data and January 14’s Supreme Court tariff ruling could have an impact on Bitcoin’s price moving forward. Many within the market, including Chad Steingraber and Ryan Rasmussen, see that the bill could move to be approved later this year.

Sentiment across altcoins was also muted. For instance, Solana (SOL) traded at around $138, down 3.2% on the day, while liquidations totaled about $11.28 million, led by $9.12 million in longs compared with $2.16 million in shorts. On Stocktwits, retail sentiment around Solana dropped from ‘bearish’ to ‘extremely bearish’ territory, accompanied by normal levels of chatter over the past day.

Dogecoin (DOGE) traded at $0.1368, down 3.2% in 24 hours, as long liquidations reached $3.25 million versus $0.48 million in shorts and total liquidations at $3.73 million overall. On Stocktwits, retail sentiment around Dogecoin remained in ‘bearish’ territory with ‘low’ chatter levels over the past day.

Cardano (ADA) was priced at $0.3862, down 3.5% over the past 24 hours, and liquidations came in at roughly $1.16 million, including $1.03 million in longs and $0.13 million in shorts. On Stocktwits, retail sentiment around Cardano dropped from ‘bullish’ to ‘neutral’ zone, accompanied by ‘low’ levels of chatter over the past day.

Analyst Says XRP Is Repriced

Ripple’s XRP (XRP) traded at $2.05, down 2.1% over the past 24 hours, and saw around $4.99 million in liquidations, with $4.03 million from longs and $0.96 million from shorts. Jake Claver, another influencer and wealth manager, said on X that “XRP is repriced because of a crisis that happens before the Clarity Act is passed.” On Stocktwits, retail sentiment around XRP dropped from ‘neutral’ to ‘bearish’ territory, while chatter levels dropped from ‘high’ to ‘low’ levels over the past day.

Binance Coin (BNB) held near $903.16, down 0.3% in 24 hours, as liquidations remained relatively muted at about $0.22 million, with $0.19 million in longs versus $0.03 million in shorts. On Stocktwits, retail sentiment around Binance Coin dropped from ‘extremely bearish’ to the 'bearish zone’, accompanied by ‘normal’ levels of chatter over the past day.

The total crypto market liquidations stood at $204.86 million over the past 24 hours.

Read also: ‘No Crypto Tax’ Push Draws Spotlight As CLARITY Act Nears Senate Markup

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)