Advertisement|Remove ads.

Bitcoin Hovers Around $114,000 As Attention Shifts To Fed Decision, Trump-Xi Meeting

- The apex cryptocurrency fell 1.2% to $114,194.83 at the time of writing, according to CoinMarketCap data, while Ethereum slipped 2% to $4,116.92 and BNB fell 2.2% to $1,132.12.

- “We're going to have a great talk. I have a lot of respect for President Xi. I like him a lot. He likes me a lot." — Donald Trump.

- The Federal Open Market Committee meeting is scheduled to begin on Tuesday.

Bitcoin dipped in early trading on Tuesday after strong gains in the earlier session, as the focus shifted to the Federal Reserve’s policymakers’ meeting as well as next week’s meeting between the heads of state of the U.S. and China.

The apex cryptocurrency fell 1.2% to $114,194.83 at the time of writing, according to CoinMarketCap data, while Ethereum slipped 2% to $4,116.92 and BNB fell 2.2% to $1,132.12. Among other tokens, Solana was down marginally, while Dogecoin fell 2.8% and Cardano fell 2.4%.

Monday’s rally was driven by optimism surrounding a framework of a legal agreement struck between the U.S. and China on the sidelines of the Association of Southeast Asian Nations (ASEAN) summit in Kuala Lumpur, Malaysia. U.S. Treasury Secretary Scott Bessent stated that the 100% tariffs that Trump had threatened on Chinese goods were “effectively off the table.”

FOMC Meeting, Xi-Trump Talks In Focus

Investors now keenly wait for the Federal Reserve’s decision on benchmark interest rates, with traders widely anticipating a 25-basis-point cut. Bitcoin and other digital assets tend to thrive in a low-interest-rate environment, as investor appetite for riskier assets grows.

Traders will also keep an eye on the meeting between U.S. President Donald Trump and his Chinese counterpart, Xi Jinping, scheduled for Thursday, in South Korea. “We're going to have a great talk. I have a lot of respect for President Xi. I like him a lot. He likes me a lot," Trump told reporters as he flew to Japan, as per an ABC report. A positive outcome of the meeting will ease concerns of a tariff war, which led to a crash in digital asset prices earlier in October.

“U.S.-China trade optimism and Fed rate cut bets are fuelling the rally. With macro tailwinds building, the market’s focused on what’s next, not what’s behind,” said BTC Markets analyst Rachael Lucas.

What Is Retail Thinking?

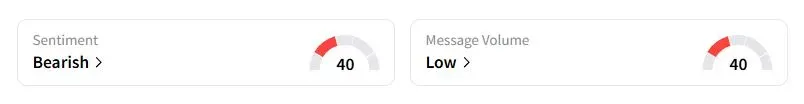

Retail sentiment on Stocktwits about Bitcoin was still in the ‘bearish’ territory at the time of writing.

“Do not overleverage yourself. I seriously doubt Trump will make a deal with China,” one user said.

Multiple ETFs To Start Trading Despite US Shutdown

On Monday, the New York Stock Exchange revealed in a filing that at least four cryptocurrency ETFs will begin trading by Wednesday, which include the Bitwise Solana Fund, the Canary Capital Litecoin Fund, the Canary Capital HBAR ETF, and the Grayscale Solana Trust.

The listing was made possible by the SEC's much more lenient listing guidelines issued in September. One of the updated rules allowed securities to go live 20 days after an amended filing, even when the SEC is understaffed during the shutdown.

Also See: HBAR Token Surges As NYSE Lists First-Ever Hedera ETF Despite US Shutdown

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_OG_jpg_d3e6e5843b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)