Advertisement|Remove ads.

HBAR Token Surges After Listing Of First-Ever Hedera ETF Despite US Shutdown

- The filings also indicated that other ETFs, including Bitwise Solana Fund, the Canary Capital Litecoin Fund, and the Grayscale Solana Trust, could be on the way.

- Bloomberg ETF analyst James Seyffart said on X that the listing was made possible by the SEC's much more lenient listing guidelines issued in September.

- According to CoinMarketCap data, the HBAR token is now the 17th-most-valuable cryptocurrency in the world with a market capitalization of over $9.1 billion.

Hedera Hashgraph was up nearly 11% from a day earlier, after a filing revealed that the first-ever exchange-traded fund for the token will begin trading on Tuesday.

The Canary Capital HBAR ETF will be listed on Nasdaq under the ticker “HBR” and will provide institutional investors and retail traders a pathway to build exposure to the token without trading actual cryptocurrencies. NYSE and Nasdaq filings also indicated that other ETFs could be on the way: the Bitwise Solana Fund, the Canary Capital Litecoin Fund, and the Grayscale Solana Trust.

Hedera is an open-source, public network designed for enterprise-grade decentralized applications. It leverages hashgraph consensus rather than blockchain to enable fast, secure, and cost-effective transactions. Several organizations, including Google, IBM, and BitGo govern the network.

SEC’s New Guidelines Help Avoid Shutdown Delays

The filings surprised many, as the federal government has remained shut for the whole of October and, by extension, the SEC is also operating with reduced staffing, with most workers sent home without pay.

Bloomberg ETF analyst James Seyffart said on X that this was made possible by the SEC's much more lenient listing guidelines issued in September. One of the updated rules allowed securities to go live 20 days after an amended filing, even when the SEC is understaffed during the shutdown.

"This is another landmark moment in what has been a pivotal year for the crypto industry. Canary is incredibly proud to have delivered on our mission to bring registered crypto investment solutions to the broader investment public," said Steven McClurg, CEO and founder of Canary Capital.

The HBR ETF plans to hold tokens in custody with BitGo and Coinbase, with CoinDesk providing the pricing benchmark. Investor Mark Chadwick hailed the move as a “major milestone for institutional access to the Hedera ecosystem”.

What Is Retail Thinking?

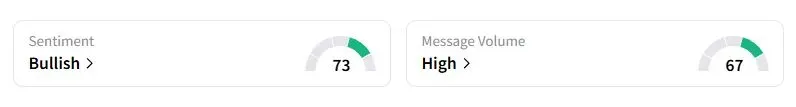

Retail sentiment on Stocktwits about HBAR was in the ‘bullish’ territory at the time of writing.

“Everything is lining up perfect[ly] for a massive run. ETF news, possible resolution to government shutdowns, and possible interest rate cuts,” one user said.

“HBAR is powering back past .42, driven by its real-world adoption, strong network growth, and expanding ecosystem. With more partnerships and increased utility on the horizon, this isn’t just a bounce; it’s a move backed by fundamentals,” another user said.

According to CoinMarketCap data, the HBAR token is now the 17th-most-valuable cryptocurrency in the world with a market capitalization of over $9.1 billion.

Also See: SoFi Stock Closes At New Peak Ahead Of Q3: Here's How Retail's Positioned

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)