Advertisement|Remove ads.

Bitcoin Isn’t Breaking: Bernstein Keeps $150K Target Intact

- Bernstein analysts pointed towards Bitcoin’s recent decline as driven by weakened investor confidence, not a breakdown in the crypto market’s structure.

- The firm noted that this cycle has avoided the major balance-sheet failures seen in past bear markets, with a more stable macro and policy environment in place.

- Analysts said spot Bitcoin exchange-traded funds are operationally ready for institutional demand, but tight liquidity is holding back inflows for now.

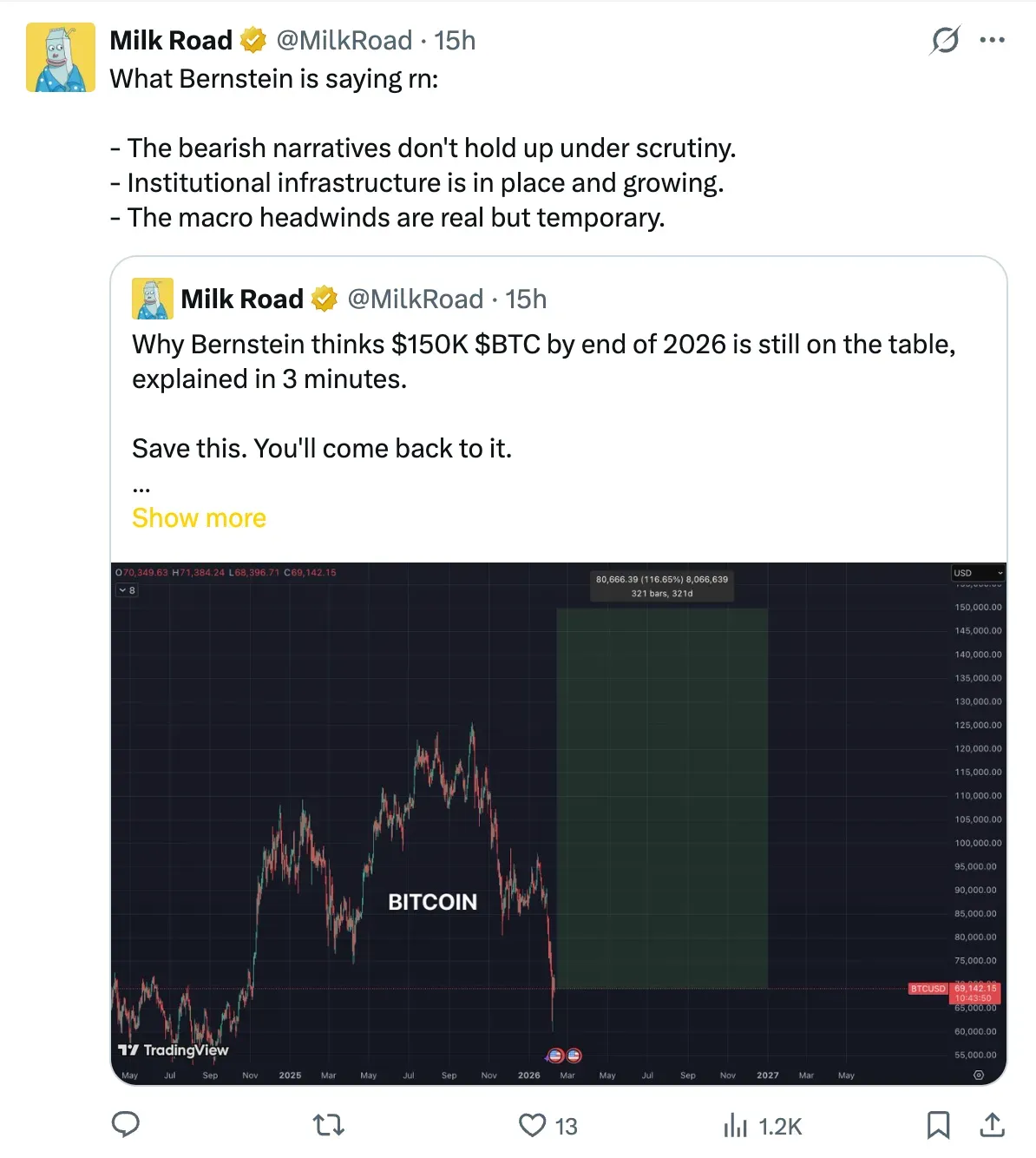

- Bernstein reiterated its view that Bitcoin could reach $150,000 by the end of 2026 if liquidity conditions ease and ETF inflows continue to build.

As Bitcoin (BTC) continues to remain rangebound in the $68,000 to $70,000 territory, analysts at Bernstein have pointed out that the current drop in the asset’s price is due to a shock in confidence rather than a systemic collapse.

Late Monday, Bitcoin’s price was trading at around $69,290.50, down by 2.5% in the last 24 hours, and saw about $127.98 million in total liquidations, according to Coinglass data. On Stocktwits, the retail sentiment around Bitcoin remained in the ‘bearish’ territory, with chatter at ‘extremely high’ levels over the past day.

Bernstein Analysts See $150,000 As Upside For Bitcoin

The current crypto cycle has yet to see the balance-sheet failures that characterized previous bear markets, according to analysts at Bernstein, who noted there have been no breakdowns like Mt. Gox, Terra’s Luna, FTX, or Three Arrows Capital to date.

The macro and policy backdrop seemed to be more stable this time, they added, citing the increasingly pro-Bitcoin U.S. government rhetoric, spot Bitcoin ETFs that have been approved with increasing adoption of them, and an increasing number of companies building crypto-based treasury positions.

Bernstein also said that U.S. spot Bitcoin ETFs already have the "plumbing" in place for institutional inflows. Currently, however, flows are limited by tight liquidity conditions, not by access or product readiness.

The research team says that Bitcoin still trades mostly as a risk asset that is sensitive to liquidity at this stage of adoption, which means that a re-rating is likely to happen when financial conditions get better. This is more of a sentiment reset than a systemic breakdown because, in their base case, the typical bear-market triggers haven't occurred yet. By the end of 2026, Bernstein still believes that the market could reach $150,000, but only if the economy moves toward less tight liquidity and ETF inflows continue to grow as anticipated.

Altcoins Remain Muted Throughout The Crypto Market

Ethereum (ETH), trading at around $2,059.28, down by 1.6% in the last 24 hours, saw about $82.90 million in total liquidations. On Stocktwits, the retail sentiment around Ethereum remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Solana (SOL), trading at around $85.53, down by 2.3% in the last 24 hours, saw about $16.37 million in total liquidations. On Stocktwits, the retail sentiment around Solana remained in the ‘bullish’ territory, with chatter at ‘extremely high’ levels over the past day.

Ripple’s XRP (XRP), trading at around $1.43, down by 1.2% in the last 24 hours, saw about $10.21 million in total liquidations. On Stocktwits, the retail sentiment around XRP remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Binance Coin (BNB), trading at around $632.93, down by 1.9% in the last 24 hours, saw about $0.91 million in total liquidations. On Stocktwits, the retail sentiment around BNB changed from ‘bullish’ to ‘neutral’ territory, with chatter shifting from ‘high’ to ‘extremely high’ levels over the past day.

Dogecoin (DOGE), trading at around $0.09477, down by 2.4% in the last 24 hours, saw about $2.53 million in total liquidations. On Stocktwits, the retail sentiment around Dogecoin remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Total liquidation across the market also remained relatively lower at $296.25 million.

Read also: After A Tough Quarter, Michael Saylor’s ‘Orange Dots’ Show He’s Not Done Buying Bitcoin

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)