Advertisement|Remove ads.

Bitcoin’s Drop Triggers $1B In Liquidations As Crypto Market Sheds $80B in a Day – Retail Sentiment Cools

Bitcoin’s (BTC) latest rally came to an abrupt halt as the cryptocurrency tumbled below $83,000, triggering over $1 billion in liquidations in the past 24 hours.

The sharp decline coincided with a broad sell-off in U.S. equities, sending shockwaves through both traditional and digital asset markets.

The global crypto market shed more than $80 billion in value within a day, according to TradingView data, erasing nearly $400 billion from its Monday morning highs.

The pullback follows a surge fueled by President Donald Trump’s announcement of a ‘strategic crypto reserve,’ which briefly pushed Bitcoin above $90,000 and lifted total digital asset market capitalization past $3.1 trillion.

The latest downturn comes amid rising macroeconomic uncertainty, with the Trump administration announcing new tariffs on Canada, Mexico, and Brazil – a move that has sparked swift retaliation from the targeted countries.

According to Coinglass data, more than 342,000 traders were liquidated, with total crypto liquidations crossing the $1 billion mark. Long positions bore the brunt of the wipeout, accounting for $877 million of the total, while shorts saw a comparatively modest $200 million in liquidations.

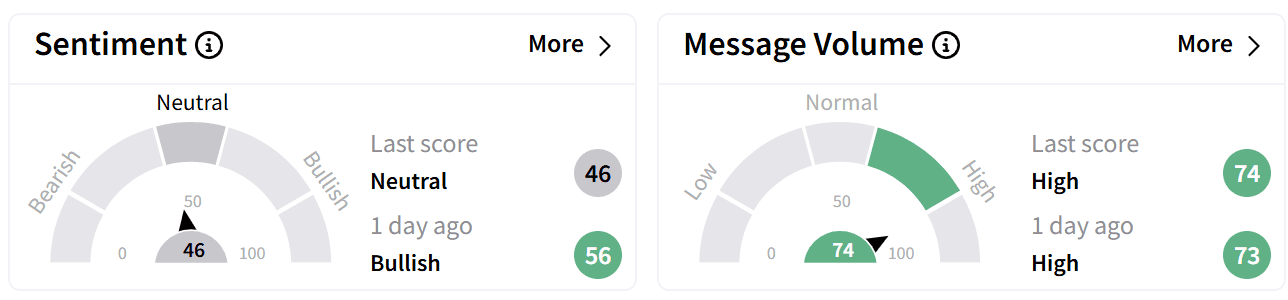

Retail sentiment around Bitcoin on Stockwits, dipped into ‘neutral’ territory from ‘bullish’ a day ago, accompanied by ‘high’ levels of chatter.

One user commented that the crypto market acted like Monday’s rally never happened.

Another joked that Bitcoin just got ‘rug pulled’ by the U.S. president.

Bitcoin alone saw $381.5 million in liquidations, with over $300 million coming from long positions.

After touching a 24-hour low of $82,467, Bitcoin’s price managed to recover slightly, trading back above $85,000. However, it remains down more than 6% for the day.

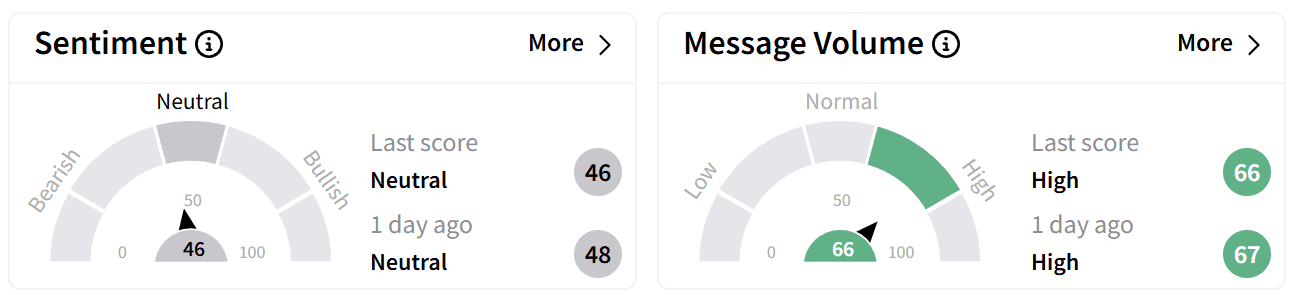

Retail sentiment on Stocktwits around Ethereum’s token remained in the ‘neutral’ zone, accompanied by ‘high’ levels of chatter.

Some users hoped that crypto prices would rebound as dramatically as they fell during U.S. trading hours.

Ethereum also faced heavy selling pressure.

The second-largest cryptocurrency by market capitalization fell below $2,000 for the first time since September 2023, hitting a low of $1,996 before climbing back above $2,100.

It remains down over 7% for the day, with $222.9 million in liquidations – $171 million from long positions and $50 million from shorts.

Ethereum has lost 40% over the past year, while Bitcoin is still up 28% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Ethereum Hits Over One-Year Low As Trump’s Tariff War Roils Crypto Markets – Retail Feeling Skittish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)