Advertisement|Remove ads.

Ethereum Hits Over One-Year Low As Trump’s Tariff War Roils Crypto Markets – Retail Feeling Skittish

Ethereum (ETH) dropped to its lowest level in over a year during U.S. pre-market hours, falling below $2,100 as U.S. tariffs on China, Mexico, and Canada took effect at midnight on Tuesday. The last time the cryptocurrency traded at these levels was November 2023.

Ethereum has lost 11% in the past 24 hours, while Bitcoin (BTC) is down 9% over the same period, according to CoinGecko data.

Its performance against Bitcoin (BTC) has dropped to its lowest level in four years. The ETH/BTC ratio is at its lowest since January 2021.

Amid the turmoil, around $191.17 million of Ethereum has been liquidated in the last 24 hours, according to CoinGlass data.

The drop comes after Trump reaffirmed Monday that the U.S. would impose 25% tariffs on Canadian and Mexican imports starting Tuesday.

Kevin Guo, director of HaskKey Research, told CoinDesk that tariffs are the key reason behind the cryptocurrency market’s fall in U.S. pre-market hours.

“Trump's latest tariff announcements on Canada, Mexico, and China caused a massive selloff of crypto assets, completely reversing the previous day's crypto strategic reserve gains,” said Kevin Guo, director of HashKey Research.

“Despite a slew of pro-crypto deregulation initiatives and supportive policies, investors view cryptocurrencies as risk assets strongly bound by the performance of the U.S. equity market,” he added.

In addition to macroeconomic pressures, the crypto market has also been weighed down by the recent $1.46 billion ByBit hack by the Lazarus group, a collective of North Korean hackers.

Bybit CEO Ben Zhou revealed that all the funds from the largest hack in crypto history, which compromised the exchange’s Ethereum cold wallet, had been laundered within 10 days of being stolen.

Around 77% of the haul, valued at around $1 billion, remains traceable after being moved using privacy-focused THORChain, while the other 20% have “gone dark” – successfully mixed, laundered, or sent to platforms that obscure transactions.

The remaining 3% of the stolen funds have been frozen.

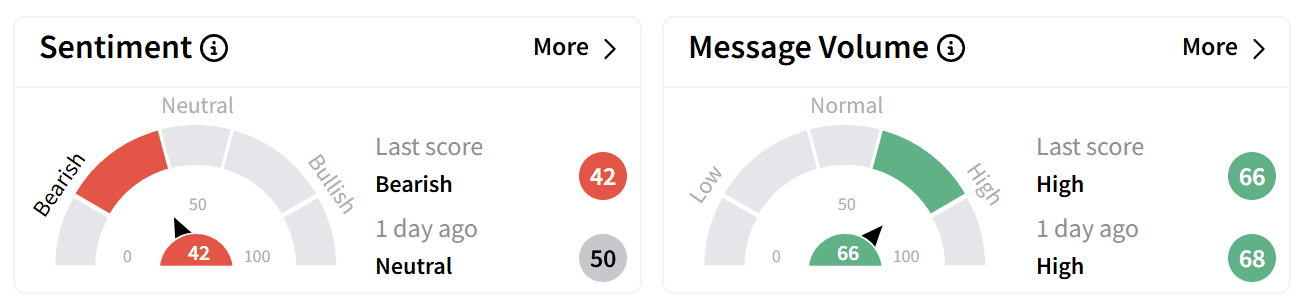

Retail sentiment on Stocktwits around Ethereum’s token dipped to ‘bearish’ from ‘neutral’ a day ago, accompanied by ‘high’ levels of chatter.

One user lamented that the crypto crash also dragged Bitcoin mining stocks like Marathon Digital (MARA) and Riot Platforms (RIOT).

China has since vowed to fight the U.S. "to the bitter end" and announced counter measures - which include up to 15% tariffs on a range of American agricultural and food products.

Canada has retaliated with immediate 25% tariffs against $30 billion worth of U.S. goods, with an additional $125 billion worth of products to be hit over the next 21 days.

Mexico is expected to announce its response later today.

Ethereum is down 40% for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)