Advertisement|Remove ads.

Bitcoin Rebounds to $85K While LINK, SUI Tokens Outperform – Retail Divided Even As BTC Reclaims 200-Day Moving Average

Bitcoin briefly touched $85,000 on Tuesday before paring gains to $84,500 during U.S. market hours, reclaiming its 200-day simple moving average (SMA). The move comes after the apex coin traded at or below the key technical level for five consecutive sessions.

A sustained move above the 200-day SMA is often seen as a bullish signal, while dipping below the level with firm conviction typically signals increased downside risk.

The world’s largest cryptocurrency gained over 5% in the past 24 hours, lifting the overall digital asset market capitalization by 2.2% to $2.8 trillion, according to CoinGecko data. Ethereum’s native token (ETH) and Ripple’s XRP token (XRP) also rose by more than 5% alongside Bitcoin.

Chainlink (LINK) and Sui (SUI) led gains among major cryptocurrencies, surging over 10% in the past day.

Bitcoin’s rally coincided with a broader recovery in risk assets as appetite returned to traditional markets.

Adding to the optimism, news emerged that a bill to be introduced in Congress aims to formalize President Donald Trump’s executive order establishing a U.S. Strategic Bitcoin Reserve.

The legislation would prevent future administrations from dismantling the reserve and the U.S. Digital Asset Stockpile through executive action if passed.

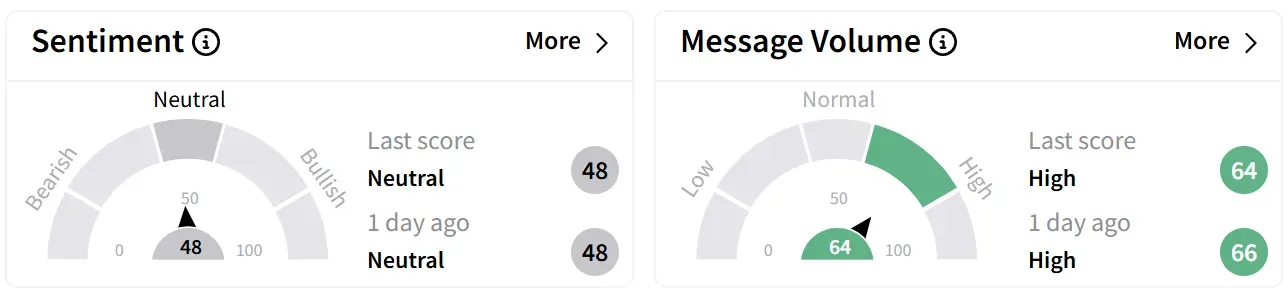

On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘neutral’ territory, accompanied by ‘high’ levels of retail chatter.

One user pointed out that Bitcoin’s previous market cycles have seen deeper lows during periods of extreme fear, suggesting the asset has matured.

Another predicted that the recent dip below $80,000 was the final shakeout before Bitcoin’s next major rally.

The apex cryptocurrency has gained approximately 19% over the past year. Despite Tuesday’s rally, Bitcoin’s price remains 22% below its all-time high of nearly $109,000 in January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)