Advertisement|Remove ads.

Bitcoin’s ‘Uptober’ Turns Into ‘Downtober’ – Analyst Warns Of Potential Pullback To $80K

- Bitcoin is down nearly 5% this month despite rebounding slightly on Friday.

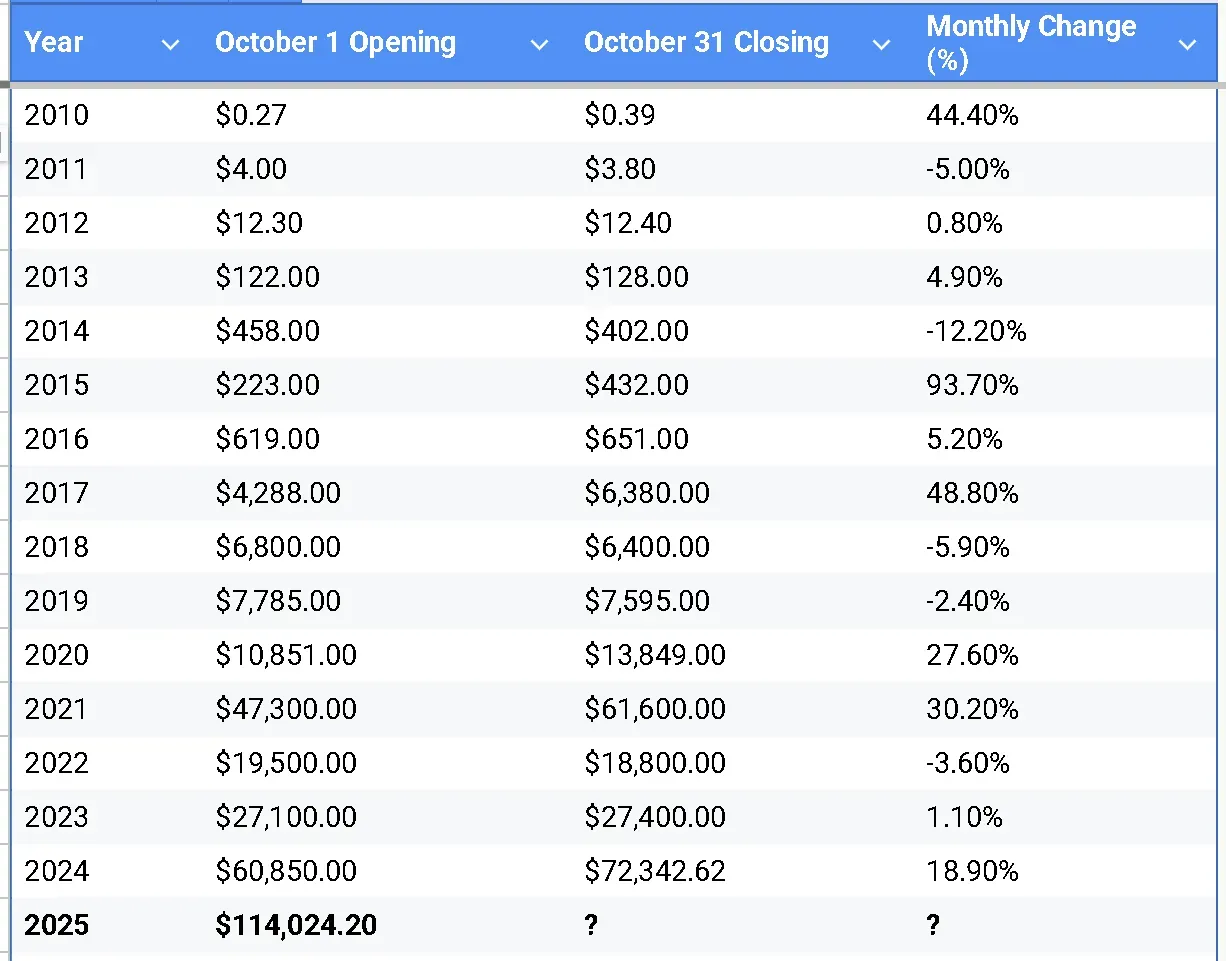

- Bitcoin’s price has recorded gains in 11 out of 16 available years.

- 10x Research CEO Markus Thielen reported a possible deeper pullback toward $80,000.

Bitcoin (BTC) was on track to post a roughly 5% loss for October — historically one of its strongest months — even after edging higher in early Friday trading.

Bitcoin’s price gained 0.4% in the past 24 hours to trade near $110,100, still about 13% below its record high above $126,000 set earlier this month. Meanwhile, on Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘neutral’ territory over the past day, even as chatter increased to ‘normal’ from ‘low’ levels.

“Bitcoin has been stuck in a grinding sideways regime,” said Markus Thielen, CEO of 10x Research, in a note shared with Stocktwits. “When BTC trades above its 1-year moving average, it’s rare to see an ‘outside month’ — one that prints both a new monthly high and low. When it does occur, it often reflects indecision and extended consolidation.”

Thielen added that Bitcoin is approaching “the apex of a narrow bull market structure,” with a confirmed breakout implying a $50,000 measured-move target. “Repeated failure near $117,000 and breakdowns below $110,000 raise the risk of a deeper pullback,” he said, estimating a potential low around $80,000.

Bitcoin’s ‘Uptober’ Turns ‘Downtober’

Bitcoin’s price has recorded gains in 11 out of 16 available years. The strongest October performance was in 2015, with a 93.7% gain, while the worst performance was in October 2014, with a 12.2% decline following the fallout from the Mt. Gox scandal.

Crypto Liquidations Surge

The overall cryptocurrency market took a dip of around 1.1% in the last 24 hours, with its market capitalization standing at around $3.76 trillion in early morning trade on Friday. CoinGlass data showed that total crypto liquidations exceeded $860 million in 24 hours — $745 million from long positions and $122 million from shorts. Bitcoin accounted for $303 million of the total, while Ethereum (ETH) saw about $191 million liquidated. Official Trump (TRUMP), Ripple’s native token XRP (XRP), and Solana (SOL) were also among the leading names seeing leveraged bets wiped out.

MSTR Stock Surges After Q3 Results

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, edged up more than 6% in pre-market trade after the reporting its third-quater (Q3) results. The stock was among the top trending tickers on Stocktwits. On the platform, retail sentiment around the MSTR jumped to ‘extremely bullish’ from ‘neutral’ over the past day, as chatter surged to ‘extremely high’ from ‘normal’ levels.

The company reported revenue of $129 million, above the estimated $117 million by Wall Street, according to Koyfin data. Its adjusted earnings per share (EPS) came in at $31.27, at par with the consensus forecast.

Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) were up 6%. Crypto-exchange Coinbase (COIN) gained more than 4%, also announcing its Q3 results with an EPS of $1.50 on revenue of $1.87 billion, beating Wall Street's forecast of $1.13 EPS on revenue of $1.8 billion.

Read also: MSTR Stock Jumps After-Hours On Strong Q3 Profit, Still Sees Bitcoin Hitting $150,000 By Year-End

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)