Advertisement|Remove ads.

Bitcoin Santa Rally Looks Unlikely With Analysts Flagging Range-Bound Finish To 2025

- Analysts cite low volume, weak momentum, and broken cycle dynamics as key constraints on upside.

- They noted that oversold technical signals do not rule out further downside, based on prior market cycles.

- Macro debt dynamics are increasingly shaping long-term crypto market behavior.

Bitcoin (BTC) appears set to remain range-bound through year-end, dimming hopes for a typical Santa Rally in the cryptocurrency markets, according to several analysts tracking momentum, macro conditions, and longer-term cycle signals.

Bitcoin’s price gained around 1% in morning trade on Thursday, trading at around $87,200 ahead of inflation data expected later in the day. On Stocktwits, retail sentiment around the apex cryptocurrency continued to trend in ‘extremely bearish’ territory amid ‘low’ levels of chatter.

Bitcoin Expected To Remain Range Bound

In a post on X, Wyckoff Analytics flagged weakening momentum across Bitcoin and broader crypto markets, noting that the recent rally occurred on low volume. Such conditions, the firm said, often precede a retest of support levels, a process that now appears to be underway.

A crypto analyst on X known as Dr. Cat echoed that view, suggesting Bitcoin is likely to trade sideways into early 2026 to fully neutralize its daily downtrend. He identified $85,000 as a near-term pivot, with stronger support clustered around $80,000 and secondary levels near $77,000. “That's why for the next 2.5 weeks it will be very hard to start a rally above 89K,” he wrote.

Dr. Cat said any rebound between $98,000 and $103,000 in January would likely represent a topping opportunity rather than the start of a new leg higher. He added that while the broader crypto cycle remains intact, fresh all-time highs appear unlikely over the next six to 12 months, given the loss of momentum on higher timeframes.

Analyst Warns Oversold Markets Can Still Fall Further

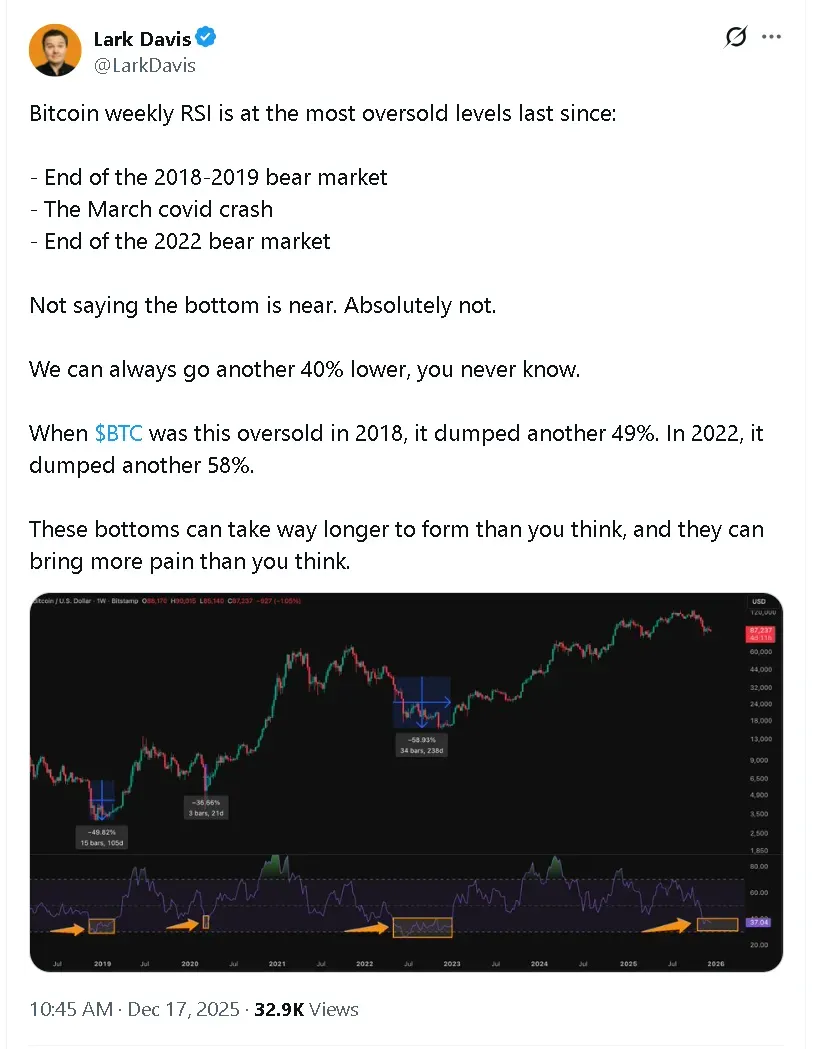

Crypto analyst Lark Davis noted that Bitcoin’s weekly relative strength index (RSI) has fallen to levels last seen during major downturns, including the 2018–2019 bear market, the March 2020 pandemic crash, and the end of the 2022 crypto winter.

Davis cautioned that oversold conditions do not guarantee an imminent bottom. He noted that during prior cycles, Bitcoin fell an additional 49% in 2018 and 58% in 2022 after reaching similarly depressed RSI levels. “These bottoms can take way longer to form than you think,” Davis said, warning that further downside remains possible.

Macro Shifts Challenge Four-Year Cycle

Julien Bittel, head of macro research at Global Macro Investor, also pointed to Bitcoin’s historical performance following deeply oversold relative strength index (RSI) readings, typically defined by RSI falling below 30. While such conditions have often preceded rebounds, Bittel cautioned against assuming a swift recovery this time.

He argued that Bitcoin’s widely cited four-year cycle is no longer intact, due to shifts in global debt dynamics.

“The bigger picture is that there is still a vast amount of interest expense that needs to be monetized,” Bittel wrote, noting that interest costs have continued to outpace GDP growth.

Bitcoin Santa Rallies

Over the last 10 years through 2023, seasonal tailwinds have often supported crypto prices in late December. CoinGecko data shows cryptocurrencies recorded a Santa Claus rally eight times over the past decade through 2023, with gains ranging from 0.69% to 11.87% during the post-Christmas week. Pre-Christmas rallies occurred five times over the same period.

However, the average return from trading only those short windows has been modest. Between 2014 and 2023, Bitcoin delivered average gains of just 1.32% in the pre-Christmas period and 1.29% in the post-Christmas window, compared with average full-month December gains of 9.48%. So far this month, Bitcoin is down more than 3%.

Read also: Bitcoin, Ethereum ETFs See Over $500M Outflows While XRP And Solana Funds Buck The Sell-Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)