Advertisement|Remove ads.

Bitcoin Tumbles Below $90K To 7-Month Low Amid Rate Worries — Bulls Scream Buy While Retail Hits Panic Button

- Investor concerns have grown that the U.S. Federal Reserve might not lower interest rates at its next policymakers’ meeting on December 9-10.

- According to CME Group’s FedWatch tool, only 42% traders see a rate cut next month, compared with over 93% a month earlier.

- “This is the last time you'll ever be able to buy bitcoin below $90k!” — Cameron Winklevoss, co-founder of Gemini Space Station.

Bitcoin plunged below $90,000 late on Monday, to hit its lowest since April, extending its declines over the past week as traders remained cautious on riskier assets amid uncertainties over the Federal Reserve’s interest rate path.

The apex cryptocurrency declined 5.3% to $89,976.61 at the time of writing, according to CoinMarketCap data, while Ethereum fell 5.4% to $3,006.10 and XRP was down 4% to $2.16. Among other tokens, Solana slipped 3.2%, and Dogecoin fell 3.8%. This month, cryptocurrencies have lost over $600 billion in market capitalization.

Traders Price In No Rate Cut In December

Investor concerns have grown that the U.S. Federal Reserve might not lower interest rates at its next policymakers’ meeting on December 9-10, as Fed officials are cautious about a spike in inflation. On Monday, the U.S. central bank’s vice chair, Philip Jefferson, said that while he believed that there was risk to the job market, the Fed should still "proceed slowly" with any further rate cuts, joining colleagues who had made similar skeptical remarks last week.

According to CME Group’s FedWatch tool, only 42% traders see a rate cut next month, compared with over 93% a month earlier. Markets are now awaiting the long-delayed September nonfarm payrolls due on Thursday after the federal government shutdown prevented the release of new data.

However, Fed Governor Christopher Waller once again made his case for another rate cut. “With the evidence of slower economic growth and the prospect of only modest wage increases from the weak labor market, I don't see any factors that would cause an acceleration of inflation,” he said.

“Bitcoin’s slide is driven by a convergence of macro and market structure factors,” said Maja Vujinovic, CEO and cofounder of Digital Assets at FG Nexus, to Forbes. “We’ve moved into a clear risk-off environment, tech, growth, and high-beta assets all sold off as investors priced in higher-for-longer interest rates.”

What Are Stocktwits Users Thinking?

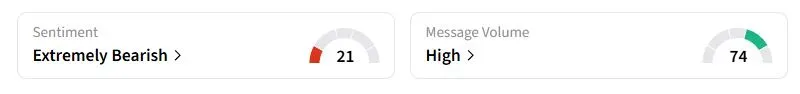

Retail sentiment on Stocktwits about Bitcoin was in the ‘extremely bearish’ territory at the time of writing.

One trader advised watching the $88,000 level. “We could see an incredible collapse here.”

Cameron Winklevoss Sees Buying Opportunity, Schiff Calls ‘Fraud’

The downward slide of Bitcoin also sparked reactions across the investment community. “This is the last time you'll ever be able to buy bitcoin below $90k!” crypto trading platform Gemini Space Station co-founder Cameron Winklevoss said on X.

However, Peter Schiff, known for his hawkish views on cryptocurrencies, highlighted Bitcoin’s underperformance relative to gold. “Bitcoin just dropped below $90,000. It’s down 28.5% from its high. But more significantly, with gold still trading above $4,000, Bitcoin is down 40% priced in gold,” he said. “Bitcoin’s collapse relative to gold exposes the digital-gold hype as a fraud. Those who bought into it will sell.”

While gold prices dipped in early trading on Tuesday, the bullion is up over 50% this year, amid robust central bank buying and safe-haven bets.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)