Advertisement|Remove ads.

BMNR’s Tom Lee Set To Join MSTR’s Michael Saylor On Strategy’s Q4 Earnings Call Amid Record Eight-Month Stock Slide

- Michael Saylor’s Strategy is scheduled to report fourth-quarter earnings after the bell on Thursday.

- It announced that Bitmine Immersion Technologies’ Tom Lee is set to join the earnings call alongside company leadership.

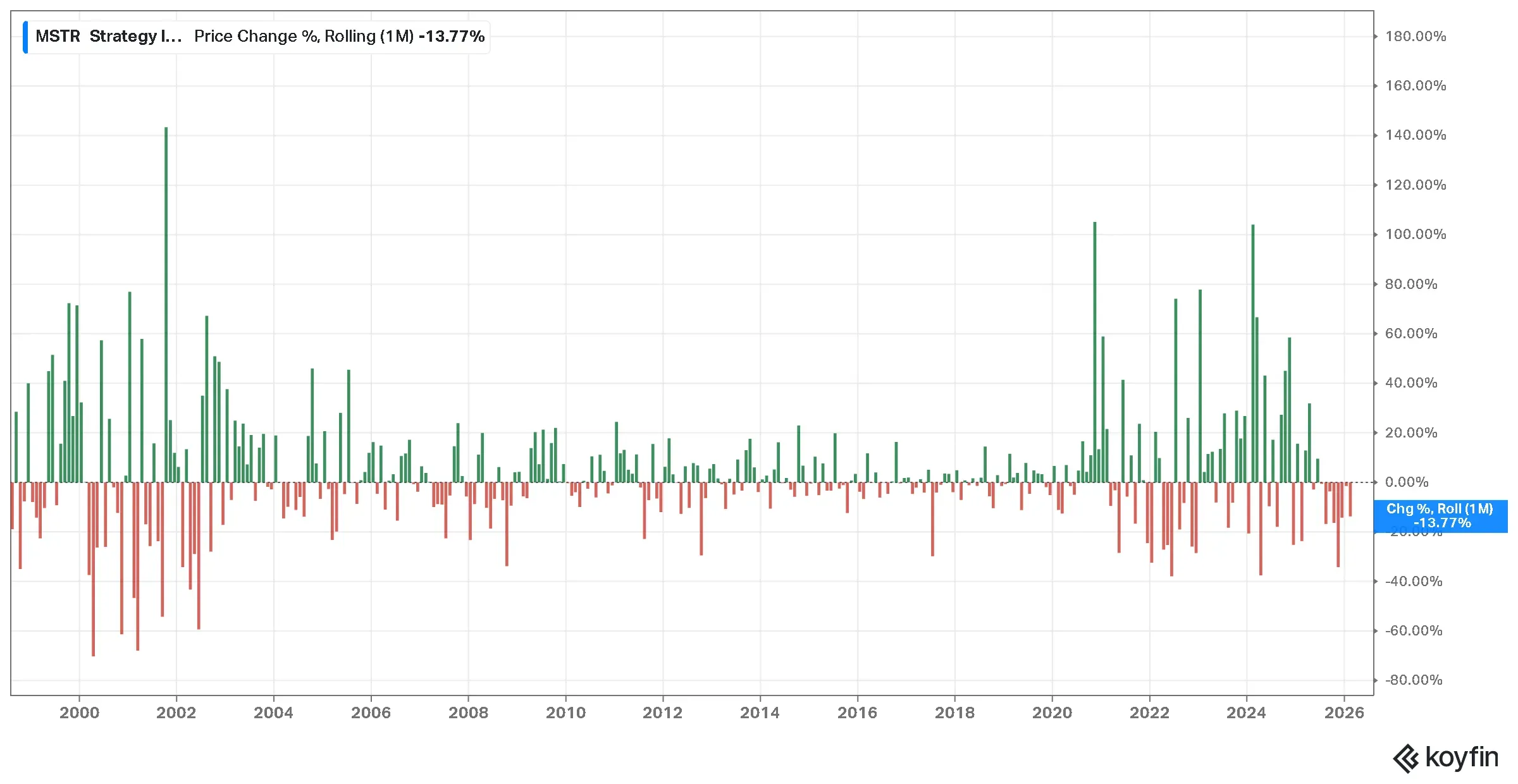

- So far this year, the shares are down 16%, extending losses to more than 60% over the past 12 months amid the slump in the cryptocurrency market.

Strategy (MSTR) is set to report its fourth quarter (Q4) earnings after the bell on Thursday, with Bitmine Immersion Technologies’ Tom Lee slated to join the earnings call.

MSTR’s stock was among the top trending tickers on Stocktwits on Thursday morning as the shares fell 1.50% in overnight trade, following a dip of over 3% in the regular session – it’s third day in the red. Retail sentiment around the Bitcoin (BTC) proxy remained in ‘bearish’ territory, accompanied by ‘high’ levels of chatter over the past day.

The stock has been in free fall this year, with the crypto market slumping to below $2.5 trillion, and Bitcoin’s price is testing the $70,000 support level. Wall Street is expecting Strategy to report a loss of $0.08 per share on revenue of $119.12 million, as per Stocktwits data.

MSTR’s Stock Faces Longest Losing Streak On Record

Shares of Strategy are on pace to finish lower for an eighth consecutive month, marking the longest losing streak in the company’s trading history. So far this year, the shares are down 16%, extending losses to more than 60% over the past 12 months.

According to ‘The Big Short’ investor Michael Burry, MSTR’s stock is at risk of heading into a “death spiral” if Bitcoin falls another 10%. BTC’s price dropped 5.9% in the last 24 hours to around $71,600 as it recovered from an intra-day low of nearly $70,000, according to CoinGecko data.

What Are Retail Traders Saying About MSTR’s Stock?

One user on Stocktwits said that Saylor may have a “surprise up his sleeve” for the earnings call.

Another joked that the company may switch its name to ‘Tragedy’ as Bitcoin’s price continues to fall.

Others weren’t as light-hearted about MSTR’s slump, citing liquidation risks and possible bankruptcy.

Analysts Worry About Bitcoin-Driven Losses

On Wednesday, Canaccord slashed its price target on Strategy’s stock to $185 from $474 while maintaining a ‘Buy’ rating. The firm cited weaker cryptocurrency prices and a compression in Strategy’s premium relative to its Bitcoin holdings. It expects Strategy to report an unrealized loss in Q4, driven by Bitcoin’s decline during the period.

In January, Strategy was reportedly sitting on an unrealized loss of $17.44 billion in the fourth quarter due to Bitcoin’s slump, which led to the value of the company’s stockpile taking a hit. For the year 2025, the company reported a $5.40 billion unrealized loss on digital assets. At the time, it also slashed its earnings forecast for 2025, citing a weak run in bitcoin.

While Canaccord continues to view Strategy as a long-term store-of-value vehicle, it noted that Bitcoin has increasingly traded like a risk asset over the past year. It maintained that Strategy is positioned to withstand a prolonged downturn.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)