Advertisement|Remove ads.

BTC Price Crashes By Nearly $10,000, Triggers $1.7B Liquidation Wave Across Crypto

- Most of the forced unwinds came from long positions, amounting to around $1.57 billion.

- Solana led declines among major tokens, falling 7.7%, while Ethereum and Cardano dropped about 7.5% each.

- Some analysts pointed to heavy spot selling on Binance as a key driver of the downside.

- Others suggested that the drop may be tied to speculation that U.S. President Donald Trump is preparing to nominate former Federal Reserve Governor Kevin Warsh to succeed current Fed Chair Jerome Powell.

Bitcoin’s (BTC) price dropped by nearly $10,000 on Thursday, triggering nearly $1.7 billion in liquidations across the crypto market.

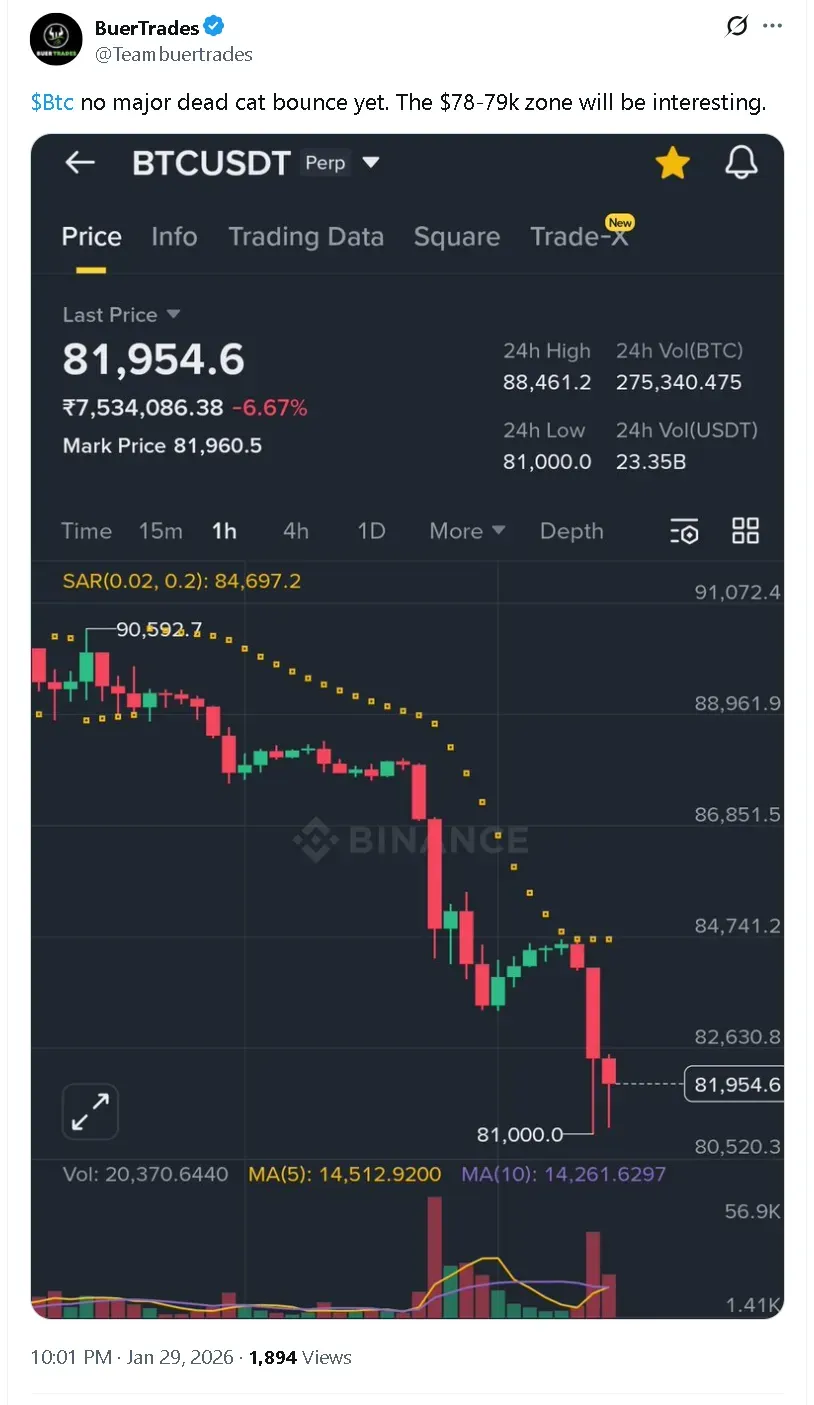

Bitcoin’s price was trading at around $82,100 at the time of writing, recuperating from an intra-day low of $81,000 after starting the day around at around $89,000. This is the lowest price BTC has seen since late-November last year, when it dipped to around $80,500.

The massive drop in Bitcoin’s price led to $1.68 billion in liquidations over the past 24 hours, according to CoinGlass data, marking the largest liquidation event so far this year. Most of the forced unwinds came from long positions, amounting to around $1.57 billion with Bitcoin, Ethereum (ETH), Ripple (XRP) and Solana (SOL) leading losses.

The overall cryptocurrency market fell 6% in the last 24 hours, dipping below $3 trillion. Other crypto majors were also in the red, with Solana leading losses among the top 10 by market capitalization.

What Are Retail Users Saying?

On Stocktwits, BTC was the top trending ticker at the time of writing. Chatter around the apex cryptocurrency rose to ‘high’ from ‘normal’ levels even as retail sentiment remained in ‘extremely bearish’ territory.

One user on Stocktwits forecast that Bitcoin hasn’t bottomed out and is likely to keep dipping till it hits at least $30,000.

Another said that Bitcoin is on track to be the worst performing asset over the past five years.

Why Is Bitcoin’s Price Falling?

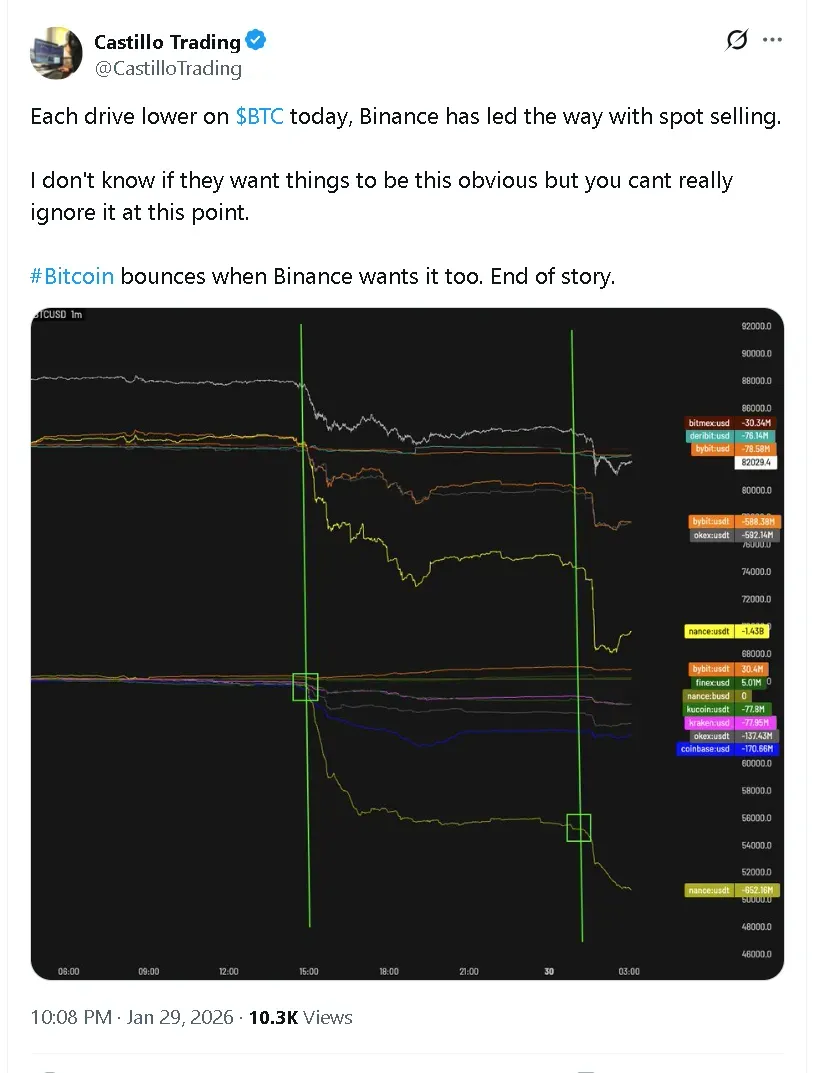

Analyst Castillo Trading pegged the blame on Binance, stating every time Bitcoin’s price dipped today, most of the selling came from Binance’s spot market. He said that Bitcoin will only rebound when selling pressure from Binance eases, making Binance a key driver of today’s price action.

Other market observers suggested that the crypto market’s drop may be tied to speculation that U.S. President Donald Trump is preparing to nominate former Federal Reserve Governor Kevin Warsh to succeed current Fed Chair Jerome Powell. Trump said late Thursday that he would announce his pick on Friday morning, just a day after sharply criticizing Powell and the Fed for keeping interest rates unchanged.

Analysts In Wait-And-Watch Mode

According to Plan C, Bitcoin has been stuck moving sideways between $80,000 and $100,000 for over two months, so most of the price action doesn’t really mean much yet. In a post on X, the analyst said that BTC needs to clearly break below $80,000 or above $100,000 to confirm a downtrend or break out.

Analysts at BuerTraders had a similar take, watching for Bitcoin to hit $79,000 to see how the price action plays out.

Bitcoin’s price drop weighed on other crypto majors as well with Solana, Ethereum, and Cardano (ADA) leading losses. Solana’s price plummeted 7.7% in the last 24 hours, while Ethereum and Cardano fell 7.5% each. XRP and Dogecoin (DOGE) both fell around 6.5% each over the past day.

Read also: Crypto Exchange Bybit Is Entering Robinhood’s Turf, ‘Looking Into’ US Expansion: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)