Advertisement|Remove ads.

Cathie Wood’s New Crypto Pick Steals Spotlight While Bitcoin Loses Steam

- As the CLARITY Act negotiations in White House have stalled due to regulatory noise, Bitcoin’s price has remained rangebound over the last 24 hours.

- A new token called LayerZero has come into the spotlight and is up over 25%.

- The sentiment around altcoin markets remained relatively muted as Ethereum, Solana, Ripple’s XRP, and other tokens saw notable liquidations.

Bitcoin (BTC) was stuck in a range-bound phase on Tuesday night, but a new token backed by Cathie Wood's Ark Invest and Citadel Group is turning heads, even as major cryptocurrencies are going down and leverage is still being washed out across the board.

Over the last 24 hours, CoinGlass data showed $213.03 million in liquidations, with longs accounting for 69.5%. Bitcoin’s price was around $68,639.56, down 1.6% from the previous day. On Stocktwits, retail sentiment around BTC remained in the ‘bearish’ zone, while chatter around the coin dropped from ‘extremely high’ to ‘high’ over the past day.

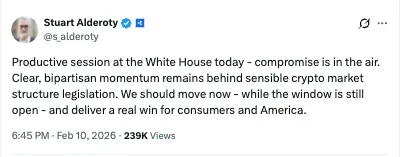

This comes amid a policy hangover in Washington. The second round of talks on Tuesday discussed the CLARITY Act, which aims to set federal rules for digital assets. While no real solution was reached, Ripple's Chief Legal Officer, Stuart Alderoty, called the session “productive” with compromise in the air.

LayerZero Expands Advisory Board With Wall Street Veterans

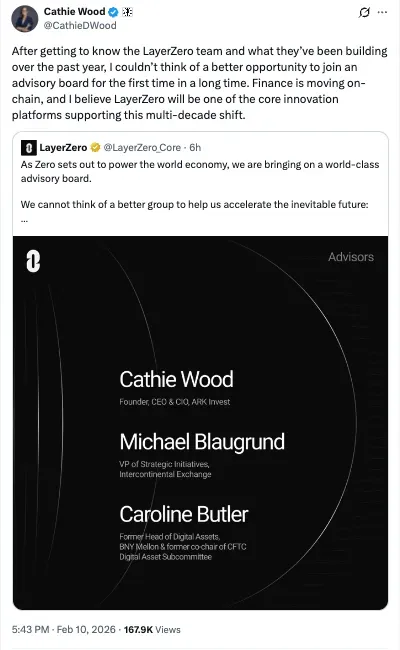

Amid all the policy noise, a relatively new contestant, supported by Cathie Wood and Citadel, had stepped into focus after Wood announced that she had joined LayerZero’s (ZRO) advisory board.

“Finance is moving on-chain, and I believe LayerZero will be one of the core innovation platforms supporting this multi-decade shift,” she stated, as the company also added Michael Blaugrund of Intercontinental Exchange and former BNY Mellon executive Caroline Butler as advisors.

LayerZero’s price was trading at around $2.36, up over 25% in the last 24 hours after the project launched its own blockchain on Tuesday. The biggest single liquidation was $1.7 million in an hour. Coinglass referred to the event as "extreme", 5.80 times higher than the 7-day average.

CoinGlass data also showed that there were $6.88 million was liquidated in the last 24 hours, with over $5 million in long-side, indicating a one-sided flush. On Stocktwits, retail sentiment around ZRO remained in ‘bullish’ territory, as chatter improved from ‘low’ to ‘extremely high’ levels over the past day.

How The Altcoin Market Is Doing

Ethereum (ETH) traded at around $2,011.24, down by 2.5% in the last 24 hours and 11.2% over the past seven days. It saw roughly $59.64 million in total liquidations over the past 24 hours. On Stocktwits, the retail sentiment around Ethereum remained in ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Solana (SOL) traded at around $83.10, down by 3.1% in the last 24 hours and 16% over the past seven days. Solana posted about $8.33 million in liquidations in the past 24 hours. On Stocktwits, retail sentiment around Solana remained in ‘bullish’ territory, with chatter changing from ‘extremely high’ to ‘high’ levels over the past day.

Ripple’s XRP (XRP) traded near $1.40, down by 2.2% in the last 24 hours and 11.3% over the past seven days. XRP saw roughly $3.80 million in total liquidations in the last 24 hours. On Stocktwits, the retail sentiment around XRP remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Dogecoin (DOGE) traded at around $0.09277, down by 2.1% in the last 24 hours and 13.9% over the past seven days. DOGE logged about $1.45 million in liquidations over the last 24 hours. On Stocktwits, the retail sentiment around Dogecoin remained in the ‘bullish’ territory, with chatter at ‘high’ levels over the past day.

Binance Coin (BNB) traded at around $619.56, down by 1.8% in the last 24 hours and 17.8% over the past seven days, and saw about $0.80 million in liquidations across the last 24 hours. On Stocktwits, the retail sentiment around BNB remained in the ‘neutral’ territory, with chatter changing from ‘extremely high’ to ‘high’ levels over the past day.

Read also: Robinhood Earnings Today: Retail Traders Bet On A Beat, Polymarket Odds Hit 87%

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)