Advertisement|Remove ads.

Robinhood Earnings Today: Retail Traders Bet On A Beat, Polymarket Odds Hit 87%

- Robinhood heads into earnings with strong expectations, as Polymarket traders have assigned an 86% chance that the company will beat quarterly estimates.

- Wall Street expects revenue growth of about 30%, driven by higher user monetization and expansion into crypto, options, and prediction markets.

- While analysts remained positive on Robinhood’s long-term outlook, today’s earnings and guidance are likely to be a major near-term catalyst for HOOD shares.

Robinhood Markets Inc. (HOOD) is about to release its earnings report later on Tuesday, with prediction market participants on Polymarket giving the trading platform an 87% chance of beating quarterly earnings expectations.

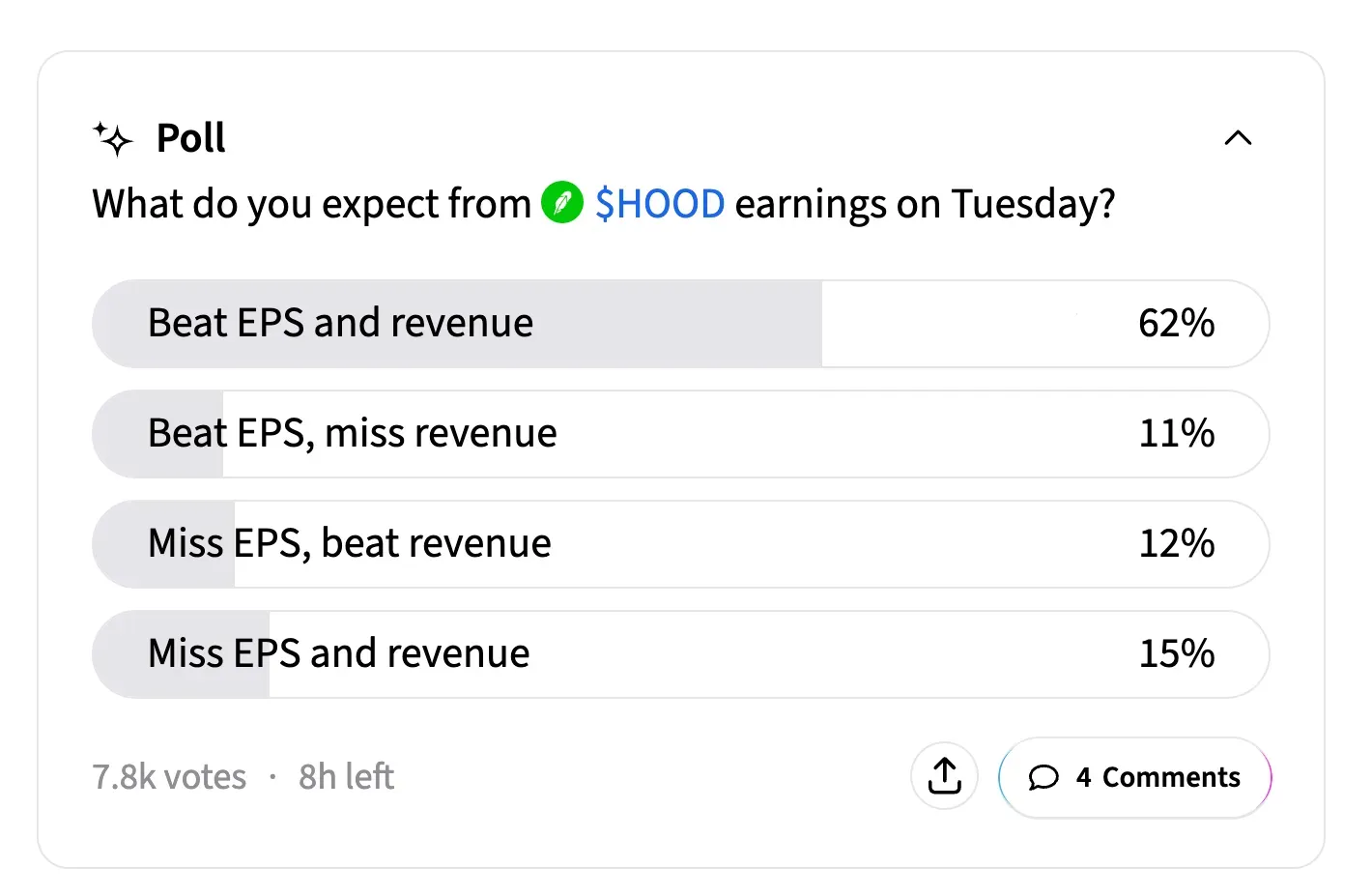

According to a Stocktwits poll with nearly 8,000 votes, 62% of respondents predicted Robinhood would beat EPS and revenue, indicating that retail sentiment on Stocktwits was also positive about the company's earnings.

A further 11% predicted a revenue miss but an earnings beat, while 12% anticipated the opposite. Despite the stock's year-to-date decline and overall market volatility, only 15% of voters expected a miss on both metrics, indicating generally positive retail expectations heading into the print.

On Monday, Robinhood (HOOD) shares closed at $86.56, up 4.52% for the day. After hours, they fell 0.24% to $86.35. The stock is still down about 27% this year. On Stocktwits, retail sentiment around HOOD is in an ‘extremely bullish’ zone, as chatter remained in ‘Extremely High’ levels over the past day.

Earnings Expectations High Ahead Of HOOD Results

Robinhood saw a significant rebound in earnings over the past year. The company reported $0.61 per share for the quarter ended September 30 last year. This was a 259% increase from the same quarter the year before. The trailing twelve-month EPS was $2.40, which was more than 300% higher than the year before. The average EPS expectation for Robinhood is between $0.62 and $0.63 per share, as per Zack’s Investment Research.

In the last few quarters, Robinhood has mostly met or exceeded Wall Street's expectations. This is because operating leverage has improved, and cost controls have taken hold following years of losses driven by pandemic-related trading slowdowns.

Analysts remain generally positive about Robinhood's long-term prospects, citing the company's expansion beyond retail equity trading into crypto, options, and event-driven markets. However, short-term results remain affected by broader market conditions and crypto prices.

Robinhood Gets Upgrade Before Earnings Report

According to TheFly, Wolfe Research raised Robinhood's rating from ‘Peer Perform’ to ‘Outperform’ and set a price target of $125. They said that the risk-reward profile has become more appealing since the stock's recent drop. The firm said that most of the ways Robinhood can improve its EPS seem to be long-lasting. For example, higher volumes in prediction markets should mitigate any issues that may arise in areas such as crypto trading.

Read also: ‘Built To Outperform Bitcoin’: Strategy CEO Defends $90 Million Bitcoin Buying During Sell-Off

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)