Advertisement|Remove ads.

Coinbase Post-Earnings Rebound Faces A Wary Wall Street, With Barclays Slashing Price Target By Over $100

- Coinbase reported earnings of $0.66 per share on revenue of $1.78 million, both below Wall Street’s expectations.

- Most analysts cited revenue coming in below estimates and a softer near-term outlook as the reason for the price cuts.

- BTIG analyst Andrew Harte pointed to management’s emphasis on revenue diversification as a positive takeaway from the earnings call.

Shares of Coinbase Global (COIN) climbed in pre-market trade on Friday despite a slew of price target cuts from Wall Street after the company’s disappointing fourth-quarter results.

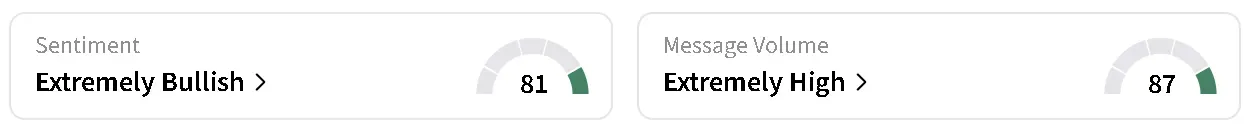

COIN’s stock rose as much as 6.3% in early morning trade and was the top trending ticker on Stocktwits. Retail sentiment around the crypto exchange rose to ‘extremely bullish’ from ‘bullish’ territory over the past day, while chatter jumped to ‘extremely high’ from ‘high’ levels.

However, Wall Street stood in contrast to retail sentiment with Barclays, Clear Street, BTIG and Citizens slashing their price target on COIN’s stock on Friday morning, as per TheFly. BTIG analyst Andrew Harte described the fourth-quarter results as “a bit messy” following the recent crypto selloff.

Wall Street Cuts Price Targets After Earnings

Harte lowered his target to $280 from $340 and reiterated a ‘Buy’ rating on COIN stock. He pointed to management’s emphasis on revenue diversification as a positive takeaway from the earnings call.

Clear Street analyst Owen Lau reduced his price target to $277 from $344 and kept a ‘Buy’ rating on Coinbase shares. The firm expects downward revisions to broader Street estimates following the quarterly report. However, Lau noted potential catalysts to help stabilize sentiment, including progress on market-structure legislation and potential shifts in interest-rate expectations.

Meanwhile, Barclays slashed its outlook by over $100 to $148 from $258 and kept an ‘Equal Weight’ rating on the shares. It attributed its bearish view to the company's revenue missing estimates and its first-quarter outlook being largely below expectations.

Citizens lowered its price target to $400 from $440 while reiterating an ‘Outperform’ rating. The firm described the crypto industry’s current phase as a ‘transitory period’ rather than a structural downturn. It said the long-term thesis for Coinbase remains intact, though near-term catalysts appear limited.

Coinbase Revenue, Earnings Miss Estimates

Coinbase reported revenue of $1.78 million, missing analyst expectations of $1.83 million, according to Koyfin data. Earnings per share (EPS) also fell short of Wall Street estimates, coming in at $0.66 versus the expected $0.96.

The company said the broader crypto market capitalization declined 11% quarter over quarter. During that time, CEO Brian Armstrong said Coinbase has doubled its trading volume and market share year over year.

“There's a lot of Monday morning quarterbacking happening,” Armstrong said during Coinbase’s fourth quarter earnings call. “I actually think markets are a little bit more like psychological things where people think someone else is going to think something, so they try to get ahead of it.”

For now, the divergence between retail enthusiasm and Wall Street caution highlights uncertainty in the near-term outlook for both Coinbase and the broader crypto market.

Read also: Crypto Market Waits On CPI Report With Bitcoin, Ethereum Under Threat Of Deeper Correction

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)