Advertisement|Remove ads.

Ethereum Extends Decline As JPMorgan Cites Solana, Layer 2 Networks as Growing Threats: Retail Awaits Altcoin Season

Ethereum (ETH) continued to trend lower during U.S. market hours, falling by 1.6% in the last 24 hours, as JPMorgan analysts warned that there could be more downside ahead of the crypto major.

According to JPMorgan analysts led by Nikolaos Panigirtzoglou, Ethereum will likely continue facing "intense competition" from rival blockchains.

The analysts also noted that Ethereum’s share of the total crypto market capitalization has fallen to a three-year low.

In a report cited by The Block, JPMorgan pointed to mounting pressure from Layer 1 blockchains such as Solana and lower-fee Layer 2 scaling solutions that are siphoning activity away from Ethereum’s main network.

While the broader crypto market saw a surge around the U.S. election, Ethereum has underperformed not only against Bitcoin but also against other altcoins.

Even after Ethereum’s recent Dencun upgrade—which introduced blobs to reduce transaction fees and improve scalability—usage has increasingly shifted to Layer 2 networks, potentially weakening Ethereum’s base chain, analysts said.

Despite these challenges, Ethereum remains the dominant platform for stablecoins, decentralized finance (DeFi), and tokenization. However, JPMorgan analysts cautioned that its ability to maintain this leadership is uncertain given the competition.

In an effort to drive institutional adoption, Ethereum co-founder Vitalik Buterin and the Ethereum Foundation have reportedly invested in Etherealize, a startup founded by former Wall Street trader Vivek Raman.

Etherealize aims to promote Ethereum’s financial applications, particularly in tokenization while developing solutions that streamline Ethereum’s integration with banks.

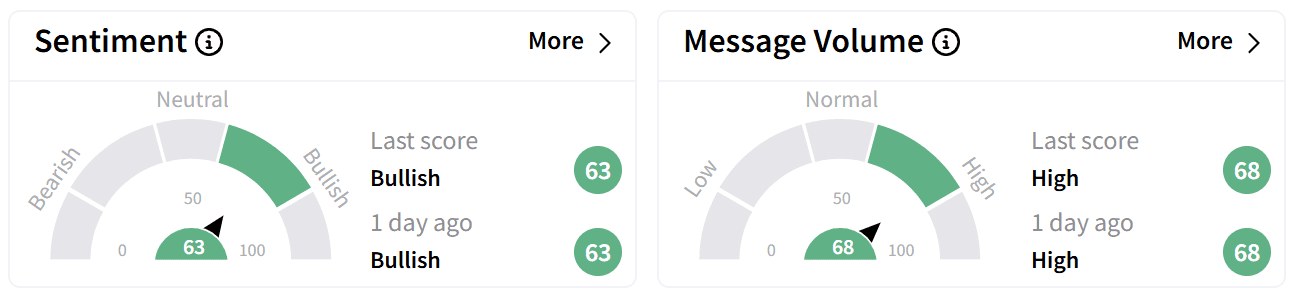

On Stocktwits, retail sentiment around Ethereum remained ‘bullish’ accompanied by ‘high’ levels of chatter.

Some traders viewed the decline as a buying opportunity, anticipating an altcoin season rally.

However, others expressed skepticism, arguing that altcoin season remains elusive.

Ethereum’s weak performance and changing Altcoin Season Index to 45 from 87 are holding the expected rally back.

Ethereum’s price, at the time of writing, is 44.6% below its all-time high of $4,878, reached three years ago.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Bitcoin Miner CleanSpark Rises Ahead of Q1 Earnings As BTC Steadies, Retail Sentiment Turns Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)