Advertisement|Remove ads.

Fed Balance Sheet Move Rekindles Crypto Risk-On Optimism, But Sentiment Remains Mixed

- A late-December Fed balance sheet increase, with fresh $19.5 billion overnight repos, could support an early crypto market risk-on move, said market analyst Paul Barron.

- A $19.5 billion overnight repo usage spike may indicate short-term funding stress rather than a liquidity tailwind, analysts warned.

- On Stocktwits, retail sentiment around Bitcoin rose from ‘bearish’ to ‘neutral’ territory, as Bitcoin traded near $89,500 after briefly reclaiming $90,000.

Paul Barron, a crypto market commentator and analyst, suggested on Friday that an easing of liquidity conditions might tee up an “early” risk-on bid for digital assets.

He cited a late-December surge in the Federal Reserve’s balance sheet and rebounding sentiment gauges as key tailwinds for crypto markets. However, on Friday, the Federal Reserve used about $19.5 billion in overnight repos, showing that short-term funding markets are becoming more reliant on central bank backstops.

Liquidity Signals Turn Constructive For Crypto

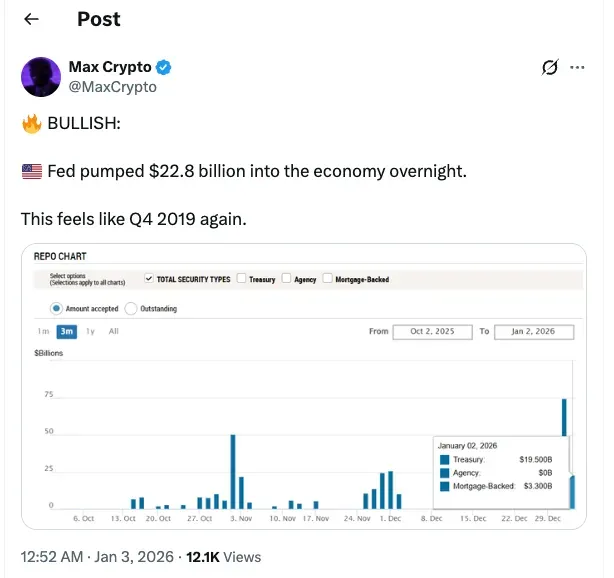

Barron pointed to a late-December expansion in the Federal Reserve’s balance sheet as a key tailwind. According to Fed data, the balance sheet increased by roughly $24.4 billion in the week ended Dec. 24, marking the largest weekly rise since the March 2023 banking stress period. Barron said the move has reignited debate around whether markets are seeing a form of “stealth QE.” Some traders, like Max Crypto, compare the setup to late 2019, when liquidity injections preceded a broader risk-asset rally.

Crypto markets have historically coincided with such macroeconomic factors. In late 2019, the Federal Reserve's balance sheet and repo operations expanded amid stress in the money markets. This happened at the same time that Bitcoin was rising from $7,000 to $10,000 later that year.

Bitcoin (BTC) was trading at $89,495.54, after briefly reaching $90,000 in the early hours on Saturday. On Stocktwits, Bitcoin was trending at number 1, as retail sentiment changed from ’bearish’ to ‘neutral’ territory. Chatter around the coin also improved from ‘low’ levels to ‘normal’ levels over the past day.

Repo Spike Raises Questions About Funding Stress

At the sentiment level, liquidity indicators have also improved. The Crypto Fear & Greed Index has bounced back from very high levels of fear seen late last year. Barron said this change could lead to an early-year rise if liquidity continues to improve. On the other hand, there are recent signs that liquidity is not all positive.

Analyst JustDario said the repo activity could be a sign of funding pressure rather than healthy liquidity growth. He wrote on X that the size and timing of the borrowing suggest that at least one bank may have experienced a sudden cash shortage during the day, possibly due to margin requirements or balance-sheet limits after year-end adjustments. He thinks that high repo use is a sign of stress in the system's plumbing and less trust between institutions, not a clean injection of risk capital.

Read also: Coinbase Executive D’Agostino Says Crypto ‘Market Structure Is Complicated’

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_newsmax_resized_jpg_3a813181b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)