Advertisement|Remove ads.

Gold-Pegged Cryptos Hit New Highs As Metal Reaches Uncharted Territory Amid Trump’s Trade War: Retail Stays Cautious

Gold-backed cryptocurrencies are outperforming the wider market amid a historic rally for the precious metal.

Gold prices are up around 9.7% so far this year to a new record of $2,880 per ounce amid escalating trade tensions between the U.S. and China.

PAX Gold (PAXG) and Tether Gold (XAUT), both backed by one troy ounce of physical gold stored in vaults, have mirrored the metal’s ascent.

Over the past month, both tokens have risen roughly 10%, tracking closely with spot gold prices.

During U.S. market hours on Wednesday, Tether Gold touched an all-time high of $2,882 before slipping 0.3% from its peak, according to CoinGecko.

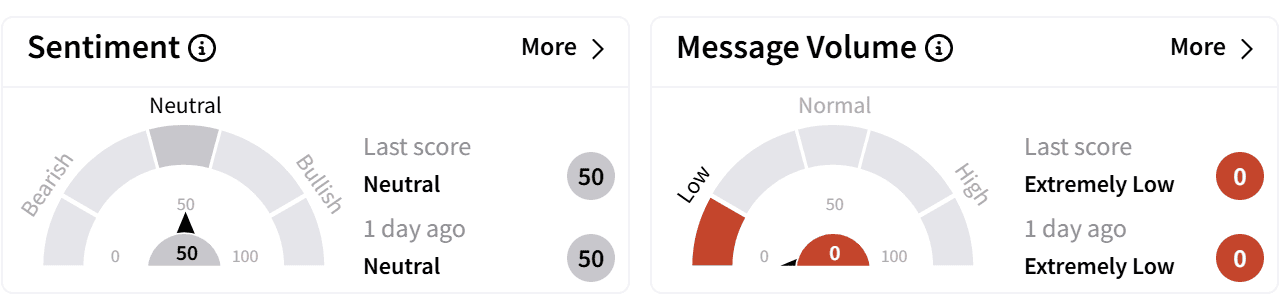

Despite the pullback, XAUT maintained gains of 1.4% over the last 24 hours, with retail sentiment on Stocktwits in the 'neutral' territory, accompanied by 'extremely low' chatter.

PAX Gold also saw gains, up 2.2% in the last 24 hours, according to CoinGecko.

The token reached an all-time high of $2,925 earlier this week and is now trading just 0.5% below the peak.

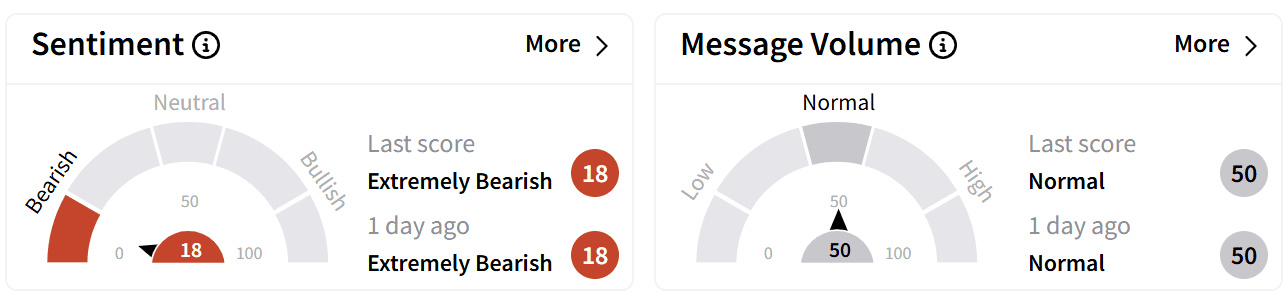

However, sentiment around PAXG on Stocktwits was 'extremely bearish,' with message volume at 'normal' levels.

These gold-backed tokens have significantly outperformed major cryptocurrencies so far this year.

Bitcoin (BTC) posted a modest 3.6% gain in January, pushing the BTC-to-gold ratio to a 12-week low, according to TradingView data.

In traditional markets, gold miners have also benefited. The VanEck Gold Miners ETF (GDX), which tracks a basket of gold mining stocks, has surged nearly 20% this year, outpacing the S&P 500.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_transocean_OG_jpg_4d836b625f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)