Advertisement|Remove ads.

Bitcoin Mining Metrics Improve, But Stocks Struggle As BTC Stays Below $100K: Retail Remains Cautiously Optimistic

In a positive development for Bitcoin mining companies, the Bitcoin network hashrate — a metric that measures competition and mining difficulty — rose slightly in January, according to a JPMorgan research report cited by CoinDesk on Monday.

The monthly average network hashrate increased 1% to 785 exahashes per second (EH/s), while mining difficulty declined 2% month-over-month.

The report also noted that the week-ending moving average hashrate stood at 781 EH/s, reflecting a 2% decrease from December's end.

“This is relatively uncommon and represents a modest tailwind for Bitcoin (BTC) mining economics,” JPMorgan analysts wrote, adding that network difficulty remains 25% higher than pre-halving levels seen last April.

Mining profitability edged higher as well. JPMorgan estimated that miners earned an average of $57,200 per EH/s in daily block reward revenue in January, marking a slight increase from December.

Additionally, the combined market capitalization of Bitcoin miners tracked by JPMorgan rose 5% compared to the previous month.

Cipher Mining (CIFR) and Riot Platforms (RIOT) outperformed in January, with shares gaining 23% and 16% respectively, buoyed by announcements related to high-performance computing (HPC) initiatives.

Conversely, TeraWulf (WULF) underperformed, with shares dropping 16% in January, according to JPMorgan.

These Bitcoin mining stocks traded mostly lower on Wednesday as Bitcoin (BTC) remained below the $100,000 threshold during U.S. market hours, despite a New York Times report suggesting the U.S. Securities and Exchange Commission (SEC) is scaling back its crypto enforcement efforts.

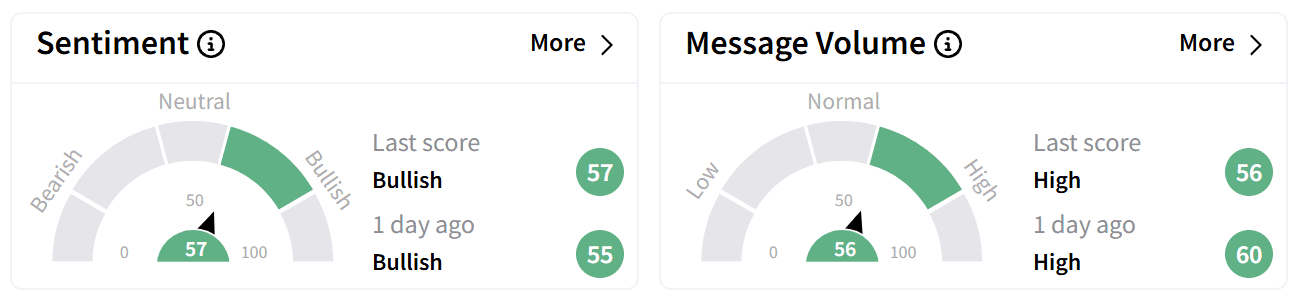

TeraWulf shares fell over 1.5% in morning trading, though retail sentiment on Stocktwits remained ‘bullish’ with ‘high’ levels of chatter.

Some users speculated that AMD's weak data center outlook could be negatively impacting TeraWulf, given its recent pivot toward HPC and artificial intelligence (AI) data center hosting services.

TeraWulf's stock surged over 187% last year, outpacing Bitcoin’s growth, but it has declined more than 12% so far in 2025.

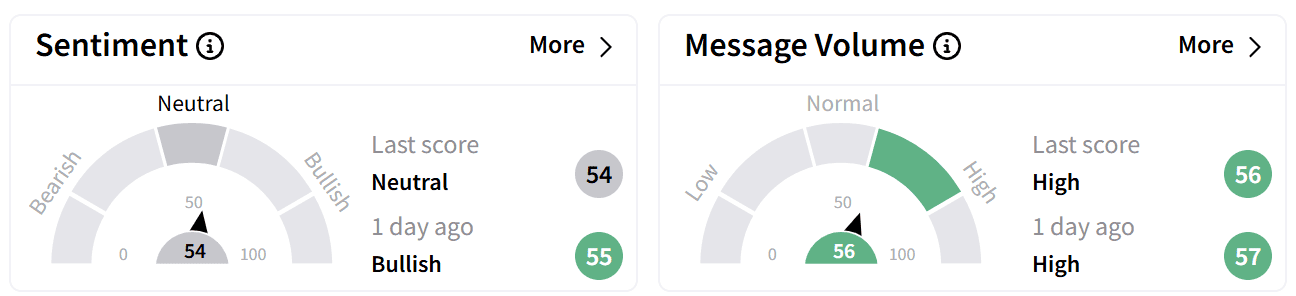

Riot Platforms' stock was down nearly 3% on Wednesday morning. Retail sentiment on Stocktwits shifted to ‘neutral’ from ‘bullish’, despite ‘high’ levels of chatter.

Riot is the third-largest corporate Bitcoin holder after MicroStrategy (MSTR) and Marathon Digital Holdings (MARA), with 17,722 BTC valued at approximately $1.7 billion, according to BitcoinTreasuries.

Riot’s stock only gained 6% over the last year, but has picked up momentum with gains of over 14% so far in 2025.

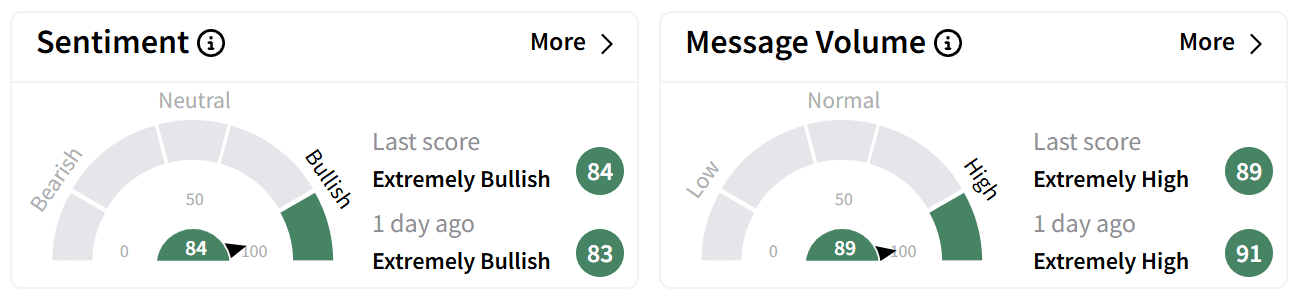

Cipher Mining’s stock was down over 1% in morning trade on Wednesday. On Stocktwits, retail sentiment remained upbeat in the ‘extremely bullish’ territory accompanied by ‘extremely high’ chatter.

The stock has more than doubled in value over the last year, in line with Bitcoin’s gains, and outpaced the apex crypto with gains of over 18% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)