Advertisement|Remove ads.

HYPE Crypto Token Soars After Kraken Confirms Exchange Listing

- Despite the rally, the token remains roughly 45% below its September 2025 record high of $59.30.

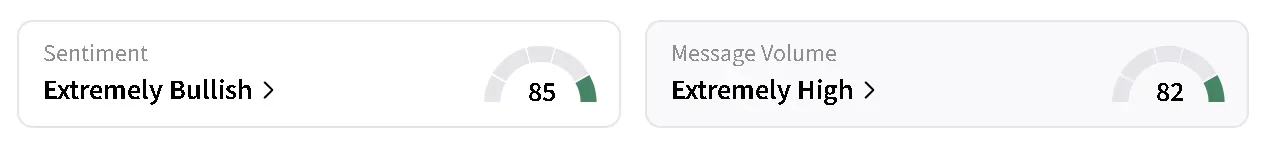

- Retail sentiment around HYPE on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ over the past day.

- Users on the platform are closely watching technical resistance levels near $36.

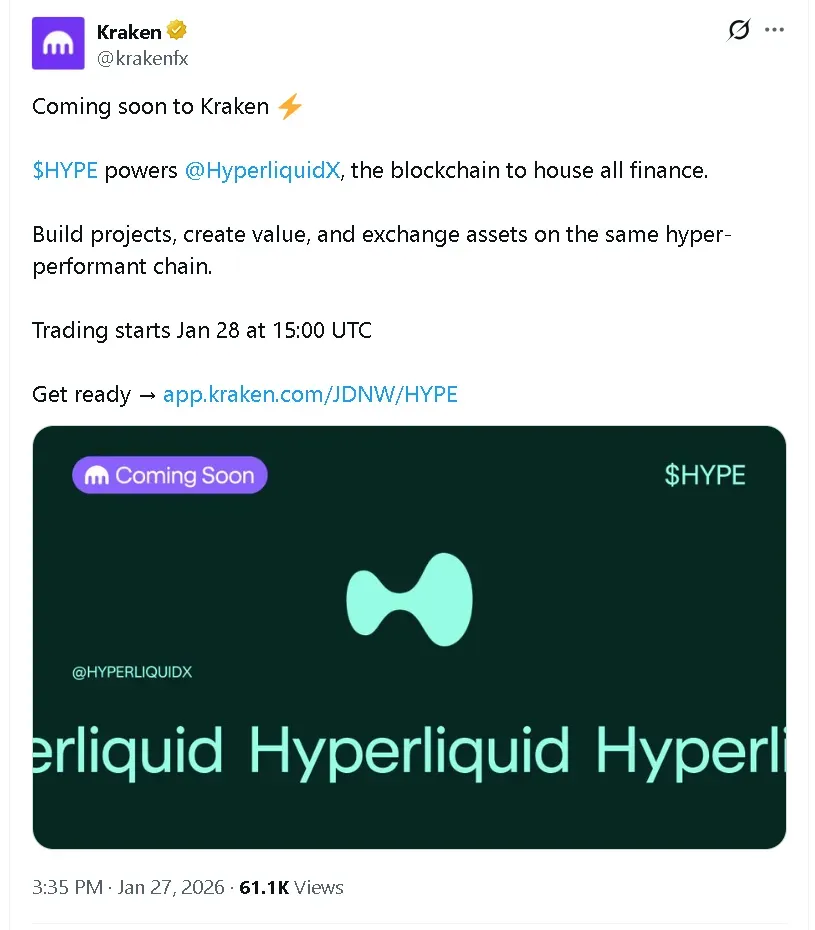

Hyperliquid (HYPE) soared on Tuesday night after Kraken announced it would be listing the token on its exchange come Wednesday.

HYPE’s price jumped by more than 22% in the last 24 hours to $32.77, paring gains after hitting $34.09 earlier in the session, according to CoinGecko data. The token remains nearly 45% below its record high of $59.30 seen in September last year.

Retail sentiment around the crypto token on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ territory over the past day, while chatter surged to ‘extremely high’ from ‘high’ levels.

What Is Retail Saying About Hype?

One user on Stocktwits accurately predicted that HYPE’s price was poised to break past the $30 resistance mark. According to them, this opens the door to more upside ahead, with the next resistance marker at $36.

Another opined that a “supply shock” is coming, which may also lift HYPE’s price. A supply shock usually occurs when the tradable supply suddenly shrinks versus demand.

What Is The HYPE Crypto Token?

HYPE is the native cryptocurrency of the Hyperliquid decentralized perpetual futures exchange. According to data on DefiLlama, Hyperliquid is the largest chain by perpetual volume over the past month. It saw over $170 billion traded in the last 30 days, followed by Lighter (LIT), which saw $111 billion traded.

Hyperliquid’s order book is fully on-chain, which is rare for decentralized exchanges and reduces off-chain risks. The platform has gained popularity among crypto traders for combining Uniswap-style decentralization with dYdX-like performance, optimized for high-volume perpetual trading on a custom blockchain.

The overall cryptocurrency market gained 1.2% in the last 24 hours, steady at a valuation of $3.1 trillion. Bitcoin (BTC) moved 0.9% higher to around $89,000, underperforming altcoins like Ethereum (ETH) and Binance Coin (BNB), both of which gained more than 2% each. Retail sentiment around Bitcoin on Stocktwits dipped to ‘extremely bearish’ from ‘bearish’ territory over the past day.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)