Advertisement|Remove ads.

MSTR, BMNR, GEMI Get Knocked Down Amid Bitcoin Crash As Retail Chatter More Than Doubles

- Shares of Strategy, Bitmine Immersion Technologies, and Gemini were the worst hit among crypto equities – dropping close to 10% each in regular trading.

- MSTR’s stock was among the top trending tickers on Stocktwits, with message volume jumping roughly 160% over the past day.

- BMNR and GEMI also saw sharp increases in chatter, with message volumes rising about 150% and 100%, respectively.

Strategy (MSTR), Tom Lee’s Bitmine Immersion Technologies (BMNR) and Gemini (GEMI) crashed on Thursday after Bitcoin (BTC) plummeted to $81,000 for the first time since November, sparking a surge in retail chatter.

All three stocks fell nearly 10% in regular trading and continued to dip after hours. GEMI’s stock dipped 0.80%, while BMNR’s stock price edged 0.59% lower, and MSTR’s stock fell 0.13%.

Stocks Slump, But Retail Chatter Jumps

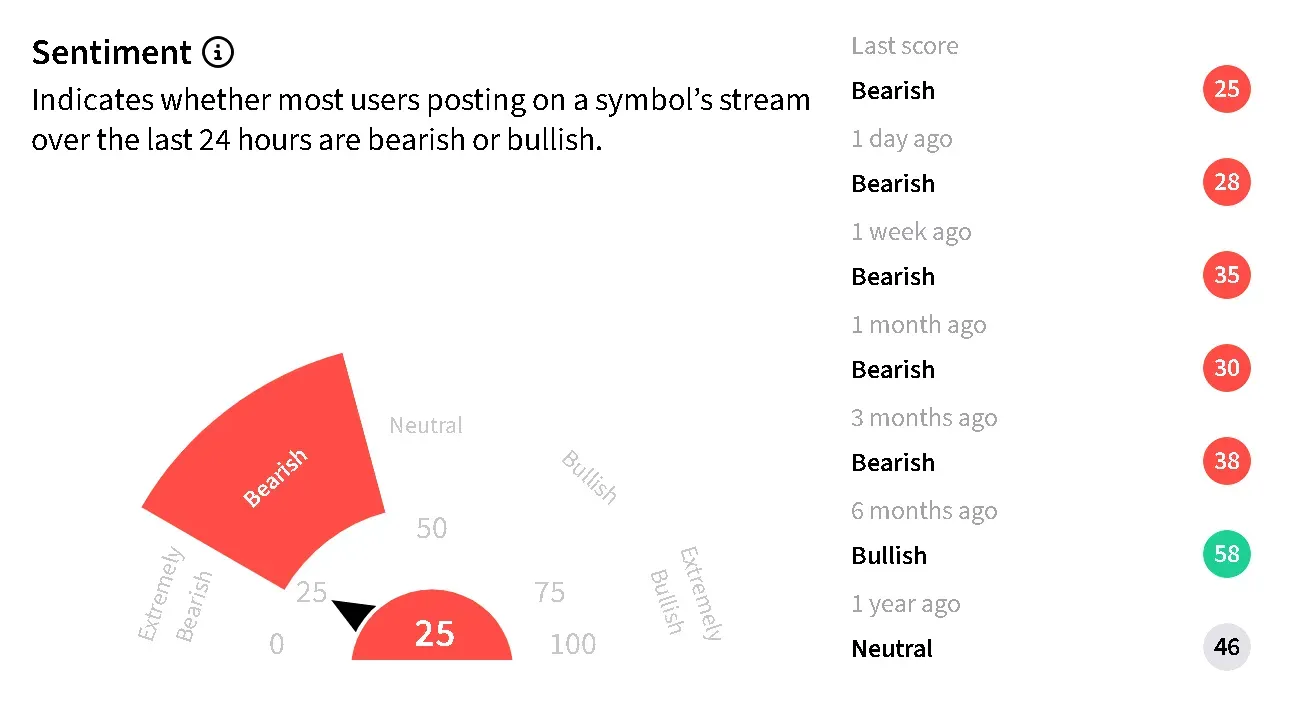

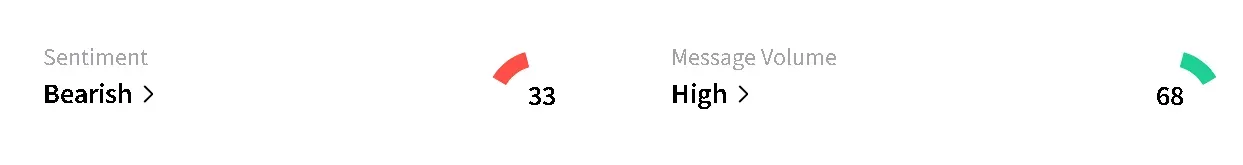

The Michael Saylor-backed firm was among the top trending tickers on Stocktwits at the time of writing. Retail sentiment around MSTR continued to trend in ‘bearish’ territory while chatter rose to ‘high’ from ‘low’ levels over the past day. Platform data showed a 160% jump in message volume.

Users following the stock were more concerned about Saylor’s well being than the company’s financial status.

Similarly, retail sentiment around Bitmine was in the ‘bearish’ zone with a 150% jump in retail chatter.

Gemini also witnessed retail sentiment in the ‘bearish’ zone with chatter rising to ‘high’ from ‘low’ levels over the past day with data indicating a 100% jump in message volume.

Why Were Crypto-Linked Equities Dropping?

Bitcoin’s price dropped by nearly $10,000 in the last 24 hours. The apex cryptocurrency was trading at around $82,100 at the time of writing, recuperating from an intra-day low of $81,000. This is the lowest price BTC has seen since late-November last year, when it dipped to around $80,500.

While MSTR, BMNR and GEMI bore the heaviest losses, other crypto stocks were also in the red on Thursday. MARA Holdings (MARA) fell nearly 5% in regular trade, but was seen recuperating after hours as it edged 0.10% higher. Coinbase Global (COIN) saw a similar dip of around 5% and continued to fall by 0.39% in overnight trading.

Read also: BTC Price Crashes By Nearly $10,000, Triggers $1.7B Liquidation Wave Across Crypto

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)