Advertisement|Remove ads.

Peter Schiff Calls Out Strategy’s $2B Cash Build Amid Inflation Risks — ‘Why Not Build Gold Reserves?’

- Schiff said Fed easing and inflation risks weaken the case for holding large dollar reserves.

- Strategy boosted cash after recent share sales and paused bitcoin purchases.

- Saylor said any slowdown in buying reflects bitcoin scarcity, not a change in strategy.

Economist and gold advocate Peter Schiff questioned Strategy Inc’s decision to build U.S. dollar reserves, arguing that rising inflation risks make cash less attractive.

In a post on X, Schiff said it appeared Strategy was building dollar reserves because it would soon need them, adding that with the Federal Reserve cutting rates and continuing quantitative easing, the company should consider holding gold instead of U.S. dollars. He also pointed to stablecoin issuer Tether as an example of a firm building gold reserves.

Strategy Pauses Bitcoin Buys, Builds Cash

Schiff’s comments followed Strategy’s disclosure that it raised $748 million through common stock sales in the seven days ended Dec. 21, lifting its U.S. dollar reserve to $2.19 billion. The company reported no bitcoin purchases during the week, marking a pause after buying about $2 billion worth of bitcoin over the prior two weeks.

Earlier this month, Strategy established a $1.4 billion reserve to support future dividend payments and interest obligations, seeking to address investor concerns that it could be forced to sell bitcoin if prices continue to fall.

Strategy holds about 671,268 bitcoins, acquired for roughly $50 billion over five years and currently valued at around $60 billion. Its modified net asset value, or mNAV, which compares enterprise value to bitcoin holdings, stood near 1.1 on Monday.

Long-Term Bitcoin Strategy

Despite the recent pause, Michael Saylor has continued to signal long-term confidence in bitcoin. On Sunday, Saylor posted what investors interpreted as “green dots” alongside his well-known “orange dots” chart ahead of the company’s weekly bitcoin update, a signal often associated with fresh accumulation.

Saylor wrote, “Green dots beget orange dots,” a phrase widely read as a hint that further bitcoin purchases could follow. Strategy has bought more than 10,600 bitcoins in each of its past two weekly purchases, its fastest accumulation pace since July.

Analysts have said the green dotted line represents Strategy’s rolling average bitcoin purchase price, which updates only when the company adds to its holdings, rather than a forecast for bitcoin’s price.

Scarcity Still Central To Strategy’s Thesis

On Friday, Saylor said Strategy plans to slow bitcoin accumulation only once it controls between 5% and 7.5% of the cryptocurrency’s total supply, arguing that scarcity, not policy, will ultimately cap purchases. The company currently holds about 3.2% of bitcoin’s supply, a level Saylor has said required roughly $50 billion in capital, with future gains becoming increasingly difficult as supply tightens.

How Did Stocktwits Users React?

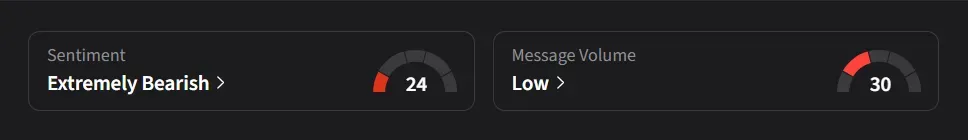

On Stocktwits, retail sentiment for Strategy was ‘extremely bearish’ amid ‘low’ message volume.

One user said Strategy’s more than $2.2 billion cash reserve undermines claims it would need to sell bitcoin, adding that Saylor may be “outmaneuvering” the market.

Another user sees the stock “going for big nose dive”

Strategy’s stock has declined 42% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)