Advertisement|Remove ads.

Peter Schiff Says People Made ‘Huge Mistake’ Selling Gold To Buy Bitcoin

- A Stocktwits poll showed most retail traders expect Bitcoin’s price to remain below $100,000 this year.

- Federal Reserve governor Christopher Waller earlier had said that the crypto sector is detached from the traditional finance world and can therefore see ‘big crashes’.

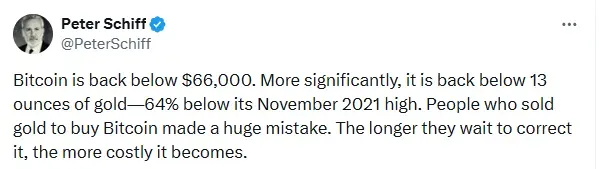

Peter Schiff on Wednesday said that people who sold gold to buy bitcoin made a huge mistake as bitcoin fell below $66,000 levels.

“People who sold gold to buy Bitcoin made a huge mistake. The longer they wait to correct it, the more costly it becomes,” he said in a post on X.

The comment comes as the broader crypto market continues to see selling pressures amid uncertainties stemming from macroeconomics as well as leadership transition in the Federal Reserve.

BTC Under The Pump

Bitcoin has been very volatile since the beginning of the year. The selloff worsened after Donald Trump announced Kevin Warsh as the nominee to become the next Federal Reserve chair.

Federal Reserve governor Christopher Waller earlier had said that the crypto sector is detached from the traditional finance world and can therefore see ‘big crashes’.

“I think there was a lot of sell off, just because firms that got into it from mainstream finance had to adjust their risk positions,” he said.

A Stocktwits poll showed most retail traders expect Bitcoin’s price to remain below $100,000 this year. The most number of respondents are betting that Bitcoin will top out below $100,000 this year. Only 25% believe BTC’s price can move higher to $150,000, and another 20% think it will set new record highs between $150,000 to $200,000.

Gold’s Continued Rally

Gold prices rose on Wednesday, as a weaker dollar supported prices and stronger lunar new year demand from China added momentum to the already record rally.

Ole Hansen, Head of Commodity Strategy for Saxo Bank said on Wednesday that gold has remained higher after weak U.S. retail sales that has strengthened expectations of Federal Reserve rate cuts, pressuring the dollar and Treasury yields ahead of the delayed January payrolls report.

How Did Stocktwits Users React?

Retail sentiment around BTC trended in ‘bearish’ territory amid ‘high’ message volume.

Meanwhile, retail sentiment around ETH trended in ‘bullish’ territory amid ‘high’ message volume.

Read More: Why Does Retail Expect Bitcoin To Go Down to $30K Levels and Gold, Silver To Outperform?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)