Advertisement|Remove ads.

Peter Thiel’s Fund Walks Away From Ethereum Play – ETHZ Stock Sinks After Hours

- ETHZilla shares fell more than 5% in overnight trading after filings showed Peter Thiel’s Founders Fund had fully exited its position.

- ETHZilla once held over 100,000 Ether but sold significant portions during the crypto downturn to fund buybacks and reduce debt.

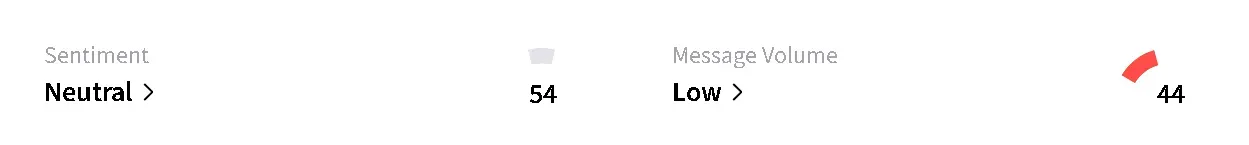

- Retail sentiment on Stocktwits around the Ethereum DAT remained in 'neutral' territory over the past day.

ETHZilla (ETHZ) shares tumbled more than 5% in overnight trade after regulatory filings showed billionaire tech investor Peter Thiel and his Founders Fund had completely sold out of the stock.

ETHZ’s stock fell as much as 5.4% after hours, leading losses among crypto-linked equities, following a gain of 0.86% in regular trade. On Stocktwits, retail sentiment around the Ethereum (ETH)-focused digital asset treasury (DAT), remained in 'neutral' territory over the past day.

Peter Thiel’s Founders Fund Exits ETHZ Stake

According to filings with the Securities and Exchange Commission (SEC), Thiel’s Founder Fund now reports owning zero shares of the company, down from a 7.5% stake disclosed in August.

The investment was reported after the company pivoted from 180 Life Sciences Corp. to ETHZilla and adopted Ethereum as its primary treasury asset. The company was among many pivoting toward a crypto-led balance sheet, hoping to replicate the success of Strategy (MSTR) and its Bitcoin (BTC) playbook.

Crypto Rout Forces Ethereum Liquidations

ETHZilla held over 100,000 Ethereum at its peak, according to data from DefiLlama. However, once the crypto market started to fall after October’s peak, the company was among the first few that were forced to sell.

ETHZ sold around $40 million of Ethereum in October to fund stock repurchases. It then sold another $74.5 million worth of ETH tokens in December to repay senior secured convertible notes.

The company has around 65,786 ETH left on its balance sheet, valued at around $138.82 million. Its average purchase price stands at $3,841, well below Ethereum’s current trading range.

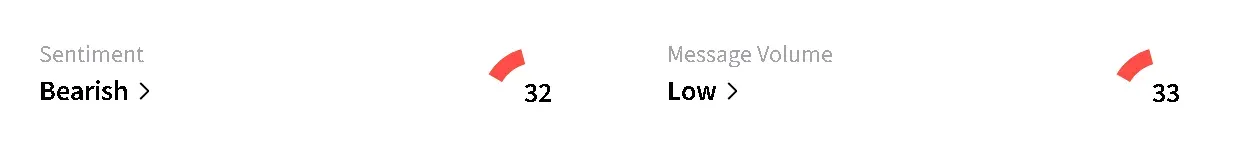

Ethereum’s price has been struggling to climb back above the $2,000 mark this month. The altcoin was trading at around $1,998 on Tuesday night, up 1.2% in the last 24 hours and leading gains among major tokens. On Stocktwits, retail sentiment around ETH remained in ‘bearish’ territory over the past day.

A Hail Mary Or Strategic Play?

In its latest pivot, ETHZilla announced in January a new subsidiary called ETHZilla Aerospace, which plans to offer tokenized access to equity in leased jet engines. Simply put, the company has two jet engines it plans to lease to airlines. Last week, it announced its first equity token, the Eurus Aero Token 1, backed by engine lease cash flows.

While this suggests the company is looking beyond a pure Ethereum play to buff up its balance sheet, it could also be a Hail Mary to avoid going under. ETHZ’s stock has fallen over 30% this year alongside ETH’s drop of over 32% in the same time frame.

Read also: MSTR's Michael Saylor Says ‘Bitcoin Is Winning’ Amid Crypto Winter, Sees ‘Glorious Summer’ Ahead

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Door_Dash_jpg_1088720ba5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_thiel_OG_jpg_9d74d987ca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)