Advertisement|Remove ads.

RUNE Remains Down Even As THORChain Sees Record-Breaking Trading Volume From ByBit Hack – Retail Isn’t Happy

THORChain’s native token, RUNE, remains under pressure, falling 13% over the past week, even as the decentralized liquidity protocol posted record-breaking trading volumes.

The network generated over $5 million in revenue as transaction volumes surged, driven by the movement of stolen funds linked to the $1.46 billion Bybit hack.

The hack, which took place on Feb. 21, ranks as the largest in crypto history. Blockchain security firms have attributed the exploit to the North Korean state-affiliated Lazarus Group, which has continued laundering the stolen funds using cross-chain swap protocols, including THORChain.

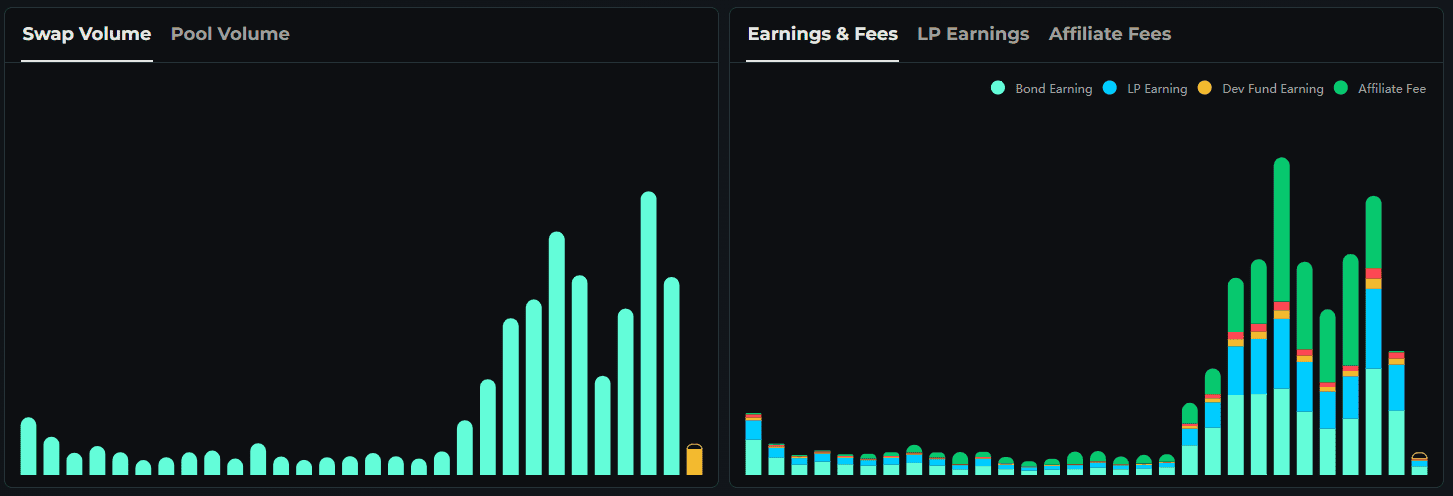

Since the attack, THORChain has processed over $5.4 billion in swap volume, generating approximately $5.5 million in revenue, according to data from the THORChain explorer.

On Sunday alone, swap volume exceeded $1 billion, contributing $912,000 in gross system income.

THORChain remains under scrutiny for its role in facilitating the movement of illicit funds.

The company’s protocol developer, "Pluto," resigned on Friday after the community voted to block North Korean-linked addresses – only to overturn the decision later.

“Other protocols have blocked dirty wallets without killing decentralization. THORChain had options – Elliptic, transaction monitoring – but ignored them,” Pluto wrote in a post on X.

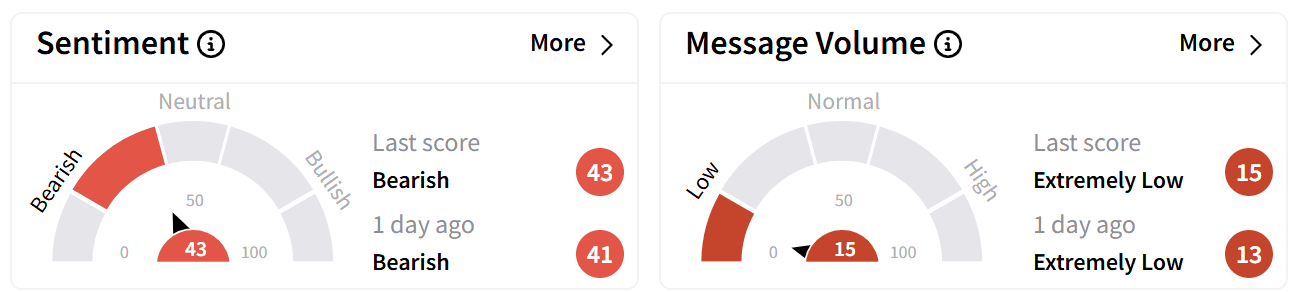

Retail sentiment on Stocktwits around the RUNE token remained in the ‘bearish’ zone, with some users criticizing THORChain for enabling criminal activity.

One user argued that the crypto community should collectively drive the token’s price down in protest.

RUNE has continued to slide, down more than 10% during U.S. trading hours and 78% lower over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_disc_medicine_jpg_984ae0fad9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1513214947_jpg_b941a8388d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2175593751_jpg_98707d06cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Roku_logo_jpg_1323183cec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)